Financial giants have made a conspicuous bullish move on Celsius Holdings. Our analysis of options history for Celsius Holdings CELH revealed 15 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $105,280, and 12 were calls, valued at $875,865.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $33.33 for Celsius Holdings during the past quarter.

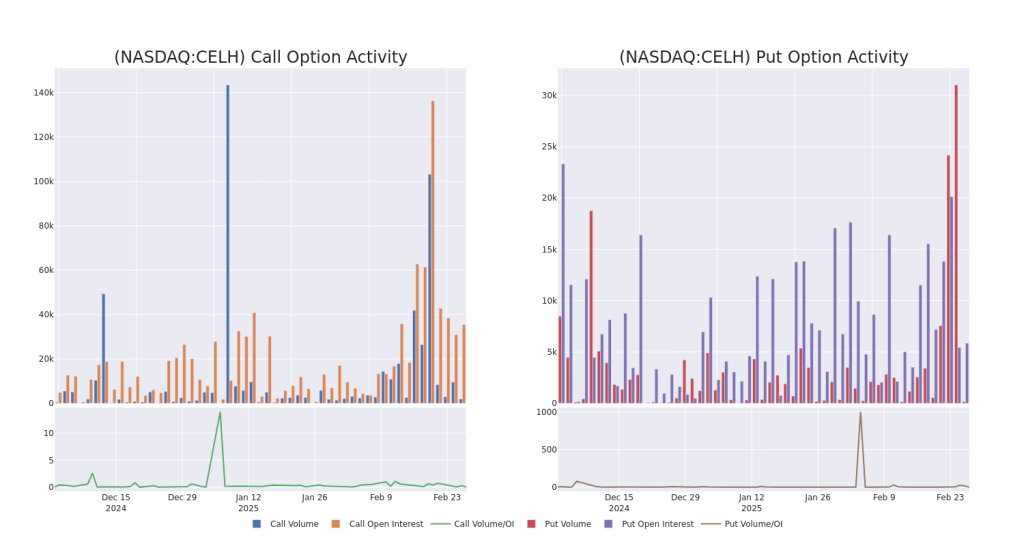

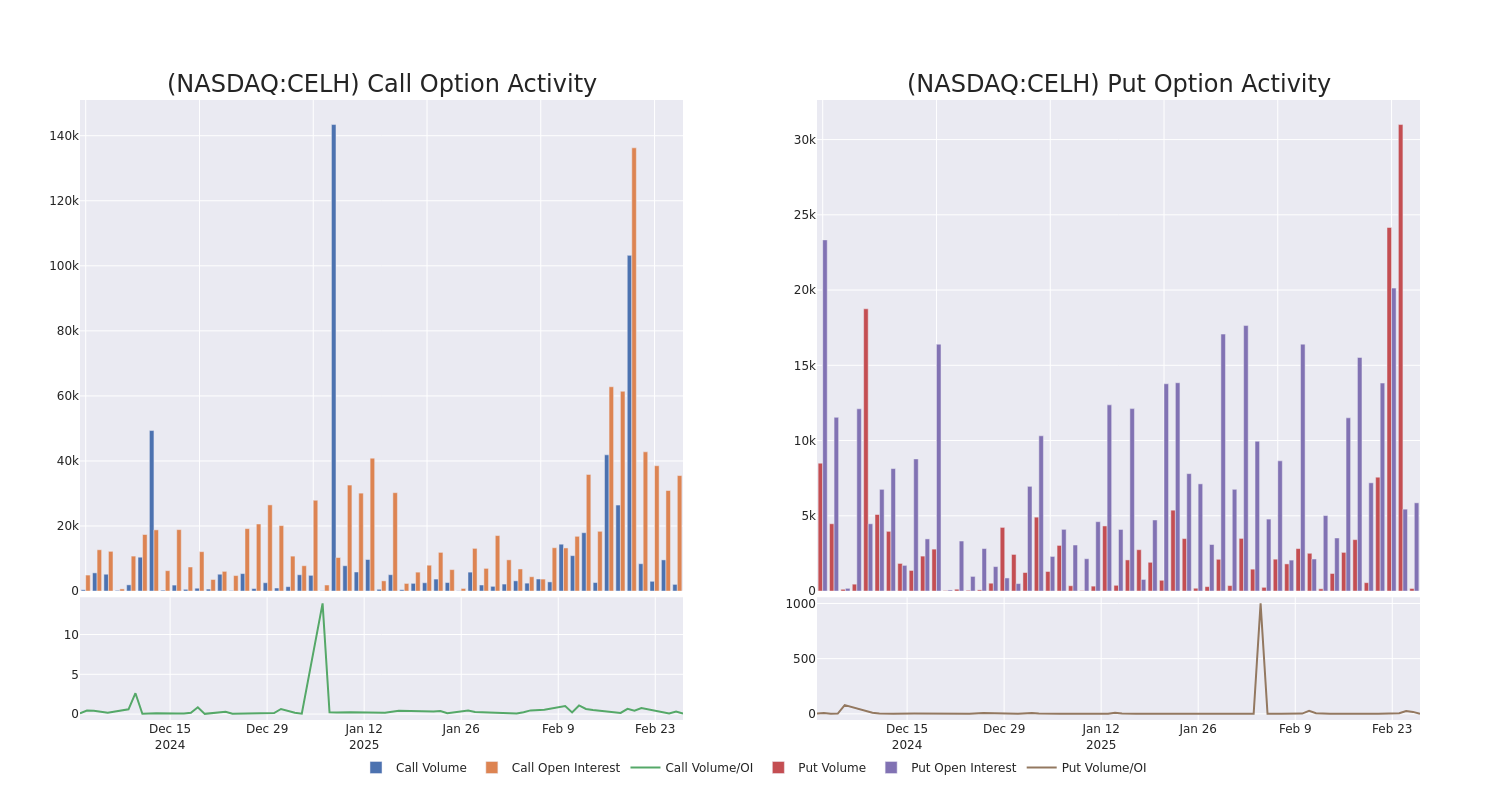

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Celsius Holdings’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Celsius Holdings’s whale trades within a strike price range from $15.0 to $33.33 in the last 30 days.

Celsius Holdings Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | CALL | SWEEP | BEARISH | 01/15/27 | $15.85 | $14.95 | $14.95 | $15.00 | $224.2K | 1.1K | 0 |

| CELH | CALL | SWEEP | BULLISH | 01/15/27 | $13.5 | $12.25 | $13.64 | $20.00 | $202.9K | 668 | 0 |

| CELH | CALL | SWEEP | BEARISH | 05/16/25 | $3.3 | $3.2 | $3.22 | $27.50 | $88.5K | 1.3K | 313 |

| CELH | CALL | TRADE | BULLISH | 01/16/26 | $6.15 | $6.1 | $6.15 | $30.00 | $60.8K | 8.6K | 260 |

| CELH | CALL | TRADE | BEARISH | 01/16/26 | $6.1 | $6.05 | $6.05 | $30.00 | $60.5K | 8.6K | 360 |

About Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius’ products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm’s portfolio includes its namesake Celsius Originals beverages, Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius dedicates its efforts to branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Present Market Standing of Celsius Holdings

- With a trading volume of 4,480,233, the price of CELH is down by -2.66%, reaching $26.48.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 68 days from now.

What Analysts Are Saying About Celsius Holdings

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $41.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Roth MKM lowers its rating to Buy with a new price target of $38.

* An analyst from Stifel persists with their Buy rating on Celsius Holdings, maintaining a target price of $37.

* An analyst from Needham persists with their Buy rating on Celsius Holdings, maintaining a target price of $40.

* An analyst from B. Riley Securities has revised its rating downward to Buy, adjusting the price target to $49.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Celsius Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.