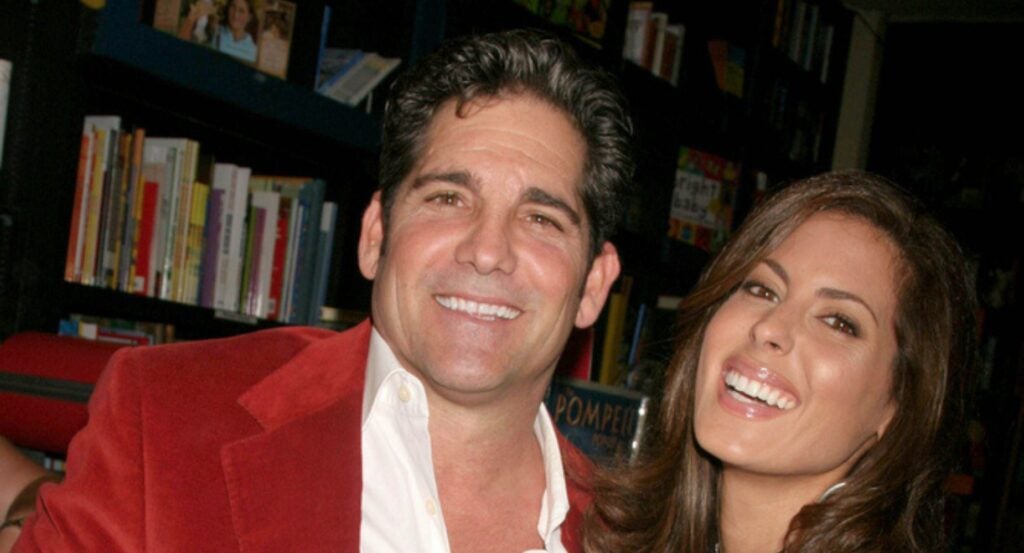

Grant Cardone, the multifamily real estate investor and social media omnipresence, has always been bullish on the benefits of buying apartment buildings. Recently, he has been predicting that the average rent in the US could double in the next decade.

Cardone’s assumption is based on several different factors. Besides the Sunbelt, new multifamily property development has slowed in many areas, increasing rental demand. He also contends that high interest rates have made it cheaper to rent than own. After a flattening off with only modest rental increases in 2025 — which has been supported by CRE Daily, and Commercial Real Estate company CBRE — Cardone predicts that “rents will explode in 2026.” CBRE agrees, stating, “As the construction pipeline shrinks, strong renter demand will lower the vacancy rate and precipitate above-average rent growth in 2026.”

Don’t Miss:

A Landlord Friendly Environment

According to some experts, that explosion could come as early as the tail end of 2025. The longer housing costs put homeownership out of reach for most Americans, the higher rents will continue to rise.

“The relationship is going to very quickly flip from a renter-friendly environment to a landlord-friendly environment,” Lee Everett, the head of research and strategy at multifamily giant Cortland, told The Wall Street Journal.

If rents were to rise significantly, it would increase housing costs — a key metric used to calculate inflation — causing the Fed to halt any lowering of rates, which would play into the hands of landlords, forcing more Americans to rent than buy. Real Estate data and analytics company, CoStar predicts that by the end of this year, every major metropolitan market is expected to see positive rent growth.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – Last Chance to get 4,000 of its pre-IPO shares for just $0.26/share!

New Construction Could Be Stunted

The prospect of President Donald Trump‘s tariffs and migrant deportations could also contribute to limited new construction, which would put pressure on current rental rates and further increase rents. According to the National Association of Home Builders, the US imports about 25% of its building materials from Canada and Mexico, while 13% of the construction workforce is comprised of undocumented workers.

The Slowest Housing Market In Three Decades

Last year saw the slowest housing market in three decades, and if interest rates, construction, and labor all remain problematic, potential buyers will remain on the sidelines, increasing rents. That certainly has been the case in the early part of 2025. In January, the average asking price for rent in the U.S. was almost $1,968 up 0.2% from December and 3.5% from a year earlier, according to Zillow.

See Also: Many don’t know there are tax benefits when buying a unit as an investment — Here’s how to invest in real estate by mirroring BlackRock’s big move

Rents Have Risen In 47 of the 50 Largest Metro Areas

According to Zillow data, rents have risen in 47 of the 50 largest metro areas compared to a year ago, with the Midwest and Northeast seeing the majority of increases and the Sunbelt, where multifamily construction has been robust, seeing the least.

Cardone envisages the pattern continuing. “The $1,900 rent that people complain will be $4,000,” he said.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.