Financial giants have made a conspicuous bullish move on Zscaler. Our analysis of options history for Zscaler ZS revealed 8 unusual trades.

Delving into the details, we found 75% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $300,994, and 2 were calls, valued at $116,890.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $217.5 for Zscaler over the last 3 months.

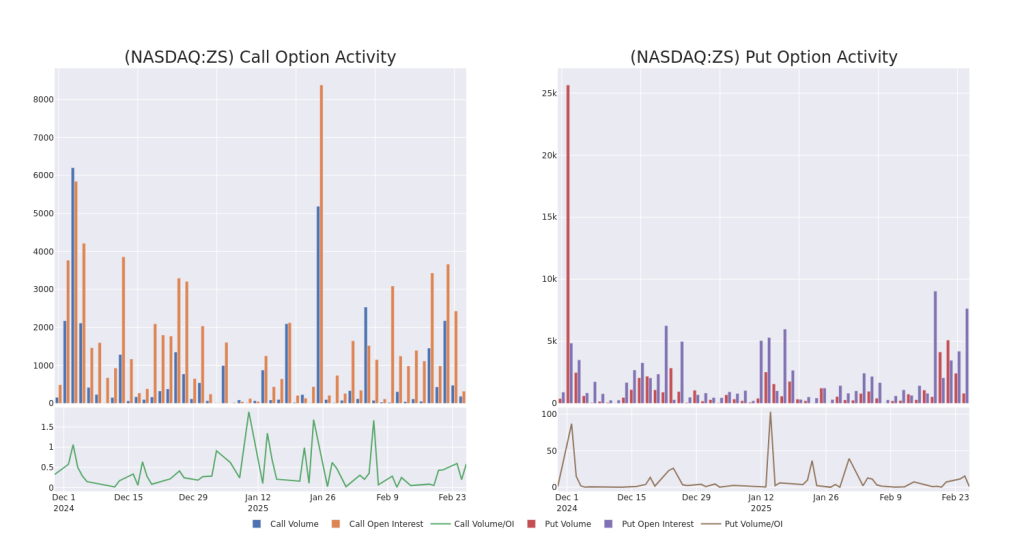

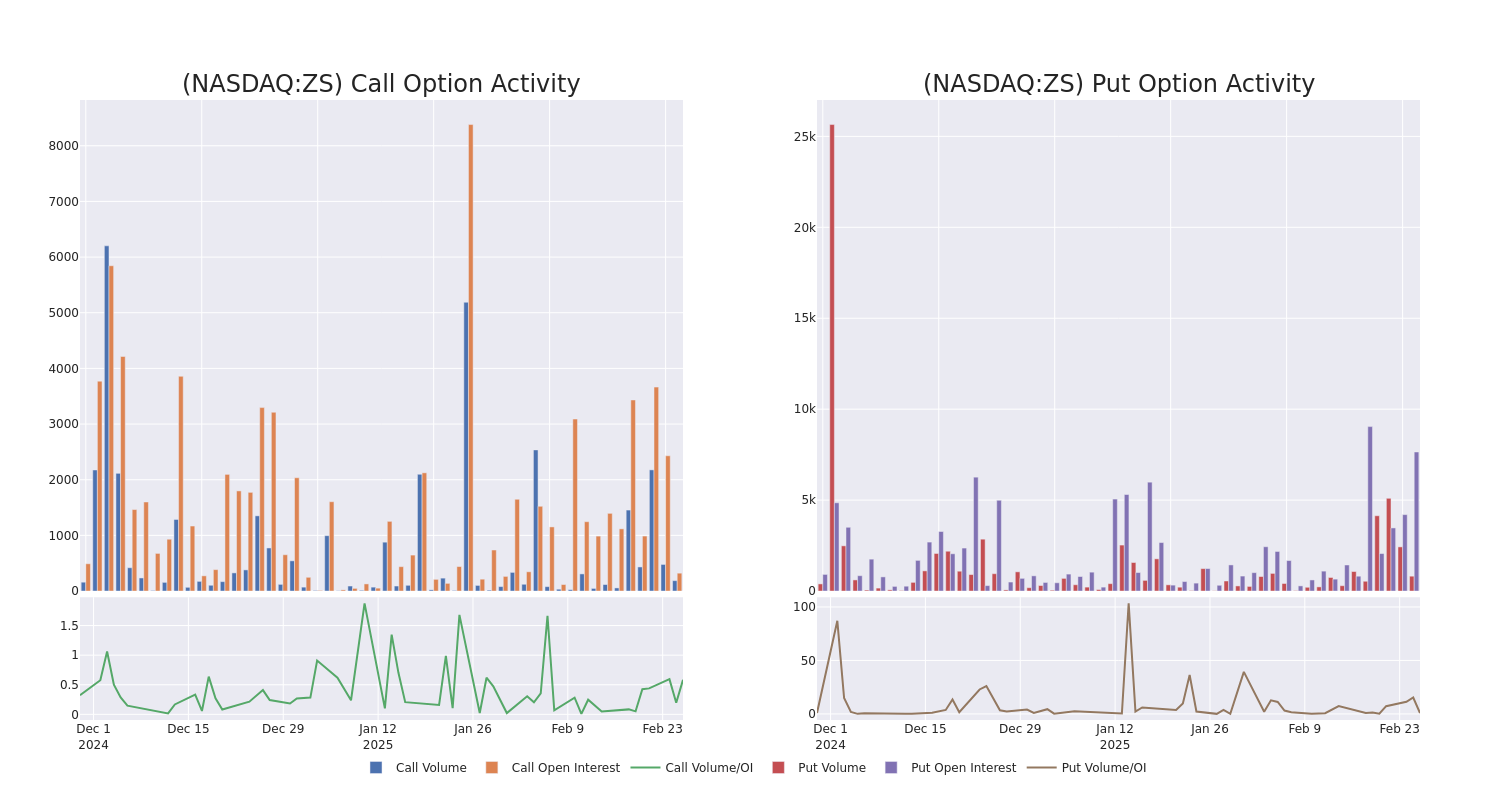

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Zscaler options trades today is 1593.6 with a total volume of 1,004.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Zscaler’s big money trades within a strike price range of $150.0 to $217.5 over the last 30 days.

Zscaler Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | CALL | TRADE | BULLISH | 03/07/25 | $7.35 | $7.15 | $7.35 | $210.00 | $91.1K | 303 | 132 |

| ZS | PUT | TRADE | BULLISH | 06/20/25 | $4.8 | $4.7 | $4.7 | $150.00 | $63.9K | 6.2K | 2 |

| ZS | PUT | TRADE | BULLISH | 06/20/25 | $4.75 | $4.65 | $4.65 | $150.00 | $61.8K | 6.2K | 138 |

| ZS | PUT | TRADE | BULLISH | 06/20/25 | $5.7 | $5.65 | $5.65 | $155.00 | $61.5K | 994 | 231 |

| ZS | PUT | TRADE | BULLISH | 06/20/25 | $5.7 | $5.65 | $5.65 | $155.00 | $40.6K | 994 | 85 |

About Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler’s offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Zscaler’s Current Market Status

- Currently trading with a volume of 247,098, the ZS’s price is up by 2.04%, now at $196.99.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 7 days.

Professional Analyst Ratings for Zscaler

In the last month, 2 experts released ratings on this stock with an average target price of $237.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Mizuho persists with their Neutral rating on Zscaler, maintaining a target price of $225.

* An analyst from Barclays persists with their Overweight rating on Zscaler, maintaining a target price of $250.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Zscaler options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.