Trip.com Group Limited TCOM shares are trading lower premarket on Tuesday.

On Monday, the company reported fourth-quarter adjusted EPS of $0.60, surpassing the $0.52 estimate. Net revenue rose 23% year over year (Y/Y) to RMB12.7 billion, primarily driven by stronger travel demand. In USD terms, sales of $1.75 billion exceeded the $1.69 billion estimate.

Accommodation reservation revenue rose 33% year over year to RMB5.2 billion ($709 million), led by higher accommodation bookings.

Read: Trip.com Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Transportation ticketing revenue upped 16% Y/Y to RMB4.8 billion ($655 million), primarily aided by an increase in transportation reservations. Packaged-tour revenue surged 24% Y/Y to RMB870 million ($119 million) on higher packaged-tour bookings.

Outbound hotel and air ticket bookings have surpassed pre-COVID levels in the quarter, reaching over 120% of the same period in 2019. Adjusted EBITDA rose to RMB3.0 billion ($408 million) from RMB2.9 billion in the prior year quarter.

As of December 31, 2024, cash and equivalents stood at RMB90.0 billion ($12.3 billion).

The company’s board authorized new capital return measures for 2025, including a $400 million share repurchase program and a $200 million cash dividend for 2024.

The dividend of $0.30 per share or ADS will be paid to eligible shareholders and ADS holders of record as of March 17, 2025, with payments scheduled for March 27, 2025, for ordinary shares and April 4, 2025, for ADS holders, subject to the deposit agreement terms.

James Liang, Executive Chairman, said, “The travel market has shown remarkable resilience in 2024, driven by travelers’ growing desire for exploration and cultural experiences,”

“We are committed to investing in AI and promoting inbound travel to foster innovation and enhance the overall travel experience. We anticipate another year of growth and success within the industry.”

Notably, shares of US-listed Chinese stocks are down following Wall Street’s worst session of the year on Friday, sparked by inflation concerns and mixed economic data. Additionally, the weakness could be attributed to profit-taking after last week’s rally.

Investors can gain exposure to the stock via Invesco Golden Dragon China ETF PGJ and AdvisorShares Hotel ETF BEDZ.

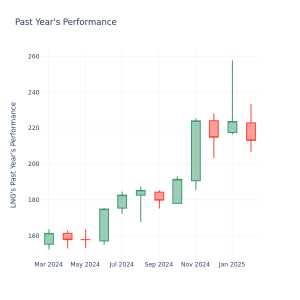

Price Action: TCOM shares are down 8.10% at $59.42 premarket at the last check Tuesday.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.