Leading cryptocurrencies corrected sharply on Monday as the Bybit hack and President Donald Trump’s tariff threat weighed on the market.

| Cryptocurrency | Gains +/- | Price (Recorded at 7:30 p.m. ET) |

| Bitcoin BTC/USD | -4.82% | $91,639.29 |

| Ethereum ETH/USD |

-11.48% | $2,494.24 |

| Dogecoin DOGE/USD | -13.79% | $0.2096 |

What Happened: Bitcoin sank below $91,000 for the first time in over three months, while Ethereum fell to an intraday low of $2,461.52, its lowest since Feb. 3.

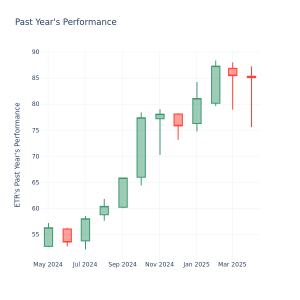

The apex cryptocurrency has already lost 9.7% since February began, in contrast to the 43% rise it saw last year. Ethereum has dropped 23.63% and could be heading to its worst February.

Ethereum was at the center of the $1.4 billion hack on cryptocurrency exchange Bybit. Although the platform claims to have restored its ETH holdings to pre-hack levels, concerns about hackers dumping such a big amount have generated alarm.

The market bled profusely, with over $960 million getting liquidated in the last 24 hours. Upside bets accounted for $890 million.

Hedges against price decline increased as the total number of short positions surpassed long positions, according to the Long/Short Ratio.

That said, a whopping $1.61 billion in short positions risked liquidation if Bitcoin reclaimed $100,000.

The market was gripped with “Extreme Fear,” according to the Crypto Fear and Greed Index, sparking concerns of further downsides.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 7:30 p.m. ET) |

| Story (IP) | +15.01% | $4.65 |

| DeXe (DEXE) | +2.31% | $19.06 |

| Berachain (BERA) | +0.87% | $16.94 |

The global cryptocurrency market capitalization stood at $3.08 trillion, falling by 2.56% in the last 24 hours.

Investors will be watching the all-important earnings report of artificial intelligence darling Nvidia Corp. NVDA, slated for Wednesday.

In addition, the Federal Reserve’s favorite inflation gauge, the personal consumption expenditures index, will be released on Friday, providing cues about the central bank’s moves on interest rates.

Major stock indexes slid on Thursday. The S&P 500 fell 0.50% to close at 5,983.25. The tech-focused Nasdaq Composite lost 1.21% during the session, ending at 19,286.92. The Dow Jones Industrial Average chalked out a narrow gain of 0.08% to close at 43,461.21.

The sentiment was impacted after Trump reaffirmed that tariffs on imports from Canada and Mexico would take effect as planned.

Investors will focus on the all-important earnings report of artificial intelligence darling Nvidia Corp. NVDA, slated for Wednesday.

See More: Best Cryptocurrency Scanners

Analyst Notes: Popular cryptocurrency analyst and investor Ali Martinez cautioned traders that if Bitcoin loses $93,700 as support, the next key level of interest is $75,600.

He also highlighted the declining capital inflows into the cryptocurrency market in the last 10 days, which fell from $52 billion to $26.5 billion.

Chris Burniske, cofounder of cryptocurrency firm Placeholder, stated that the ongoing “mid-bull reset” is not unprecedented and that top coins like Bitcoin, Ethereum, and Solana SOL/USD witnessed big corrections during the last bull cycle in 2021.

“Those calling for a full-blown bear are misguided,” Burniske added.

Photo by CMP_NZ on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.