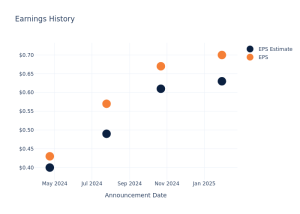

Repligen Corp RGEN released its fourth-quarter adjusted EPS of 44 cents on Tuesday, down from 48 cents a year ago but beating the consensus of 41 cents.

The bioprocessing technology reported sales of $167.55 million, slightly up from $166.6 million a year ago, almost in line with the consensus of $167.67 million.

Olivier Loeillot, President and Chief Executive Officer of Repligen, said, “During the fourth quarter, we were very encouraged by the continued momentum across our portfolio. Total revenue in the fourth quarter grew 13%, excluding COVID-19, overcoming two points of currency headwind. Total orders outpaced sales by 6%, driven by our Filtration and Analytics franchises…While we continue to monitor China and emerging biotech, the overall bioprocessing market is returning to growth. Our order momentum during the second half gives us confidence that we can achieve our 2025 guidance.”

Guidance: Repligen expects 2025 sales of $685 million—$710 million, with organic growth of 9.5%—13.5% and non-COVID revenue growth of 10%—14% compared to the consensus of $694.86 million.

The company expects adjusted EPS of $1.67—$1.76 compared to the consensus of $1.73.

William Blair says Repligen’s Q4 results and 2025 outlook confirm that the bioprocessing industry is recovering strongly, with growth expected to return to normal levels next year.

Repligen’s guidance reflects strong quarterly momentum, signaling a market recovery.

Compared to peers like Danaher Corporation DHR and Avantor Inc AVTR, which project mid-to-high single-digit growth in bioprocessing, Repligen’s outlook highlights its strong product portfolio and customer positioning that have driven consistent above-market growth.

Since Repligen focuses solely on bioprocessing and has minimal exposure to risks in NIH-funded research, academia, or China, analyst Matt Larew believes its guidance is more predictable than competitors with broader market and geographic exposure.

Price Action: RGEN stock is up 8.16% at $163.03 at the last check Thursday.

Read Next:

Image via Repligen

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.