(Bloomberg) — European bonds fell and shares in defense companies rallied on the likelihood of greater military spending, which could force governments to step up borrowing in the coming years.

Most Read from Bloomberg

German, French and Italian bonds all slipped, with 10-year bund yields — the benchmark borrowing rate for the euro area — reaching the highest in more than two weeks. Europe’s Stoxx 600 index rose 0.4%, led by strong gains in defense names including Germany’s Rheinmetall AG and Sweden’s Saab AB. A Goldman Sachs Group Inc. index of European defense shares topped a record high. US markets are shut for a holiday.

Officials are working on a major new package to ramp up defense spending and some EU leaders are planning to meet on Monday in Paris to start drawing up their response. The moves come as the US pushes for a quick end to the war in Ukraine and after Vice President JD Vance attacked longstanding European allies at a security conference Friday.

“The goalposts are shifting, and the EU is realizing they can rely less and less on the US for protecting their borders. In lockstep, we’re going to have to see European countries spend more on defense,” said Aneeka Gupta, head of macro research at Wisdomtree UK Ltd. “That does warrant a bit more caution on bonds.”

The developments have cemented the view that debt sales will need to increase as European nations shoulder the cost of a lasting peace deal between Ukraine and Russia. Upgrading defense and protecting Ukraine may cost Europe’s major powers an additional $3.1 trillion over 10 years, according to Bloomberg Economics estimates.

European stocks were also buoyed by improved sentiment over China, a key export market, where a meeting between President Xi Jinping and business figures including e-commerce icon Jack Ma raised hopes that authorities’ years-long crackdown on the private sector is ending.

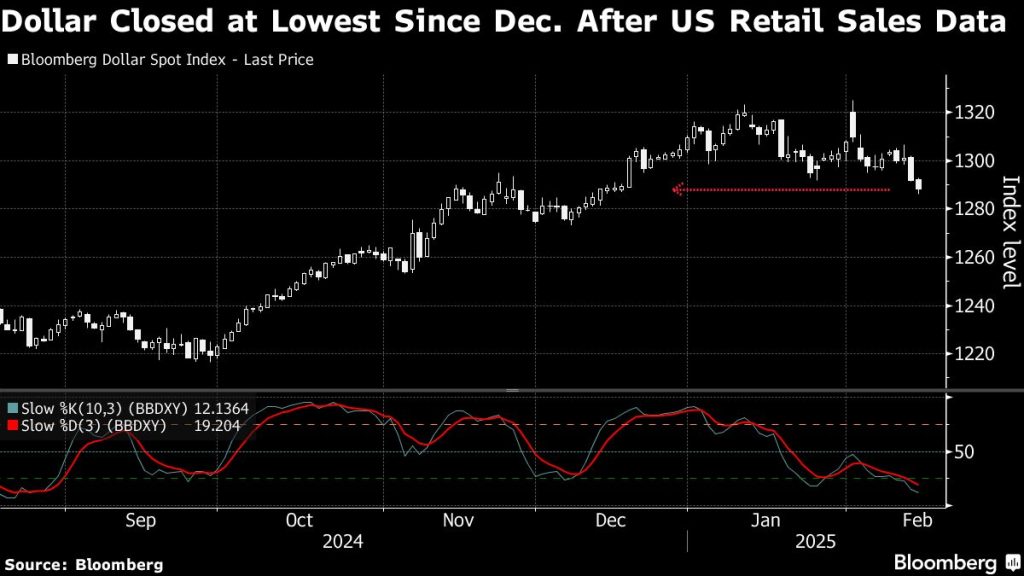

In currency markets, Japan’s yen strengthened against all its Group-of-10 peers after the economy grew faster than expected, bolstering expectations of interest-rate hikes from the Bank of Japan. Bloomberg’s dollar index traded steady after two days of losses.

Some of the key events this week:

-

Presidents Day holiday in the US; bond and stock markets are closed, Monday

-

Australia rate decision, Tuesday

-

UK jobless claims, unemployment, Tuesday

-

Bank of England Governor Andrew Bailey speaks, Tuesday

-

Canada CPI, Tuesday

-

New Zealand rate decision, Wednesday

-

Indonesia rate decision, Wednesday

-

UK CPI, Wednesday

-

South Africa CPI, retail sales, Wednesday

-

US FOMC minutes, housing starts, Wednesday

-

Australia unemployment, Thursday

-

China loan prime rates, Thursday

-

Eurozone consumer confidence, Thursday

-

G-20 foreign ministers meet in South Africa, Thursday – Friday

-

Reserve Bank of Australia Governor Michele Bullock and officials testify to parliamentary committee, Friday

-

Japan CPI, Friday

-

Eurozone HCOB manufacturing & services PMI, Friday

-

UK S&P Global manufacturing & services PMI, Friday

-

US S&P Global manufacturing & services PMI, Friday

-

Bank of Canada Governor Tiff Macklem speaks, Friday