Financial giants have made a conspicuous bearish move on NVIDIA. Our analysis of options history for NVIDIA NVDA revealed 360 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 46 were puts, with a value of $4,086,939, and 314 were calls, valued at $19,291,819.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $180.0 for NVIDIA, spanning the last three months.

Analyzing Volume & Open Interest

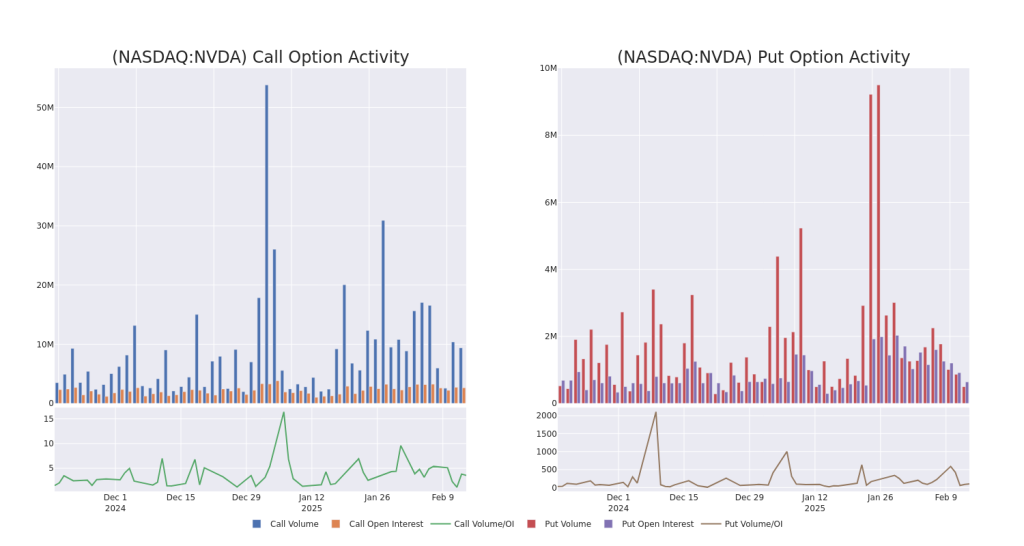

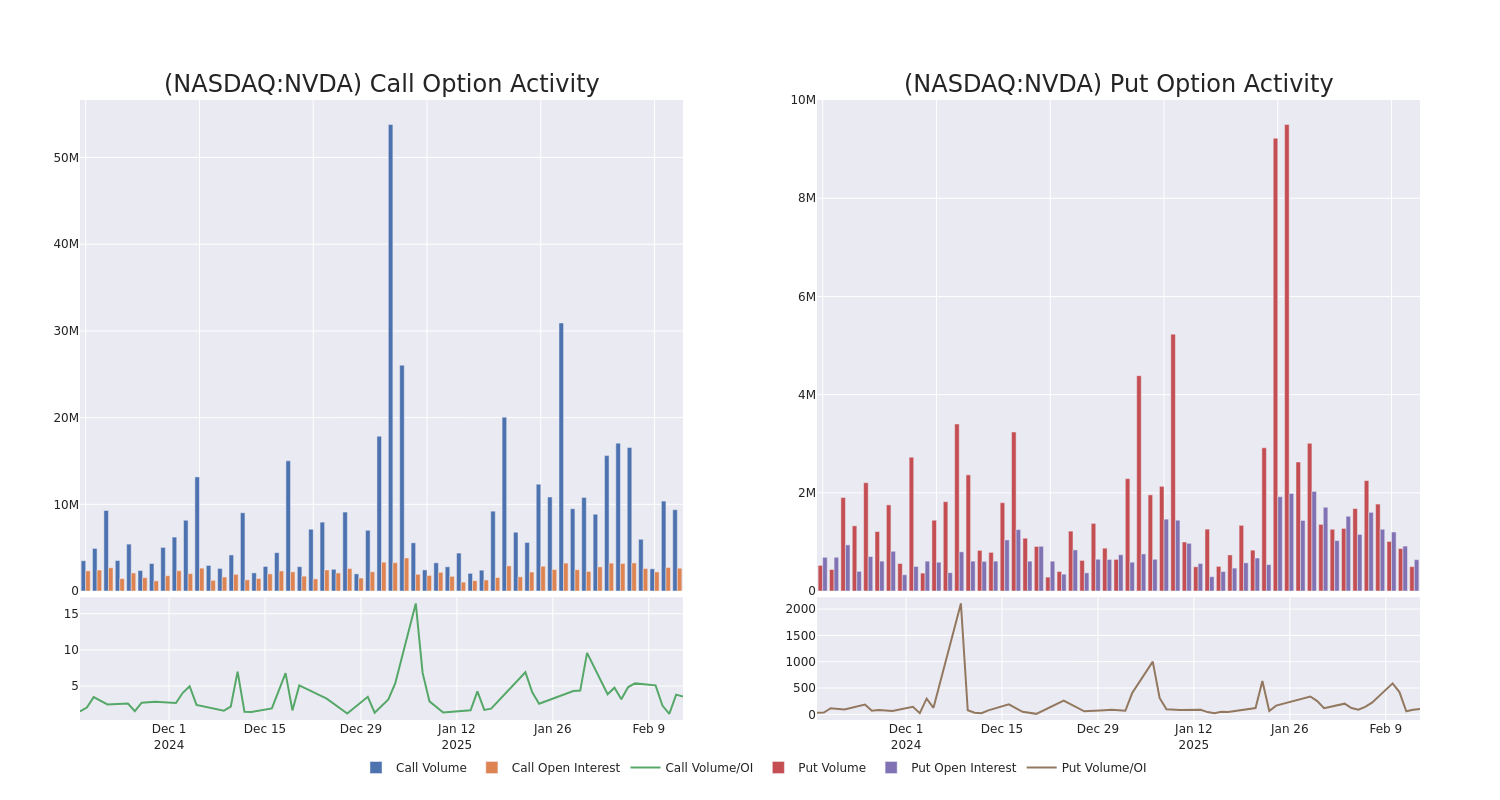

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for NVIDIA’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across NVIDIA’s significant trades, within a strike price range of $50.0 to $180.0, over the past month.

NVIDIA Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | BEARISH | 02/21/25 | $1.73 | $1.73 | $1.73 | $140.00 | $338.5K | 158.4K | 75.4K |

| NVDA | PUT | SWEEP | BEARISH | 03/21/25 | $6.6 | $6.55 | $6.6 | $130.00 | $206.5K | 97.3K | 1.4K |

| NVDA | PUT | SWEEP | BEARISH | 02/14/25 | $0.95 | $0.93 | $0.95 | $138.00 | $193.9K | 6.8K | 47.5K |

| NVDA | CALL | SWEEP | NEUTRAL | 03/21/25 | $9.15 | $9.05 | $9.1 | $140.00 | $179.2K | 103.8K | 6.8K |

| NVDA | PUT | SWEEP | BULLISH | 07/18/25 | $7.0 | $6.9 | $6.95 | $115.00 | $116.0K | 12.1K | 3.7K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

NVIDIA’s Current Market Status

- With a trading volume of 110,769,392, the price of NVDA is up by 1.56%, reaching $137.4.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 12 days from now.

What The Experts Say On NVIDIA

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $186.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on NVIDIA with a target price of $175.

* An analyst from Morgan Stanley persists with their Overweight rating on NVIDIA, maintaining a target price of $152.

* In a positive move, an analyst from Tigress Financial has upgraded their rating to Strong Buy and adjusted the price target to $220.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.