Aspen Aerogels, Inc. ASPN reported better-than-expected earnings for its fourth quarter on Thursday.

The company posted quarterly earnings of 14 cents per share which beat the analyst consensus estimate of 8 cents per share. The company reported quarterly sales of $123.09 million which beat the analyst consensus estimate of $120.80 million.

“Our financial results for 2024 underscore the scalability of our business model and leading market position,” commented Don Young, Aspen’s President and CEO. “In addition to exceeding our initial 2024 revenue and profitability expectations, we added multiple OEMs to our growing list of customers, including the recent award from Volvo Truck, and established external manufacturing capabilities to provide supply for our growing Energy Industrial business. We are taking a prudent approach to 2025 and are implementing several actions that increase our agility and capital efficiency.”

Aspen said it sees first-quarter revenue to range between $75 million and $95 million and net loss per share to range between $0.18 and breakeven.

Aspen Aerogels shares fell 0.6% to trade at $8.95 on Friday.

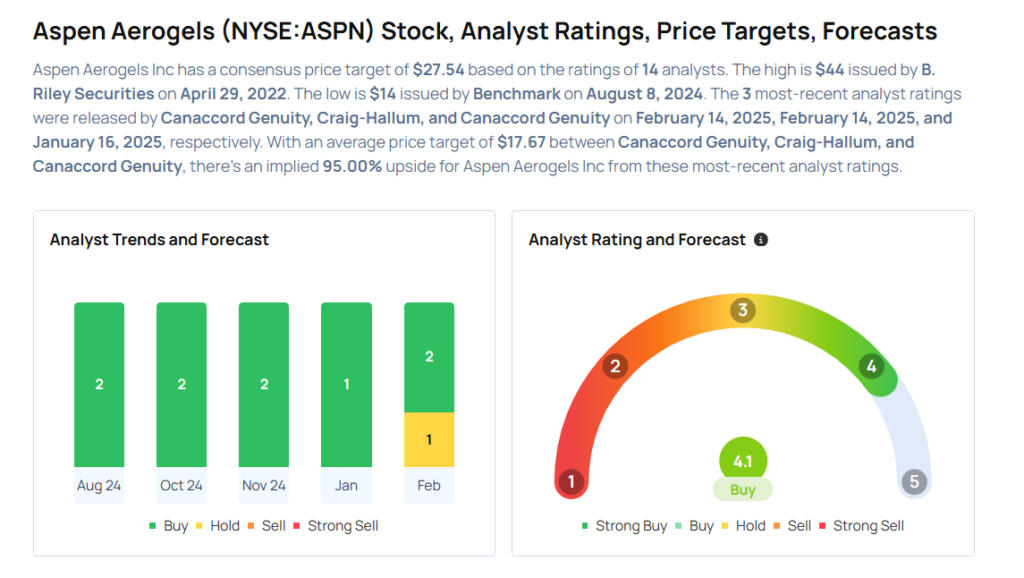

These analysts made changes to their price targets on Aspen Aerogels following earnings announcement.

- Craig-Hallum analyst Eric Stine maintained Aspen Aerogels with a Buy and lowered the price target from $21 to $18.

- Canaccord Genuity analyst George Gianarikas maintained the stock with a Buy and lowered the price target from $20 to $15.

Considering buying ASPN stock? Here’s what analysts think:

Read This Next:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.