(Bloomberg) — The US Treasury Department cut the size of some benchmark bill auctions, the start of what’s likely to be a series of reductions as the government preserves its borrowing authority under the statutory debt ceiling.

Most Read from Bloomberg

Treasury said it plans to sell $90 billion of four-week bills Thursday, $5 billion smaller than the previous offering at that tenor. It announced $85 billion of eight-week bills to be sold Thursday, which is also $5 billion smaller. The regular 17-week bill to be sold Wednesday was lowered to $62 billion, a $2 billion reduction.

Those are the first reductions for the four- and eight-week offerings since Dec. 26, and the first ever cut to the 17-week issue.

“Treasury is starting to trim supply as the tax date approaches and as the debt-ceiling constraint becomes more binding,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities. “We expect bills to gradually become more scarce as the debt ceiling becomes more binding, richening bills and likely increasing the use” of the Federal Reserve’s reverse repurchase agreement facility.

With the Treasury taking various measures to avoid crashing into the statutory debt limit — which Congress may be planning to do via the reconciliation process — there has been widespread expectation that the department would start shrinking the amount of short-term securities it sells at weekly auctions.

Even without a debt-ceiling crunch on the horizon, the government tends to reduce its borrowing activity in March and April as it collects income taxes. After that, however, it has historically tended to ramp up issuance as the excess generated by tax receipts dissipates.

Yet, depending on how long it takes to resolve the debt ceiling, supply reductions could persist. At its quarterly refunding on Feb. 5, Treasury said that until the debt ceiling is suspended or increased, constraints under the limit will lead to greater-than-normal variability in benchmark bill issuance and significant usage of ad hoc cash management bills.

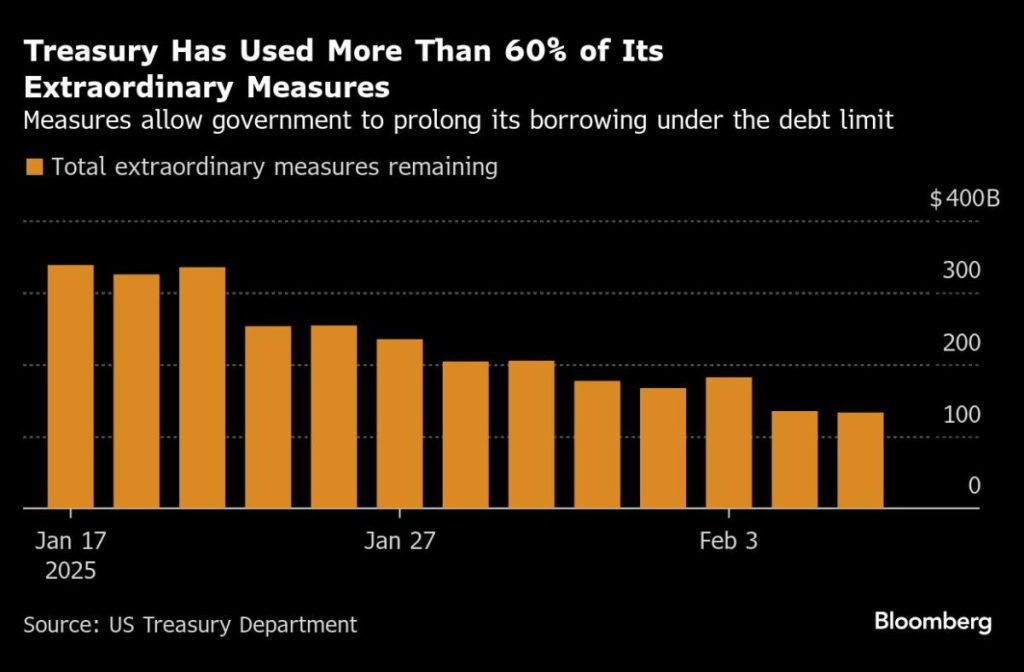

So far, the US Treasury has $133 billion of extraordinary measures left, in addition to its cash pile, to help keep paying the government’s bills, the department said, citing data as of Feb. 5. That’s out of a total of $338 billion of authorized measures that were available to keep the government from running out of borrowing room under the statutory debt limit and is down from around $205 billion on Jan. 29, according to a Treasury statement released Friday.