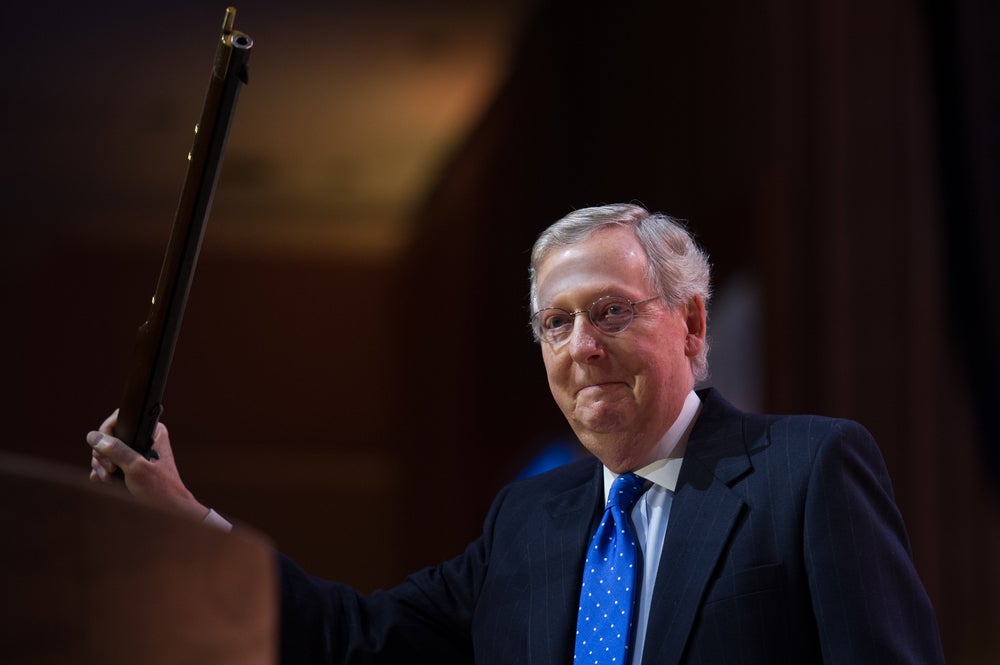

Sen. Mitch McConnell (R-Ky.) expressed his concerns over President Donald Trump’s tariff policies, warning that they could trigger a trade war and subsequently inflate prices for consumers and businesses in the U.S.

What Happened: McConnell’s apprehensions were voiced in an op-ed published in Louisville’s Courier-Journal, as reported by CNBC on Wednesday. The Kentucky Senator expressed that Trump’s “aggressive proposals leave big, lingering concerns for American industry and workers.”

Trump, well known for his support of tariffs, recently implemented widespread import duties on Canada, Mexico, and China, along with additional tariffs on steel and aluminum imports. Though he postponed the tariffs on Mexico and Canada for a month, the delay is scheduled to expire in the first week of March.

‘In his op-ed, McConnell acknowledged the necessity for America’s closest neighbors to take significant action on the border crisis. However, he firmly asserted that “tariffs are bad policy.” In his op-ed, McConnell acknowledged the necessity for America’s closest neighbors to take significant action on the border crisis. However, he firmly asserted that “tariffs are bad policy.”

He also expressed concerns over the possible effects of Trump’s protectionist policies on Kentucky, considering the state’s reliance on global trade for its farming, auto, and bourbon whiskey industries.

Why It Matters: McConnell’s criticism of Trump’s tariff plans is significant, as he is one of the few Republicans to publicly oppose the President’s trade war with the U.S.’s biggest trading partners. “Blanket tariffs make it more expensive to do business in America, driving up costs for consumers across the board,” cautioned McConnell.

Market analyst Peter Schiff echoed McConnell as he warned about the ripple effect: “Everything that American companies manufacture or build that requires steel or aluminum, such as cars, aircraft, appliances, and houses will cost more.”

Shares of steel companies cheered on the announcement amid hopes of increased domestic demand. United States Steel X climbed over 6% in the past month while Steel Dynamics Inc. STLD surged more than 7% in the same period.

Meanwhile, Goldman Sachs stated, “The models for earnings-per-share and valuations indicate the fair value of the S&P 500 could decline 5% in the near term, should sustained US tariffs like those recently discussed take place.” added that the uncertainty surrounding the impact of the trade war could lower the forward 12-month price-to-earnings ratio by approximately 3%.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.