(Reuters) -China oversaw its largest-ever wave of rural bank mergers last year, a Reuters review of official data showed, but analysts say Beijing’s efforts to tackle risks in the small banking sector could end up creating more problems down the road.

Many of the roughly 4,000 small Chinese banks are backed by indebted provincial governments and largely funded via short-term money market and interbank borrowings, potentially jeopardising financial stability in the event a few of them fail.

The move comes at a time when many of these smaller banks have been hit hard by slowing loan growth and a spike in bad loans amid a property sector crisis and a prolonged downturn in the world’s no. 2 economy.

At least 290 rural Chinese banks and rural cooperatives were merged into larger regional lenders in 2024, according to Reuters calculation of regulatory and company filings over the past 12 months.

The scale of the mergers, which have not been reported previously, underscore the depth of the problem in a crucial corner of China’s financial sector.

It’s also the most sweeping consolidation since China’s small rural commercial banks were transformed in early 2000 from socialist-style, rural cooperatives to serve farmers and small enterprises overlooked by major state banks.

China’s rural or small banking sector has about 3,700 firms with a combined 57 trillion yuan ($7.8 trillion) in assets as of the end of June last year, roughly twice the size of Australia’s banking sector and one-third the size of the United States.

“After years of clean-up the banking system is in relatively good health despite the weakening economic backdrop,” said Jason Bedford, a former Asia analyst with Bridgewater and UBS, known for his in-depth research on the Chinese banking sector.

However, often these mergers simply create “larger troubled banks” by combining insolvent institutions, said Bedford.

China’s banking regulator, the National Financial Regulatory Authority, did not respond to Reuters request for comment.

SOARING BAD LOANS

Over the past decade, many small banks started aggressively lending to property developers and local government financing vehicles.

That practice made them vulnerable to the post-COVID economic downturn, the property market upheaval, and the weakening financials of the indebted local governments.

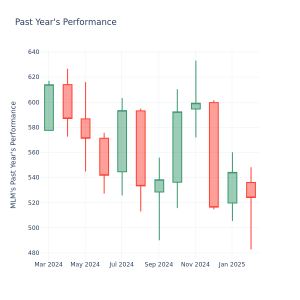

Rural commercial banks’ bad loan ratio hit 3.04% in the third quarter of last year, nearly double the overall banking sector’s 1.56%, show the latest official data. Analysts say the financial health of many small lenders is in a much worse state.