Financial giants have made a conspicuous bearish move on Lucid Gr. Our analysis of options history for Lucid Gr LCID revealed 10 unusual trades.

Delving into the details, we found 10% of traders were bullish, while 80% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $192,162, and 7 were calls, valued at $562,383.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $0.5 to $4.0 for Lucid Gr during the past quarter.

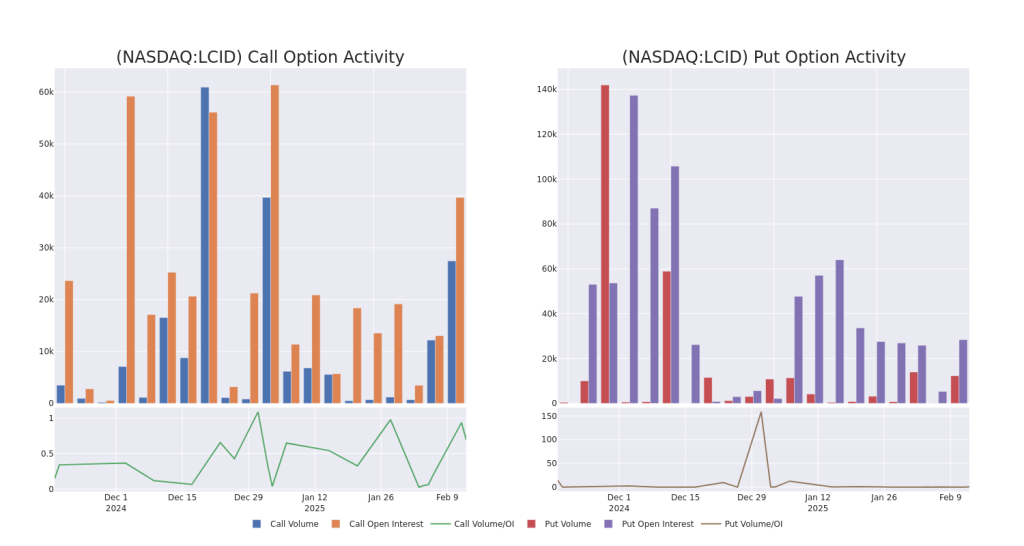

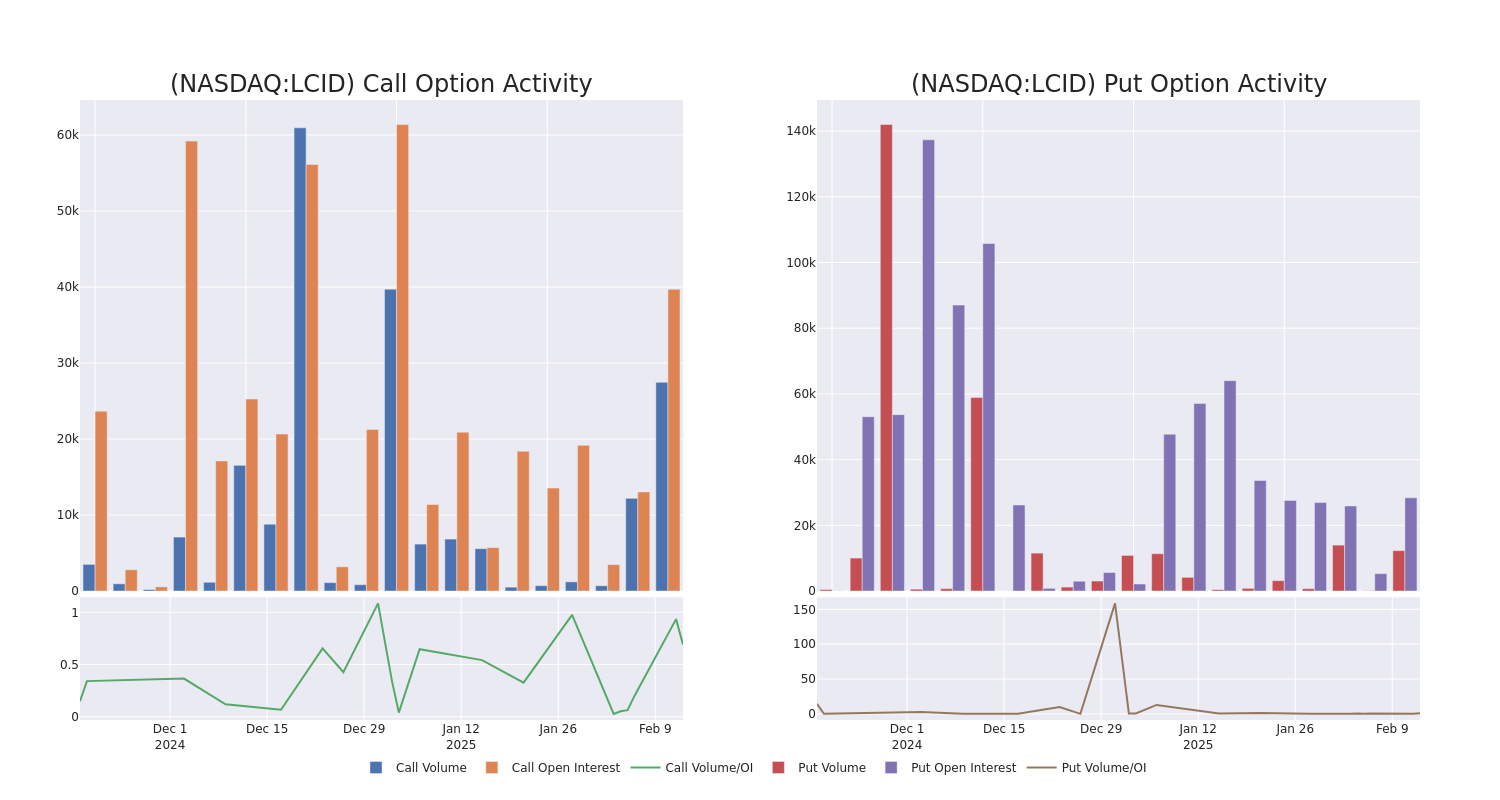

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Lucid Gr options trades today is 8508.75 with a total volume of 39,752.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lucid Gr’s big money trades within a strike price range of $0.5 to $4.0 over the last 30 days.

Lucid Gr Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LCID | CALL | TRADE | NEUTRAL | 08/21/26 | $1.41 | $1.2 | $1.3 | $4.00 | $377.0K | 4.4K | 3.0K |

| LCID | PUT | SWEEP | BEARISH | 03/21/25 | $0.33 | $0.32 | $0.33 | $3.00 | $124.5K | 27.1K | 4.7K |

| LCID | PUT | SWEEP | BEARISH | 01/16/26 | $1.2 | $1.17 | $1.2 | $3.50 | $39.0K | 1.2K | 330 |

| LCID | CALL | SWEEP | BULLISH | 02/28/25 | $0.39 | $0.38 | $0.39 | $3.00 | $37.1K | 7.5K | 3.2K |

| LCID | CALL | SWEEP | BEARISH | 06/20/25 | $0.95 | $0.77 | $0.76 | $2.50 | $34.2K | 3.2K | 4 |

About Lucid Gr

Lucid Group Inc is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using our own equipment and factory.

Following our analysis of the options activities associated with Lucid Gr, we pivot to a closer look at the company’s own performance.

Where Is Lucid Gr Standing Right Now?

- With a volume of 102,828,117, the price of LCID is up 13.41% at $3.25.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 12 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lucid Gr options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.