Financial giants have made a conspicuous bullish move on Alibaba Gr Hldgs. Our analysis of options history for Alibaba Gr Hldgs BABA revealed 12 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $84,100, and 10 were calls, valued at $761,828.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $100.0 and $180.0 for Alibaba Gr Hldgs, spanning the last three months.

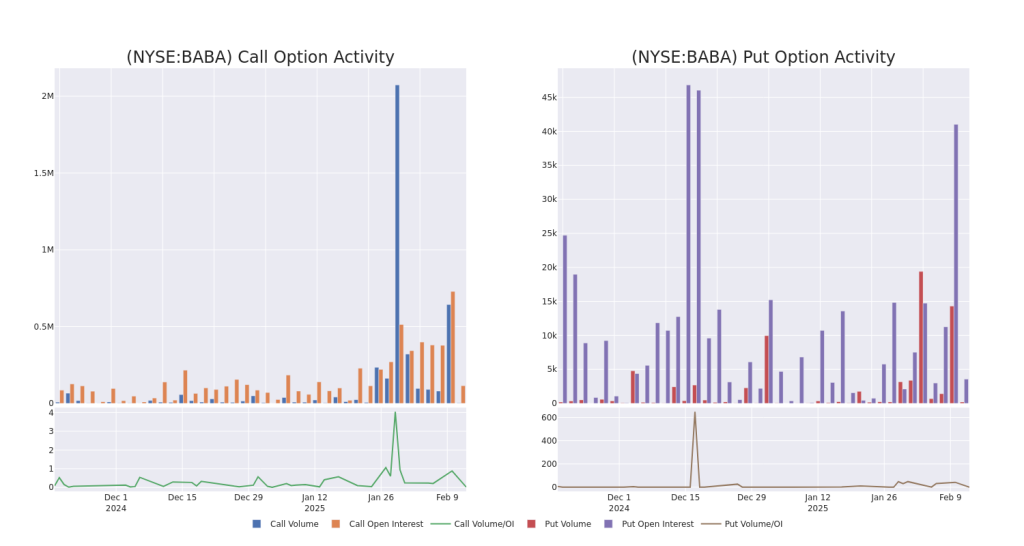

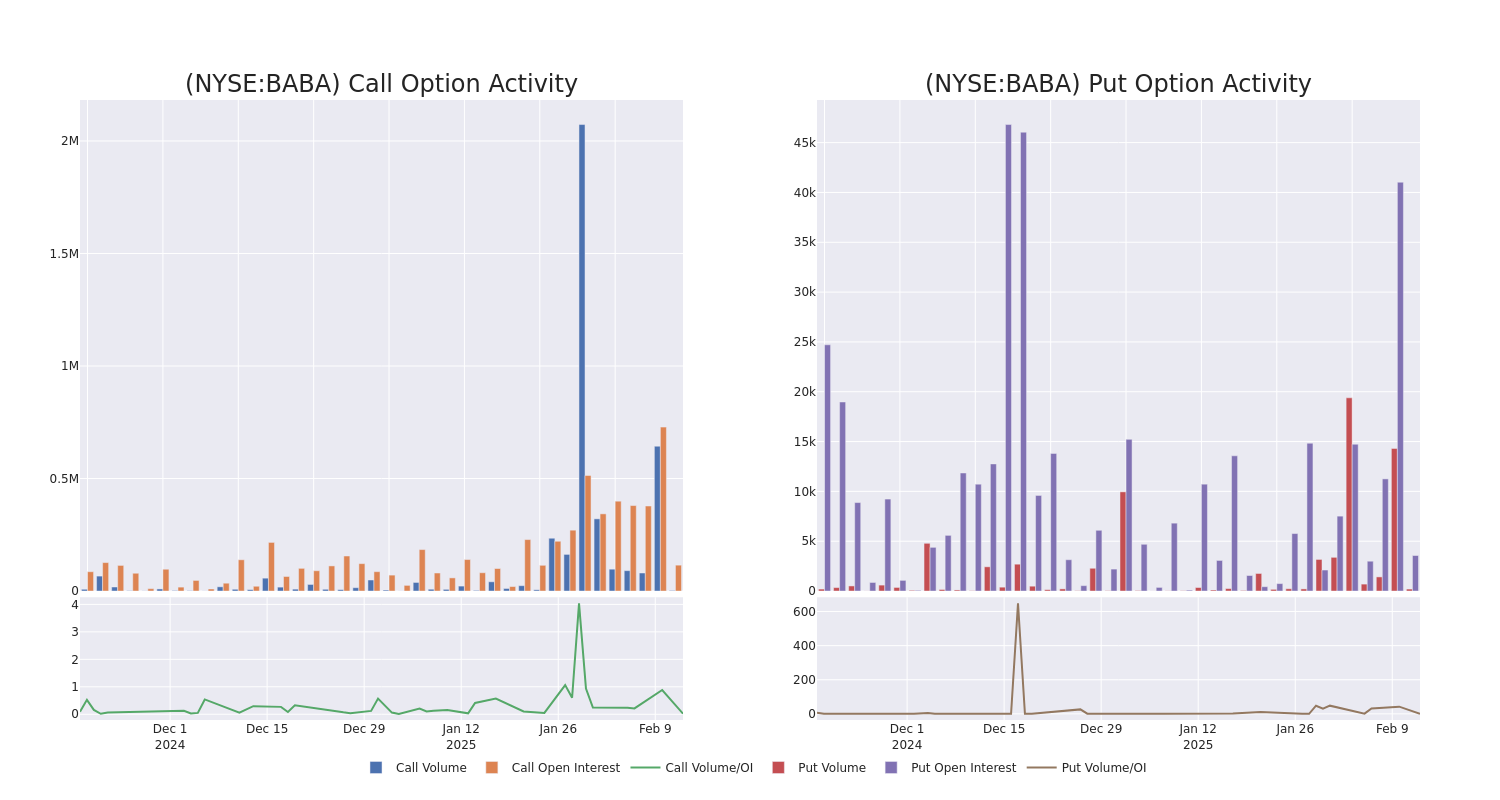

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Alibaba Gr Hldgs’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Alibaba Gr Hldgs’s whale activity within a strike price range from $100.0 to $180.0 in the last 30 days.

Alibaba Gr Hldgs Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BABA | CALL | SWEEP | BULLISH | 06/20/25 | $13.0 | $12.75 | $13.0 | $120.00 | $285.1K | 17.7K | 1.2K |

| BABA | CALL | TRADE | BULLISH | 02/21/25 | $5.05 | $4.9 | $5.0 | $117.00 | $125.0K | 3.8K | 384 |

| BABA | CALL | SWEEP | BULLISH | 12/19/25 | $6.0 | $5.95 | $6.0 | $180.00 | $78.6K | 235 | 21 |

| BABA | CALL | SWEEP | BEARISH | 06/20/25 | $8.65 | $8.55 | $8.55 | $130.00 | $68.4K | 4.7K | 93 |

| BABA | PUT | SWEEP | BEARISH | 02/21/25 | $4.35 | $4.3 | $4.32 | $115.00 | $43.3K | 3.3K | 159 |

About Alibaba Gr Hldgs

Alibaba is the world’s largest online and mobile commerce company as measured by gross merchandise volume. It operates China’s online marketplaces, including Taobao (consumer-to-consumer) and Tmall (business-to-consumer). The China commerce retail division is the most valuable cash flow-generating business at Alibaba. Additional revenue sources include China commerce wholesale, international commerce retail/wholesale, local consumer services, cloud computing, digital media and entertainment platforms, Cainiao logistics services, and innovation initiatives/other.

Having examined the options trading patterns of Alibaba Gr Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Alibaba Gr Hldgs

- With a trading volume of 10,400,885, the price of BABA is down by -1.75%, reaching $116.26.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 7 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Alibaba Gr Hldgs options trades with real-time alerts from Benzinga Pro.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.