Arvinas, Inc. ARVN reported worse-than-expected fourth-quarter sales results on Tuesday.

Arvinas reported quarterly losses of 63 cents per share which beat the analyst consensus estimate of a loss of 87 cents per share. The company reported quarterly sales of $59.20 million which missed the analyst consensus estimate of $65.28 million.

“We made significant progress across our pipeline in 2024, all of which we believe supports our mission to improve the lives of patients with debilitating and life-threatening diseases,” said John Houston, Ph.D., Chairperson, Chief Executive Officer and President at Arvinas. “Looking ahead, we are on the cusp of a number of firsts, including results from VERITAC-2, the first ever Phase 3 clinical trial of a PROTAC. In addition, we plan to present the first-in-human data for our most advanced neuroscience program, ARV-102, which we believe will highlight the potential value our PROTAC degraders can offer to patients with neurodegenerative diseases. In the coming months, we look forward to sharing additional updates emerging from our pipeline and PROTAC platform.”

Arvinas shares gained 1.4% to trade at $17.92 on Wednesday.

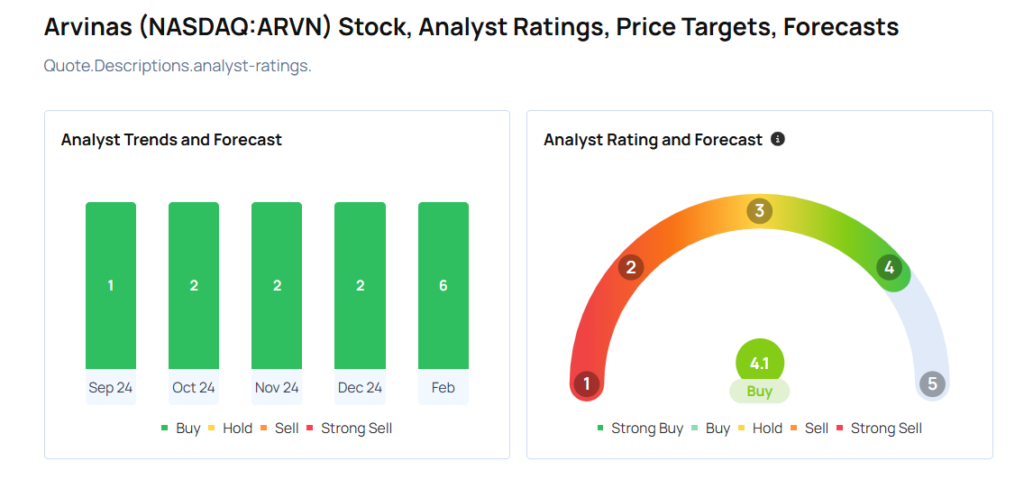

These analysts made changes to their price targets on Arvinas following earnings announcement.

- Stifel analyst Bradley Canino maintained Arvinas with a Buy and lowered the price target from $63 to $51.

- BMO Capital analyst Etzer Darout reiterated Arvinas with an Outperform and cut the price target from $88 to $82.

- Oppenheimer analyst Matthew Biegler maintained the stock with an Outperform and raised the price target from $40 to $45.

Considering buying ARVN stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.