Whales with a lot of money to spend have taken a noticeably bullish stance on On Holding.

Looking at options history for On Holding ONON we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 77% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $108,371 and 6, calls, for a total amount of $564,201.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $35.0 to $60.0 for On Holding over the recent three months.

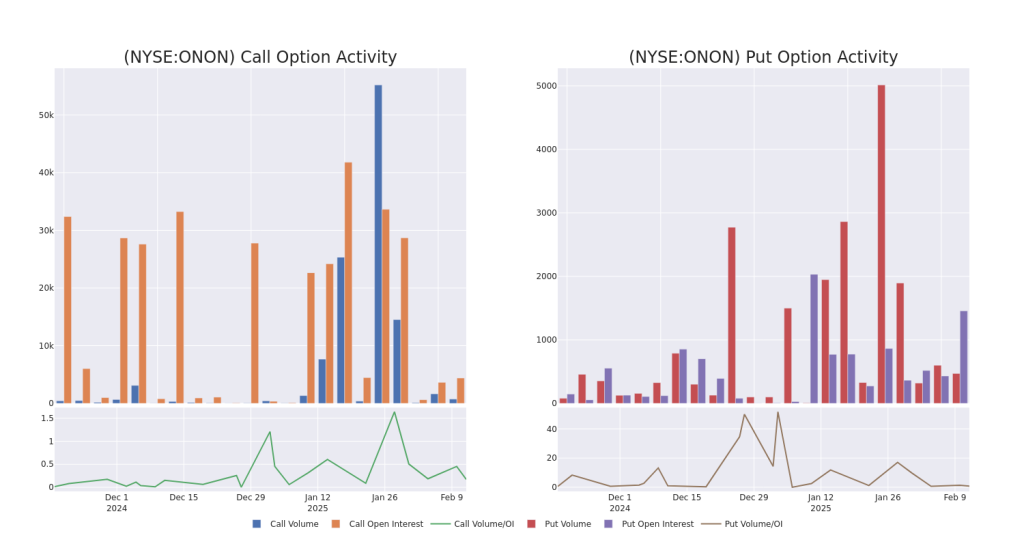

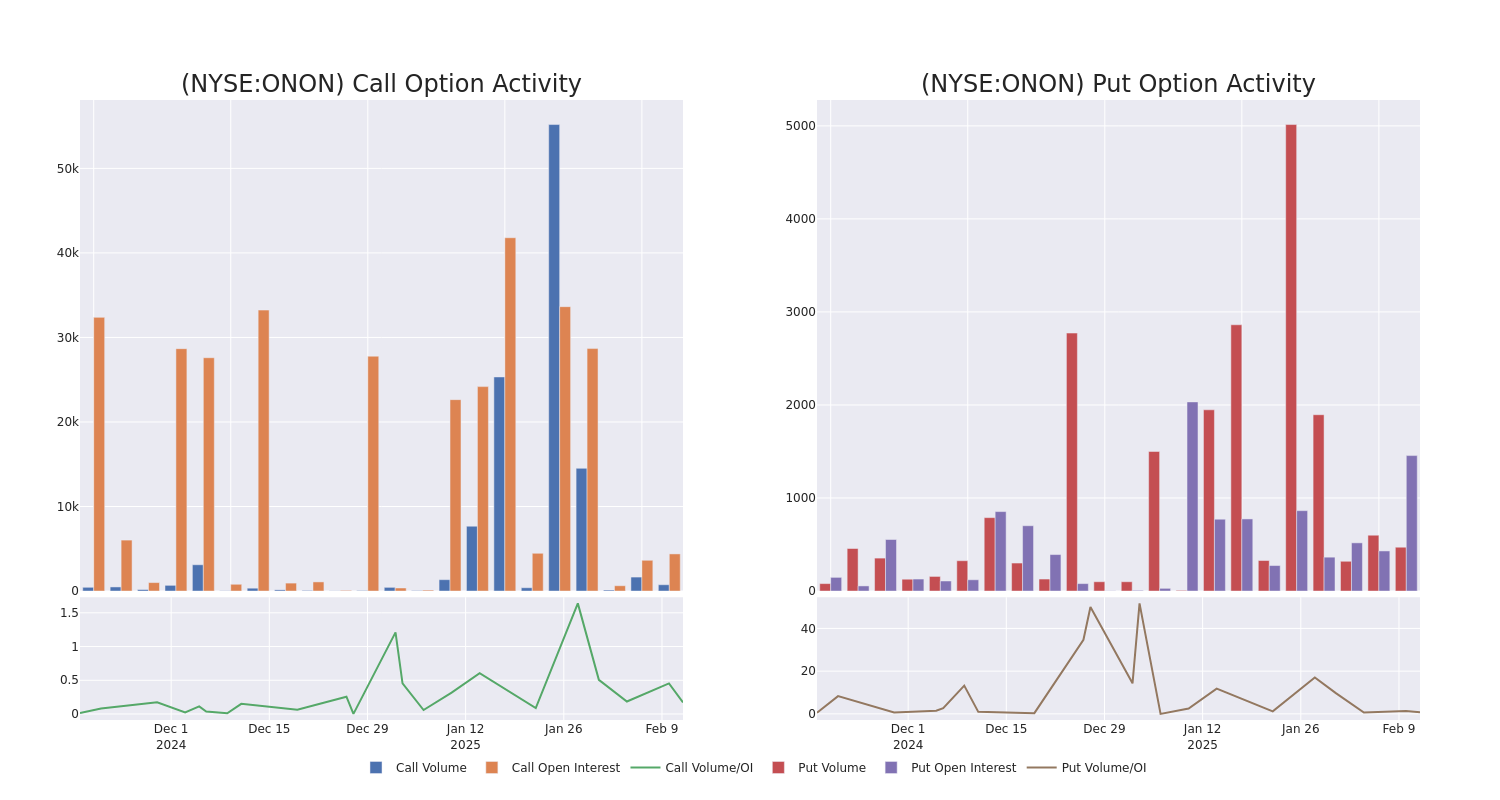

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in On Holding’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to On Holding’s substantial trades, within a strike price spectrum from $35.0 to $60.0 over the preceding 30 days.

On Holding 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ONON | CALL | SWEEP | BULLISH | 04/17/25 | $6.25 | $5.8 | $6.25 | $47.50 | $153.1K | 884 | 248 |

| ONON | CALL | SWEEP | BEARISH | 04/17/25 | $16.9 | $16.75 | $16.75 | $35.00 | $105.5K | 158 | 63 |

| ONON | CALL | SWEEP | BULLISH | 03/21/25 | $0.99 | $0.89 | $0.99 | $60.00 | $98.7K | 3.0K | 265 |

| ONON | CALL | SWEEP | BULLISH | 04/17/25 | $14.4 | $14.4 | $14.4 | $37.50 | $96.4K | 255 | 69 |

| ONON | CALL | SWEEP | BULLISH | 03/07/25 | $3.05 | $3.0 | $3.05 | $52.00 | $57.9K | 0 | 0 |

About On Holding

On Holding AG is a premium performance sports brand rooted in technology, design, and impact. Its shoes, apparel, and accessories products are designed predominantly for athletic use, casual, or leisure purposes. It does not manufacture the products or the raw materials and relies instead on third-party suppliers and contract manufacturers. Geographically, it derives a majority of its revenue from the Americas and rest from Europe, Middle East and Africa, and Asia-Pacific region.

Having examined the options trading patterns of On Holding, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of On Holding

- Currently trading with a volume of 4,547,354, the ONON’s price is down by -5.41%, now at $51.05.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 20 days.

Professional Analyst Ratings for On Holding

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $64.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Goldman Sachs downgraded its action to Neutral with a price target of $57.

* An analyst from Needham downgraded its action to Buy with a price target of $64.

* Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for On Holding, targeting a price of $67.

* An analyst from Morgan Stanley persists with their Overweight rating on On Holding, maintaining a target price of $65.

* An analyst from Keybanc persists with their Overweight rating on On Holding, maintaining a target price of $68.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for On Holding with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.