Financial giants have made a conspicuous bullish move on Coca-Cola. Our analysis of options history for Coca-Cola KO revealed 21 unusual trades.

Delving into the details, we found 57% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $181,525, and 17 were calls, valued at $5,454,079.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $70.0 for Coca-Cola during the past quarter.

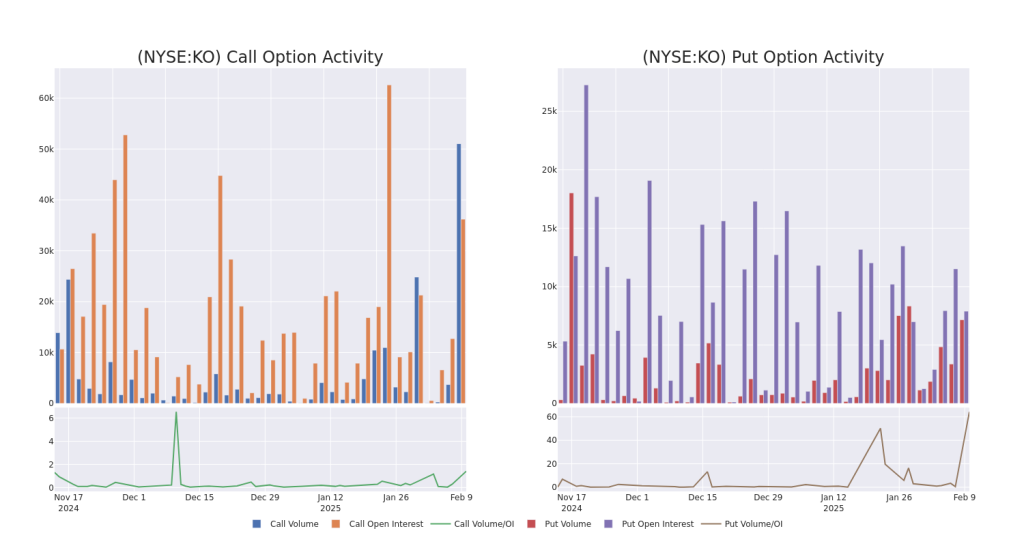

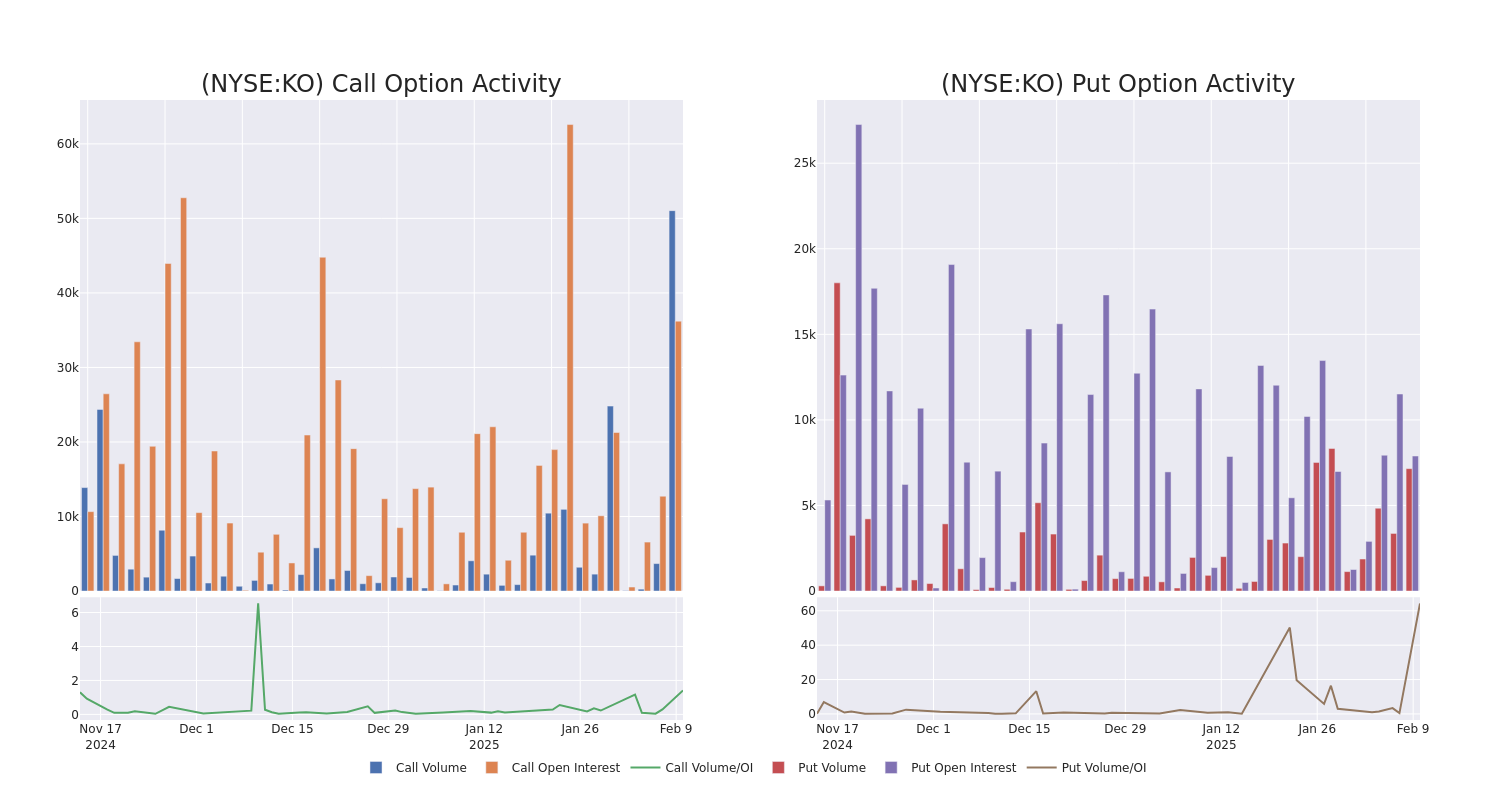

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Coca-Cola’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Coca-Cola’s whale activity within a strike price range from $55.0 to $70.0 in the last 30 days.

Coca-Cola Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | SWEEP | BULLISH | 01/15/27 | $9.85 | $9.75 | $9.85 | $62.50 | $3.6M | 15.2K | 3.7K |

| KO | CALL | SWEEP | BULLISH | 01/15/27 | $9.8 | $9.6 | $9.8 | $62.50 | $911.4K | 15.2K | 3.7K |

| KO | CALL | SWEEP | BULLISH | 03/21/25 | $5.8 | $4.8 | $5.33 | $62.50 | $220.6K | 4.1K | 403 |

| KO | CALL | TRADE | BULLISH | 02/21/25 | $3.1 | $2.83 | $3.0 | $64.00 | $82.2K | 5.1K | 615 |

| KO | CALL | TRADE | BEARISH | 02/21/25 | $3.05 | $2.84 | $2.92 | $64.00 | $81.7K | 5.1K | 1.1K |

About Coca-Cola

Founded in 1886, Atlanta-headquartered Coca-Cola is the world’s largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

After a thorough review of the options trading surrounding Coca-Cola, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Coca-Cola Standing Right Now?

- Trading volume stands at 13,800,013, with KO’s price up by 3.18%, positioned at $66.61.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 0 days.

Professional Analyst Ratings for Coca-Cola

5 market experts have recently issued ratings for this stock, with a consensus target price of $71.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from UBS has decided to maintain their Buy rating on Coca-Cola, which currently sits at a price target of $72.

* An analyst from Piper Sandler has decided to maintain their Overweight rating on Coca-Cola, which currently sits at a price target of $73.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Coca-Cola, which currently sits at a price target of $70.

* An analyst from Jefferies upgraded its action to Buy with a price target of $75.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Coca-Cola, targeting a price of $66.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Coca-Cola, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.