(Bloomberg) — Donald Trump’s punishing tariff salvos and frequent flip-flops are laying down a challenge to Asian fund managers: how to avoid any potential wipe-outs in a headline-driven market.

Most Read from Bloomberg

The US president’s plethora of announcements in his first three weeks in office, targeting nations as diverse as Canada, Mexico and China, have whipsawed financial assets from Treasuries to oil and Bitcoin. They’ve also made selecting investments based on long-term fundamentals something of a fool’s errand.

Asian investors are responding to the volatility by seeking out assets offering relative protection from the swelling global trade frictions. Among these are DeepSeek-themed “hidden gems” in China, high-yielding stocks in Singapore and Australia, countries with upsized domestic markets, and India’s government bonds.

“Our playbook for Trump 2.0 was to buckle up for higher volatility, so investors should take less gross risk now than in 2024,” said Louis Luo, head of multi-asset investment solutions for Greater China at abrdn plc in Hong Kong. The infinite loop of “escalation, retaliation, negotiation and de-escalation,” will create a lot of noise and volatility, he said.

Here are some of the investments currently favored by Asian money managers and analysts:

DeepSeek Theme

One place to reduce exposure to Trump tariff headlines is seen in Chinese technology firms related to DeepSeek’s new artificial intelligence app.

The nation’s internet giants, such as Alibaba Group Holding Ltd., have touted their ability to build AI models of comparable capacity to their Western rivals, adding to their allure. The expected wider adoption of AI in China has helped software companies such as Beijing Kingsoft Office Software Inc. and 360 Security Technology Inc. jump almost 30% this year, putting them among the top 10 performers in the CSI 300 Index.

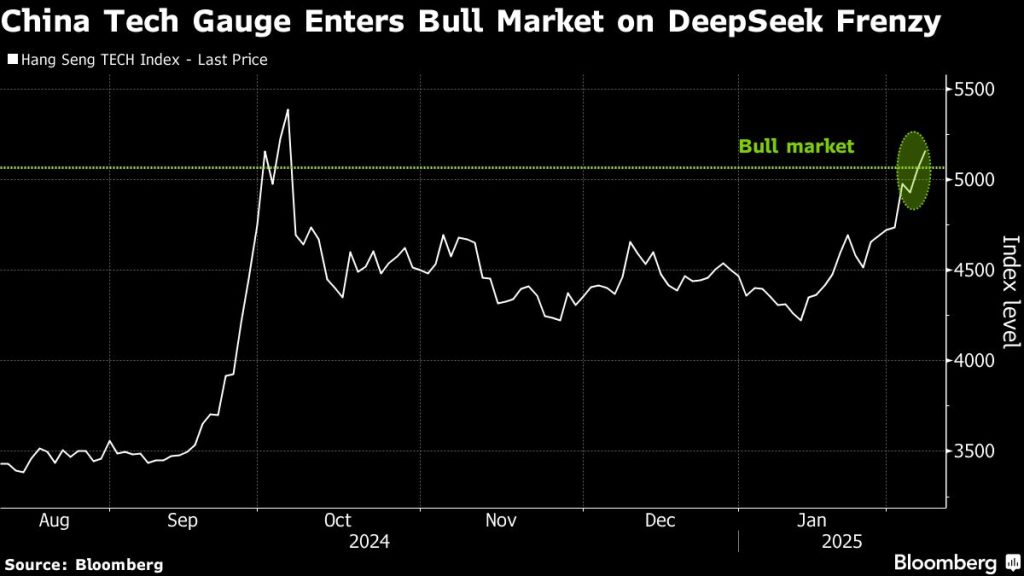

A gauge of Chinese tech shares trading in Hong Kong entered a technical bull market Friday on the back of DeepSeek’s AI model, which had drawn bullish comments from analysts at firms such as Deutsche Bank AG and HSBC Holdings Plc.

Chinese stocks have proven to be a difficult trade in recent years but there are “a lot of hidden gems,” said Joanne Goh, senior investment strategist at DBS Bank Ltd. in Singapore “Because of DeepSeek, we see a lot more attention coming back to China’s technological prowess.”