(Bloomberg) — US airports may turn to the municipal bond market for financing if federal funding for infrastructure is rolled back as part of President Donald Trump’s push to cull government spending.

Most Read from Bloomberg

Many facilities rely on federal grants to help fund renovations of aging infrastructure. Former President Joe Biden’s administration earmarked $14.5 billion over five years to modernize facilities and improve service amid a boom in air travel after the pandemic. A decline in such funding would force airports to fill the gap themselves — through borrowing or other measures, or make them scale back projects, said Seth Lehman, a senior director in the global infrastructure group for Fitch Ratings.

“For some airports, it may be that less grants means more debt borrowing to get the job done,” Lehman said.

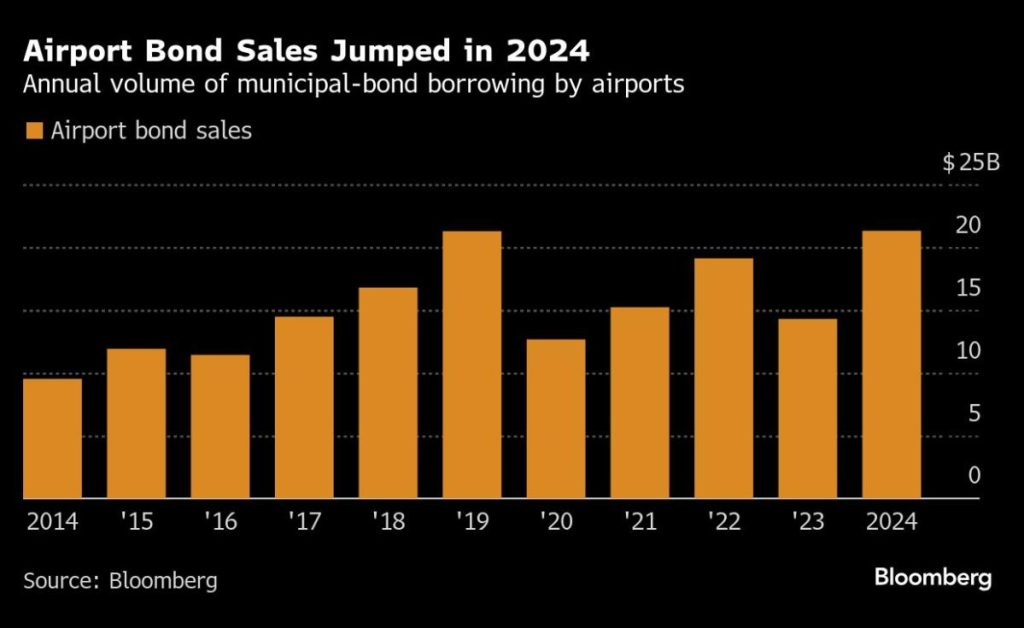

Airports already are major issuers of municipal bonds, borrowing more than $20 billion of debt in 2024, according to data compiled by Bloomberg. Much of those sales came from the country’s largest hubs, like New York City’s John F. Kennedy International Airport or Orlando International Airport in Florida.

But Lehman said smaller facilities would be most impacted by a reduction in federal grants. Facilities in tourist hot-spots like Key West, Florida, and Myrtle Beach, South Carolina, tend to rely on grants rather than debt and may have to reconsider their funding strategies, he said.

“If we start to see a decrease in annual funding, that puts more pressure” on airports, he said. But for projects that are needed, airports can tap the muni market. “They know they can go to the capital markets,” he said.

Lehman expects airport issuance to range between $15 billion and $20 billion this year, especially since many borrowers already sold bonds in 2024.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.