Aptiv PLC APTV reported better-than-expected financial results and issued strong guidance on Thursday.

The company posted quarterly revenue of $4.91 billion, versus estimates of $4.89 billion. Adjusted earnings came in at $1.75 per share, versus estimates of $1.65 per share.

“Looking ahead, as we navigate a dynamic market environment, we will remain focused on enabling our customers as they transition to a more feature-rich, software-defined future,” said Kevin Clark, chairman and CEO of Aptiv.

“This year also marks a major milestone in Aptiv’s evolution, as we execute on the separation of our Electrical Distribution Systems business, which will create two independent companies better positioned to address the evolving needs of our customers and further capitalize on market opportunities.”

Aptiv said it expects first-quarter revenue of $4.64 billion to $4.84 billion versus estimates of $4.81 billion, according to Benzinga Pro. The company anticipates first-quarter adjusted earnings of $1.40 to $1.60 per share versus estimates of $1.49 per share.

Aptiv expects full-year revenue to be between $19.6 billion and $20.4 billion versus estimates of $19.96 billion. The company expects full-year adjusted earnings of $7 to $7.60 per share versus estimates of $6.92 per share.

Aptiv shares gained 0.6% to trade at $63.85 on Friday.

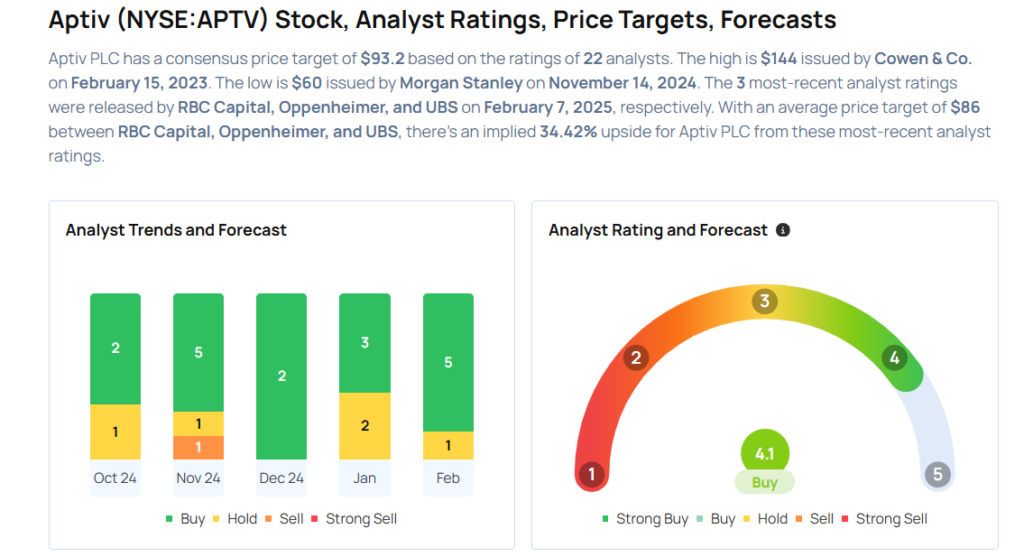

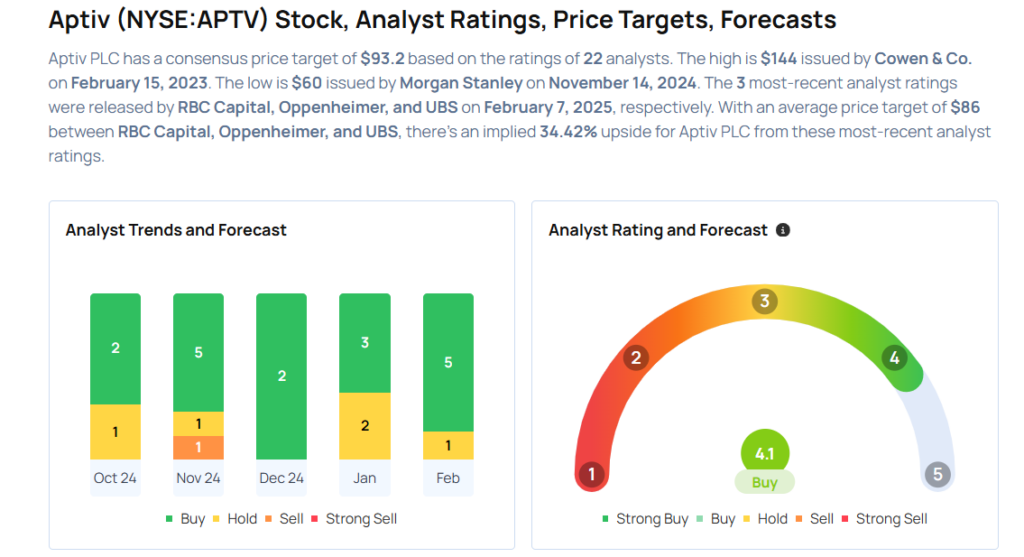

These analysts made changes to their price targets on Aptiv following earnings announcement.

- Wells Fargo analyst Colin Langan maintained Aptiv with an Overweight and raised the price target from $76 to $86.

- UBS analyst Joseph Spak maintained Aptiv with a Buy and raised the price target from $82 to $91.

- Oppenheimer analyst Colin Rusch maintained Aptiv with an Outperform and raised the price target from $83 to $85.

- RBC Capital analyst Tom Narayan maintained the stock with an Outperform and boosted the price target from $75 to $82.

Considering buying APTV stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.