Take-Two Interactive Software Inc TTWO reported upbeat third-quarter financial earnings after the market close on Thursday.

Take-Two reported third-quarter revenue of $1.37 billion, missing analyst estimates of $1.39 billion, according to Benzinga Pro. The video game publisher reported third-quarter adjusted earnings of 72 cents per share, beating analyst estimates of 57 cents per share.

Total net bookings grew 3% year-over-year. Net Bookings from recurrent consumer spending grew 9% year-over-year and accounted for 79% of total Net Bookings.

“We achieved solid results during the holiday season,” said Strauss Zelnick, chairman and CEO of Take-Two Interactive. “Looking ahead, this calendar year is shaping up to be one of the strongest ever for Take-Two, as we plan to launch Sid Meier’s Civilization VII on Feb. 11, Mafia: The Old Country in the Summer, Grand Theft Auto VI in the Fall, and Borderlands 4.”

For the fourth quarter, Take-Two expects revenue to be between $1.52 billion and $1.62 billion versus estimates of $1.54 billion. The company anticipates anywhere from a loss of 20 cents per share to positive earnings of 13 cents per share in the fourth quarter versus estimates of 6 cents per share.

Take-Two sees full-year revenue in the range of $5.57 billion to $5.67 billion versus estimates of $5.62 billion. The company anticipates a full-year loss of $4.17 to $4.50 per share versus estimates for a loss of $4.47 per share, per Benzinga Pro.

Take-Two shares gained 16.2% to trade at $212.71 on Friday.

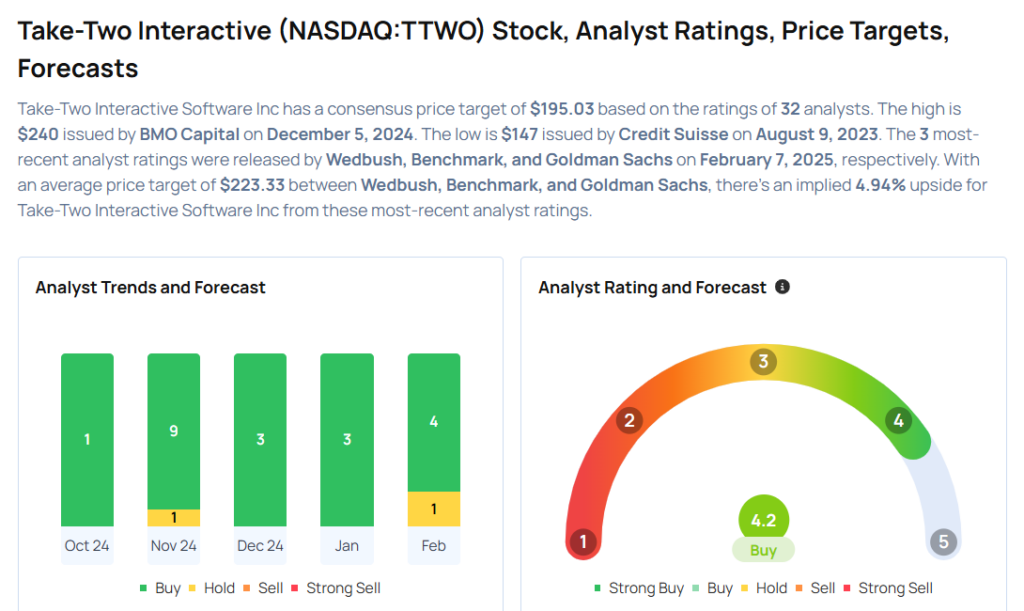

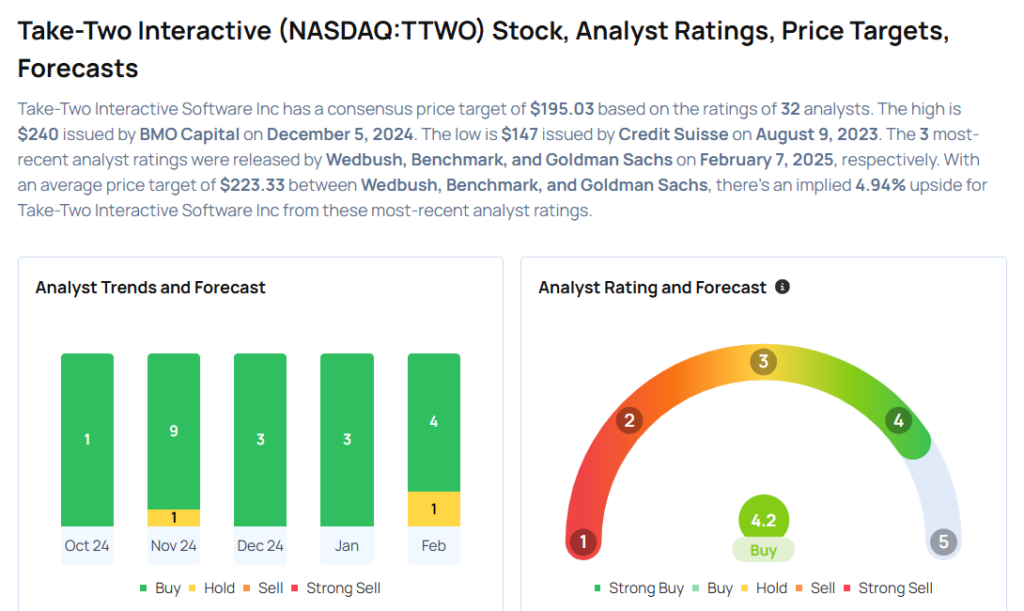

These analysts made changes to their price targets on Take-Two following earnings announcement.

- MoffettNathanson analyst Clay Griffin maintained Take-Two Interactive with a Neutral and raised the price target from $156 to $170.

- Raymond James analyst Andrew Marok reiterated Take-Two with an Outperform and raised the price target from $190 to $220.

- Goldman Sachs analyst Eric Sheridan maintained Take-Two with a Buy and raised the price target from $205 to $230.

- Benchmark analyst Mike Hickey reiterated the stock with a Buy and raised the price target from $210 to $225.

Considering buying TTWO stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.