Cboe Global Markets, Inc CBOE reported fourth-quarter revenue growth of 5% year-on-year to $524.50 million, missing the analyst consensus estimate of $525.88 million.

An increase in net revenue from cash and spot markets, Data Vantage, and derivatives markets drove the topline growth.

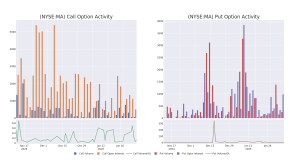

The company reported options net revenue of $324.3 million, up by 3%.

- North American Equities net revenue of $94.9 million increased 10%.

- Europe and APAC’s net revenue increased by $56.2 million by 17%.

- Futures net revenue of $30.2 million decreased 7%.

- Global FX net revenue of $19.4 million increased 3%.

- EPS of $2.10 missed the analyst consensus estimate of $2.11.

- The adjusted operating income grew by 4% to $319.7 million.

- The adjusted operating margin declined by 60 bps to 60.6%.

- The adjusted EBITDA margin declined 110 bps to 63.2%.

- Cboe Global Markets generated $920.3 million in cash and equivalents as of Dec. 31, 2024.

- During the quarter, the company paid cash dividends of $66.4 million, or 63 cents per share.

CEO Fredric Tomczyk noted that while the robust options volumes were a standout for 2024, the results were notable in each category, namely Derivatives Markets, Data Vantage, and Cash and Spot Markets.

Cboe Global Markets stock gained over 12% in the last 12 months. At least five Wall Street firms cut their price targets on the stock, including a rating downgrade by JPMorgan.

Price Action: CBOE stock is down 0.24% at $206.05 at last check Friday.

Also Read:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.