Financial giants have made a conspicuous bullish move on Marvell Tech. Our analysis of options history for Marvell Tech MRVL revealed 39 unusual trades.

Delving into the details, we found 51% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $1,811,864, and 27 were calls, valued at $1,423,555.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $145.0 for Marvell Tech during the past quarter.

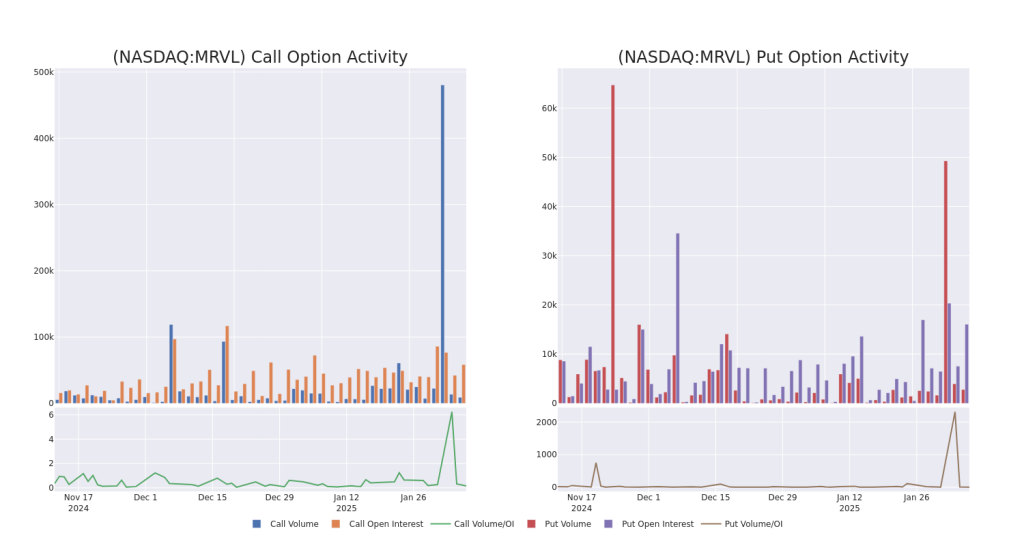

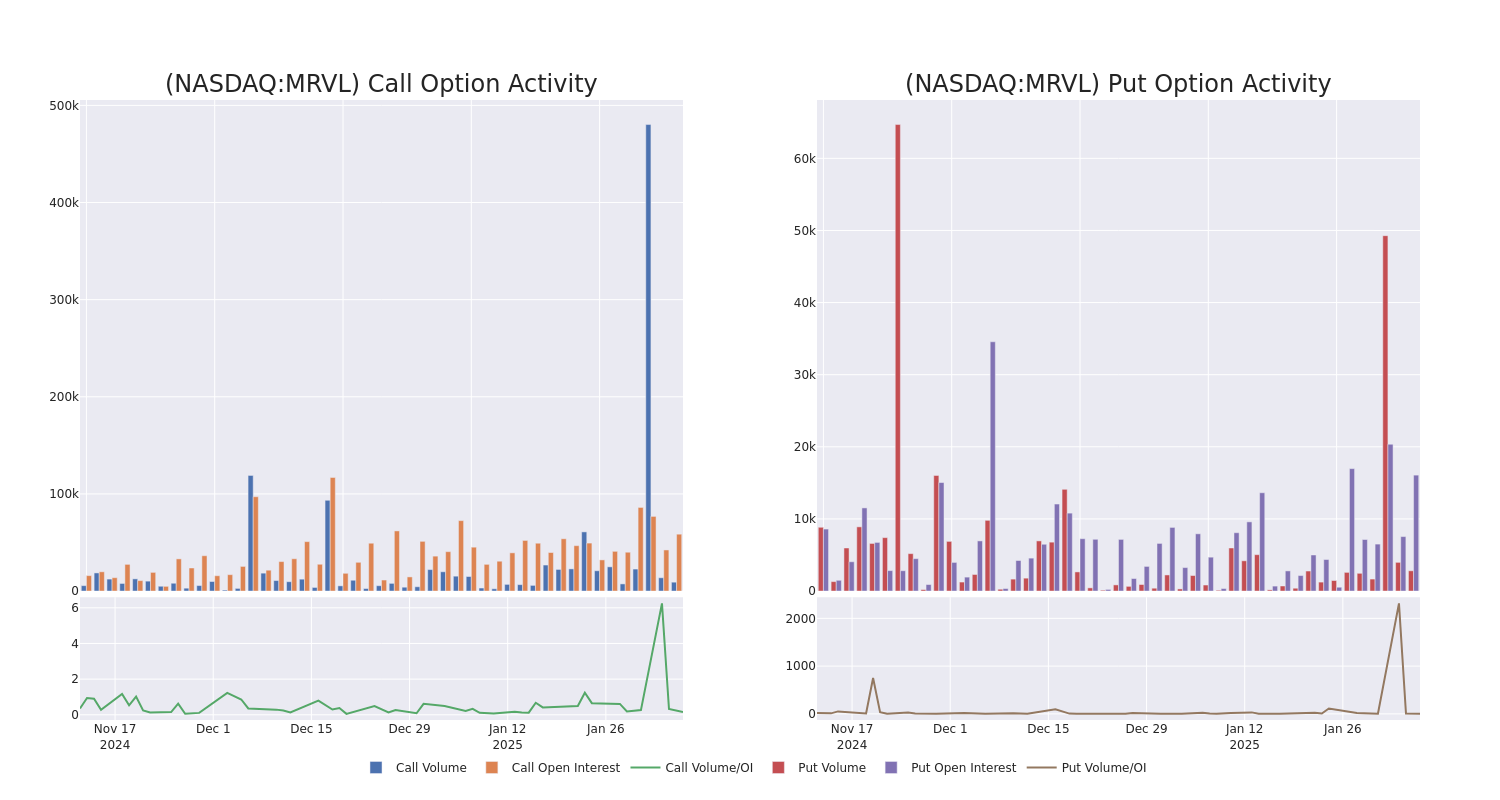

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Marvell Tech’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Marvell Tech’s whale activity within a strike price range from $35.0 to $145.0 in the last 30 days.

Marvell Tech Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | PUT | TRADE | BEARISH | 01/16/26 | $8.85 | $8.7 | $8.85 | $90.00 | $885.0K | 919 | 1.0K |

| MRVL | PUT | SWEEP | BEARISH | 06/20/25 | $5.65 | $5.6 | $5.65 | $95.00 | $553.1K | 1.5K | 979 |

| MRVL | CALL | TRADE | BULLISH | 03/21/25 | $38.8 | $35.05 | $37.7 | $80.00 | $169.6K | 3.3K | 45 |

| MRVL | CALL | SWEEP | BEARISH | 03/21/25 | $7.45 | $7.4 | $7.4 | $125.00 | $140.6K | 8.2K | 280 |

| MRVL | CALL | TRADE | BEARISH | 02/07/25 | $4.35 | $3.9 | $4.0 | $115.00 | $98.0K | 3.1K | 760 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Present Market Standing of Marvell Tech

- Trading volume stands at 4,043,522, with MRVL’s price up by 0.71%, positioned at $117.29.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 27 days.

What The Experts Say On Marvell Tech

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $133.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Marvell Tech, targeting a price of $131.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Marvell Tech, targeting a price of $113.

* An analyst from Keybanc persists with their Overweight rating on Marvell Tech, maintaining a target price of $135.

* An analyst from Barclays persists with their Overweight rating on Marvell Tech, maintaining a target price of $150.

* An analyst from Wells Fargo persists with their Overweight rating on Marvell Tech, maintaining a target price of $140.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Marvell Tech, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.