(Bloomberg) — Google parent Alphabet Inc.’s shares dropped in premarket trading after slower growth in its cloud business contributed to lower-than-expected revenue in the fourth quarter.

Most Read from Bloomberg

Quarterly sales, excluding partner payouts, were $81.6 billion, Alphabet said Tuesday in a statement. Analysts had projected $82.8 billion, according to data compiled by Bloomberg.

Alphabet announced $75 billion in 2025 capital expenditures, far exceeding the $57.9 billion that analysts expected. The investment is “directly driving revenue” because it helps customers, Alphabet Chief Executive Officer Sundar Pichai said on the earnings call with investors.

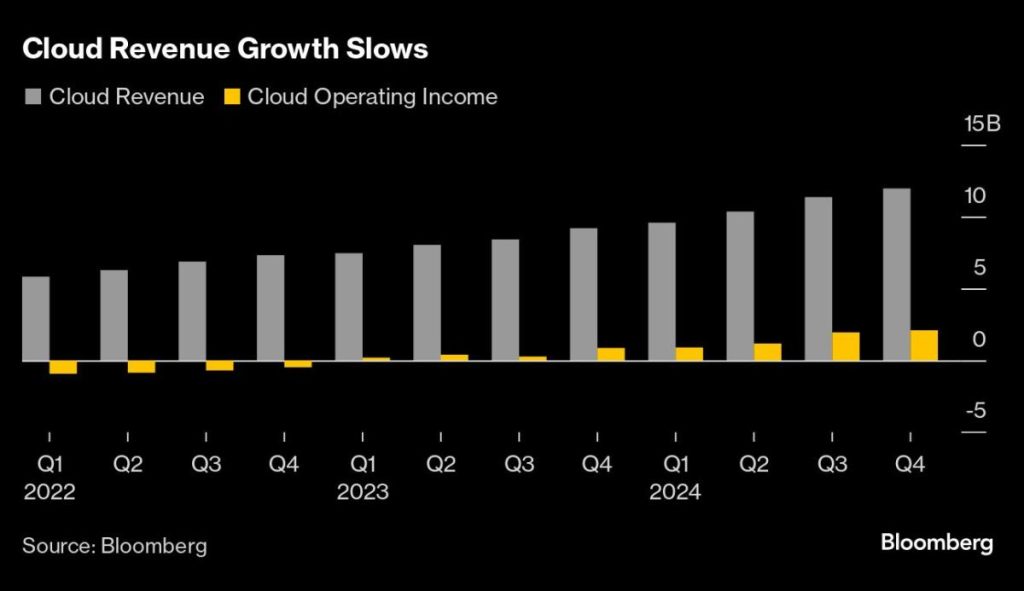

Google’s cloud unit is so far the clearest indicator of how the AI boom is contributing to the company’s sales. Startups are becoming customers because they require more computing power for their work, but not as quickly as expected. Sales of about $12 billion in the period ended Dec. 31 missed estimates. Google Cloud still trails behind Amazon.com Inc. and Microsoft Corp. in size, and Pichai said Google needs to keep investing in cloud to “ensure we can address the increase in customer demand.”

Alphabet shares dropped about 7% in premarket trading on Wednesday, after closing at $206.38 in New York. The shares have gained 9% so far this year.

Investors have urged Alphabet to demonstrate that it is maintaining momentum across its businesses as it spends more heavily on AI, and as competition in that market intensifies. Chinese AI startup DeepSeek took Silicon Valley by surprise last month when it said it had created a powerful AI model at a fraction of the cost of US rivals. During the earnings call, Pichai called DeepSeek a “tremendous team” but said that Google’s models have also excelled in efficiency.

Still, DeepSeek’s model is open to use, and Google’s costs money, raising concerns that its advantages in AI and search could “meaningfully erode” this year, Emarketer senior analyst Evelyn Mitchell-Wolf said via email.

Dan Morgan, senior portfolio manager at Synovus Trust, added that the tech giant is now under increasing pressure to show how its investments in AI are translating to real business gains.

Morgan said the richest returns from the AI boom may come not to companies like Google that are pushing forward the models, but to the companies that specialize in chips. “You don’t want to be the people who are mining for gold,” he said. “You want to be the guy who sells them the picks.”