High-rolling investors have positioned themselves bullish on Pfizer PFE, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PFE often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 33 options trades for Pfizer. This is not a typical pattern.

The sentiment among these major traders is split, with 66% bullish and 33% bearish. Among all the options we identified, there was one put, amounting to $46,800, and 32 calls, totaling $4,965,419.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $30.0 for Pfizer, spanning the last three months.

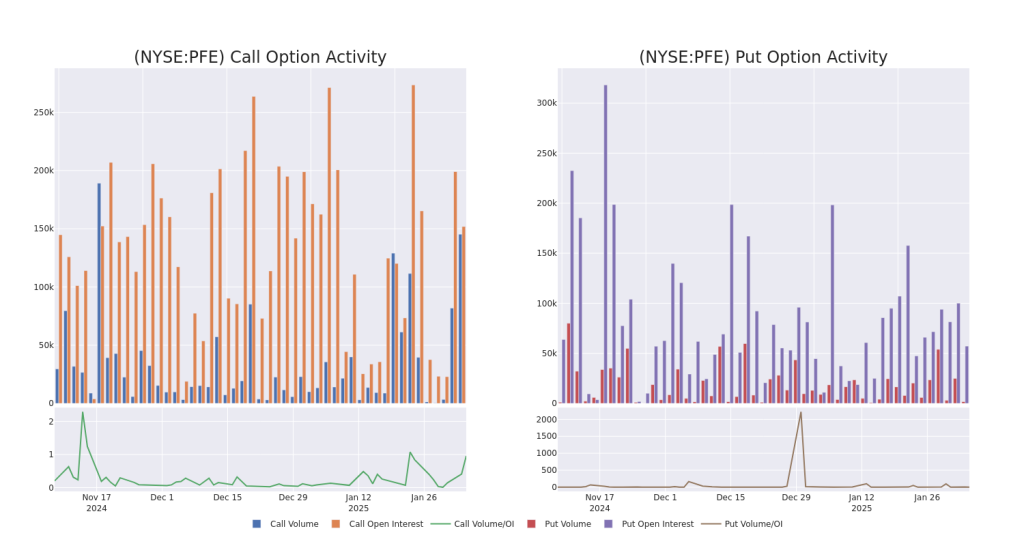

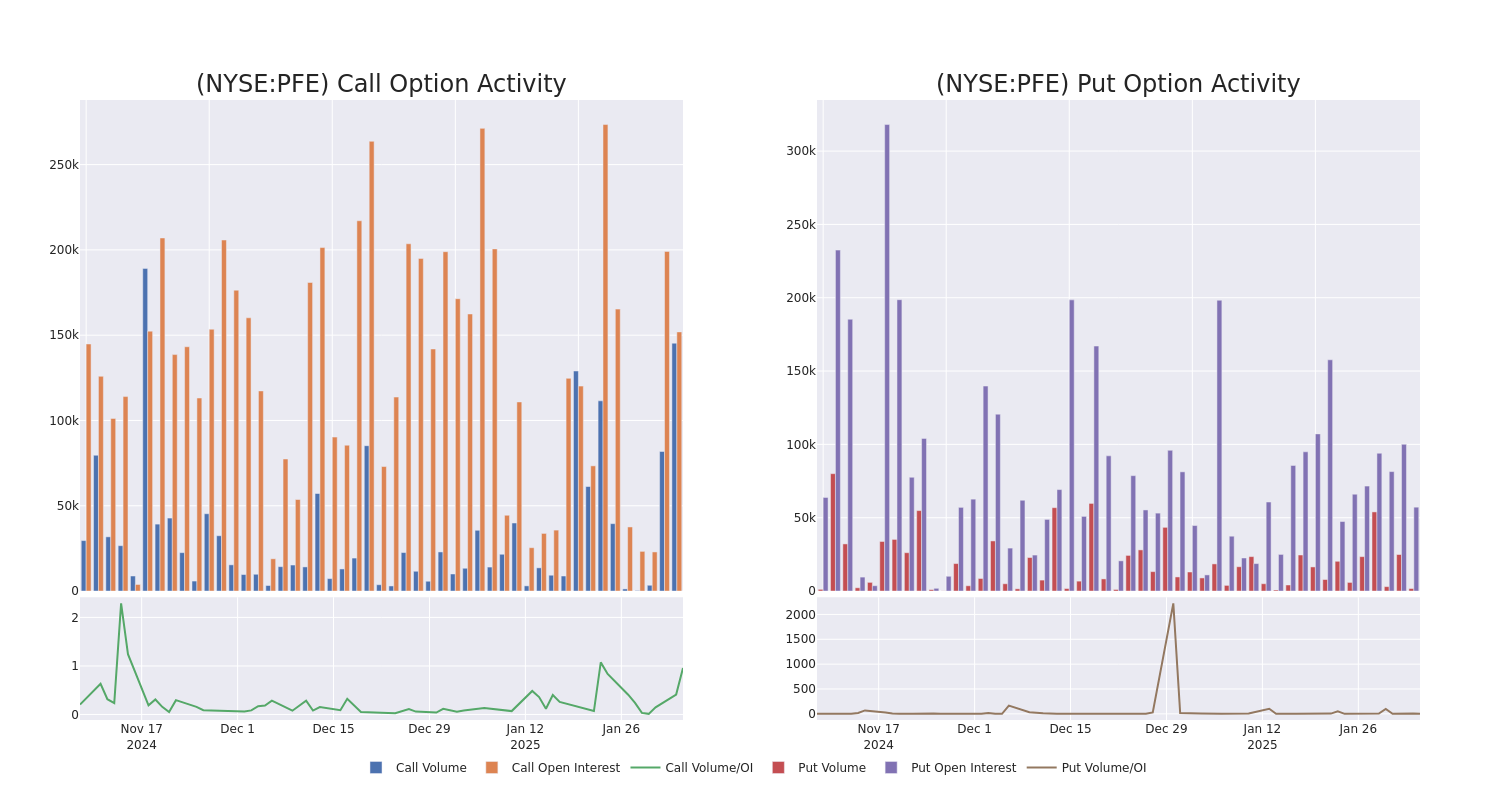

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Pfizer’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Pfizer’s significant trades, within a strike price range of $20.0 to $30.0, over the past month.

Pfizer Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | CALL | TRADE | BEARISH | 05/16/25 | $1.39 | $1.34 | $1.34 | $26.00 | $1.9M | 933 | 15.3K |

| PFE | CALL | TRADE | BEARISH | 03/21/25 | $0.85 | $0.82 | $0.82 | $26.00 | $1.2M | 21.0K | 16.3K |

| PFE | CALL | SWEEP | BULLISH | 02/14/25 | $1.4 | $1.39 | $1.4 | $25.00 | $243.8K | 139 | 8.1K |

| PFE | CALL | SWEEP | BULLISH | 02/14/25 | $1.43 | $1.25 | $1.43 | $25.00 | $150.2K | 139 | 9.9K |

| PFE | CALL | SWEEP | BULLISH | 02/14/25 | $1.4 | $1.4 | $1.4 | $25.00 | $132.4K | 139 | 6.0K |

About Pfizer

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding covid-19-related product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

After a thorough review of the options trading surrounding Pfizer, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Pfizer Standing Right Now?

- With a trading volume of 45,035,165, the price of PFE is down by -1.85%, reaching $25.71.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 0 days from now.

Expert Opinions on Pfizer

2 market experts have recently issued ratings for this stock, with a consensus target price of $29.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Pfizer, targeting a price of $29.

* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Pfizer with a target price of $29.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.