By Shashwat Chauhan and Sukriti Gupta

(Reuters) -The S&P 500 climbed on Tuesday, aided by energy stocks, while investors focused on upcoming talks between U.S. President Donald Trump and his Chinese counterpart Xi Jinping after Beijing imposed retaliatory tariffs.

Seven of the 11 S&P 500 sectors traded higher, with energy stocks leading the gains with a 2% rise, paring earlier losses.

Trump and Xi were set to talk later in the day, White House trade adviser Peter Navarro said at a Politico Live event, as new 10% tariffs on Chinese imports took effect, which China countered with levies on U.S. goods.

Trump had said over the weekend that he would impose a 25% tariff on goods from Mexico and Canada, but agreed to a 30-day pause on Monday, in return for border and crime concessions from both countries.

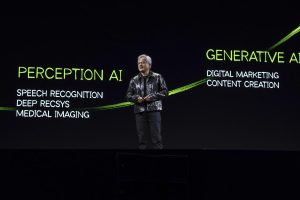

Megacaps also rose, aiding a recovery in indexes from a tepid start to the session. Alphabet was up 1.6% ahead of its quarterly results, which are due after markets close, while Nvidia advanced 2.5%.

Palantir jumped 23.7% after the data analytics company forecast first-quarter and annual revenue above Wall Street estimates.

“The fundamentals of the market are still solid and earnings growth is great, but every time the President (Trump) speaks and says he’s going to do something, the market reacts drastically,” said Paul Stanley, chief investment officer, Granite Bay Wealth Management.

“Palantir just had a great earnings report, and everybody reacts to those big public companies right now and thinks that it’s going to have the same impact on all other companies.”

At 11:55 a.m. ET, the Dow Jones Industrial Average rose 36.97 points, or 0.08%, to 44,458.88, the S&P 500 gained 35.15 points, or 0.59%, to 6,029.72, and the Nasdaq Composite gained 225.54 points, or 1.16%, to 19,617.84.

Biotechnology firm Illumina dropped 5.9%, while PVH Corp, the holding company for brands including Calvin Klein, shed 0.9% after China placed the companies in its “unreliable entity list”.

The last-minute change helped the three major U.S. stock indexes pare some of the heavy losses suffered earlier on Monday and closed trading well off session lows.

Three Federal Reserve officials warned on Monday that trade tariffs carried inflation risks, with one arguing that uncertainty over the outlook for prices called for slower interest-rate cuts than otherwise.

A Labor Department report showed U.S. job openings stood at 7.6 million in December, compared to an estimated 8 million, according to economists polled by Reuters.