Financial giants have made a conspicuous bearish move on Roblox. Our analysis of options history for Roblox RBLX revealed 22 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $422,830, and 14 were calls, valued at $627,923.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $42.5 to $80.0 for Roblox over the recent three months.

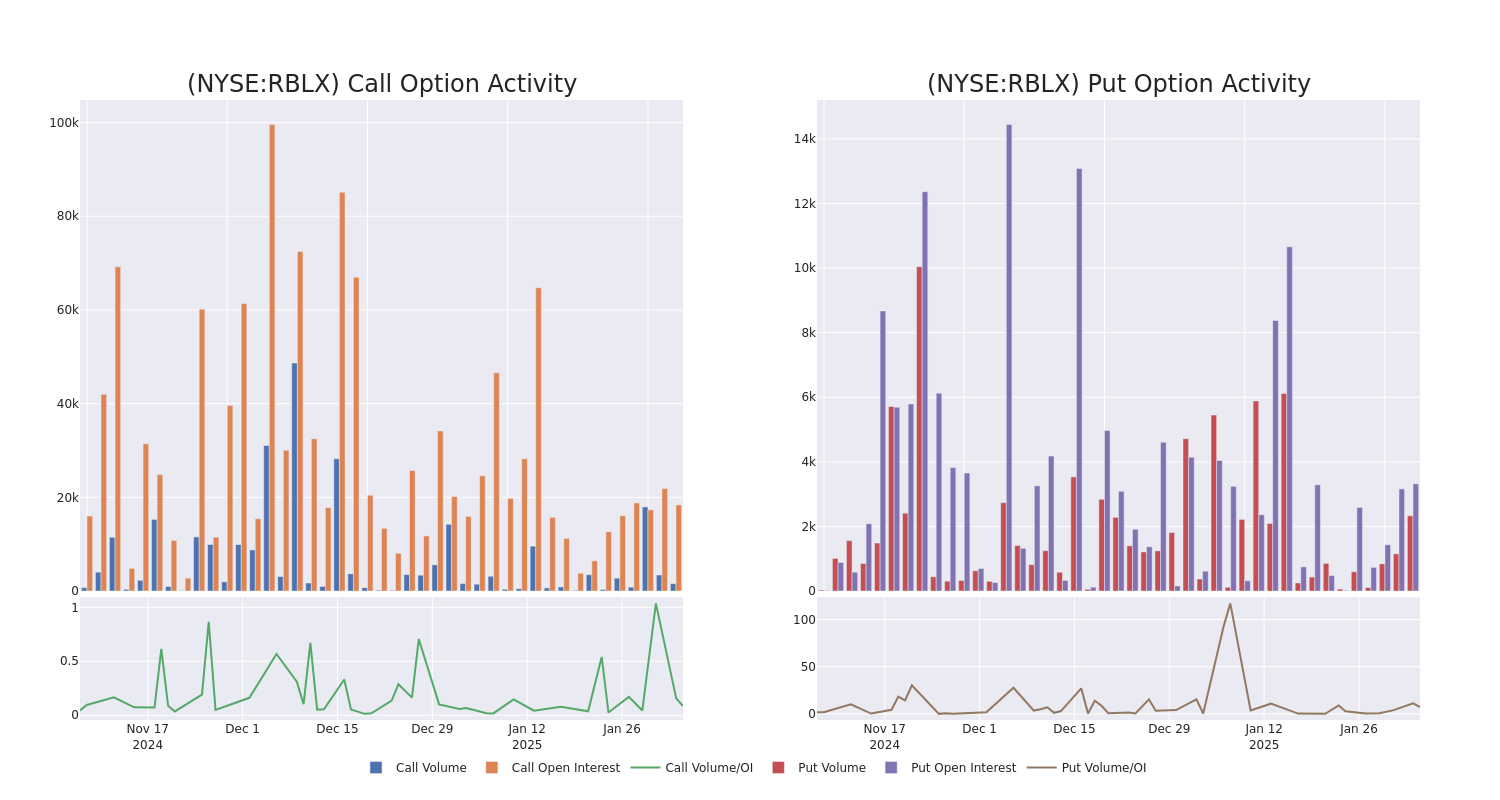

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Roblox stands at 1205.22, with a total volume reaching 3,908.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Roblox, situated within the strike price corridor from $42.5 to $80.0, throughout the last 30 days.

Roblox Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | TRADE | BULLISH | 06/20/25 | $1.15 | $0.97 | $0.99 | $47.50 | $148.5K | 1.8K | 1.5K |

| RBLX | CALL | SWEEP | BULLISH | 02/14/25 | $6.05 | $5.95 | $6.05 | $70.00 | $110.1K | 1.0K | 63 |

| RBLX | CALL | TRADE | BEARISH | 03/21/25 | $7.6 | $7.5 | $7.5 | $70.00 | $75.0K | 8.1K | 225 |

| RBLX | PUT | SWEEP | BEARISH | 02/07/25 | $4.8 | $4.7 | $4.8 | $73.00 | $72.0K | 50 | 159 |

| RBLX | CALL | SWEEP | BEARISH | 02/14/25 | $3.75 | $3.65 | $3.66 | $75.00 | $47.4K | 761 | 320 |

About Roblox

Roblox operates an online video game platform with 80 million daily active users that lets young gamers create, develop, and monetize games (or “experiences”) for other players. The firm offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning $3.5 billion in bookings in 2023 through in-game purchases and advertising while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers than creating new games or franchises.

Following our analysis of the options activities associated with Roblox, we pivot to a closer look at the company’s own performance.

Where Is Roblox Standing Right Now?

- With a volume of 4,822,086, the price of RBLX is up 2.65% at $72.56.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 2 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roblox options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.