AECOM ACM will release its first-quarter financial results, after the closing bell, on Monday, Feb. 3, 2025.

Analysts expect the Dallas, Texas-based company to report quarterly earnings at $1.10 per share, up from $1.05 per share in the year-ago period. Aecom projects quarterly revenue of $4.11 billion, compared to $3.9 billion a year earlier, according to data from Benzinga Pro.

On Nov. 18, the company posted better-than-expected fourth-quarter earnings.

Aecom shares fell 0.1% to close at $105.44 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

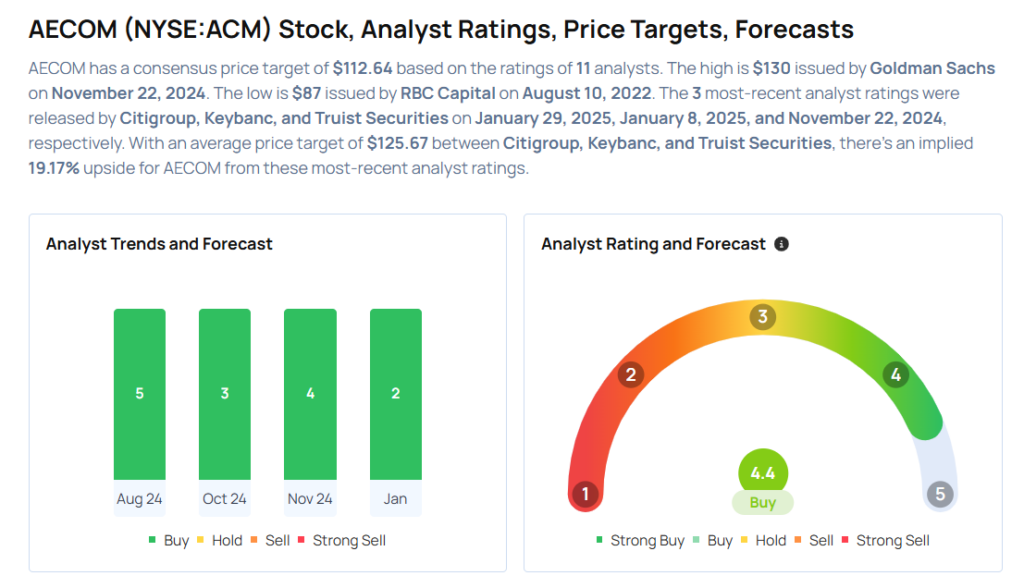

- Citigroup analyst Andrew Kaplowitz maintained a Buy rating and cut the price target from $128 to $127 on Jan. 29, 2025. This analyst has an accuracy rate of 84%.

- Keybanc analyst Sangita Jain maintained an Overweight rating and cut the price target from $122 to $121 on Jan. 8, 2025. This analyst has an accuracy rate of 63%.

- Truist Securities analyst Jamie Cook maintained a Buy rating and raised the price target from $119 to $129 on Nov. 22, 2024. This analyst has an accuracy rate of 71%.

- Goldman Sachs analyst Adam Bubes initiated coverage on the stock with a Buy rating and a price target of $130 on Nov. 22, 2024. This analyst has an accuracy rate of 71%.

- Baird analyst Andrew Wittmann maintained an Outperform rating and raised the price target from $113 to $122 on Nov. 19, 2024. This analyst has an accuracy rate of 78%.

Considering buying ACM stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.