Whales with a lot of money to spend have taken a noticeably bearish stance on Halliburton.

Looking at options history for Halliburton HAL we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 55% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $577,537 and 2, calls, for a total amount of $76,000.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $30.0 for Halliburton over the recent three months.

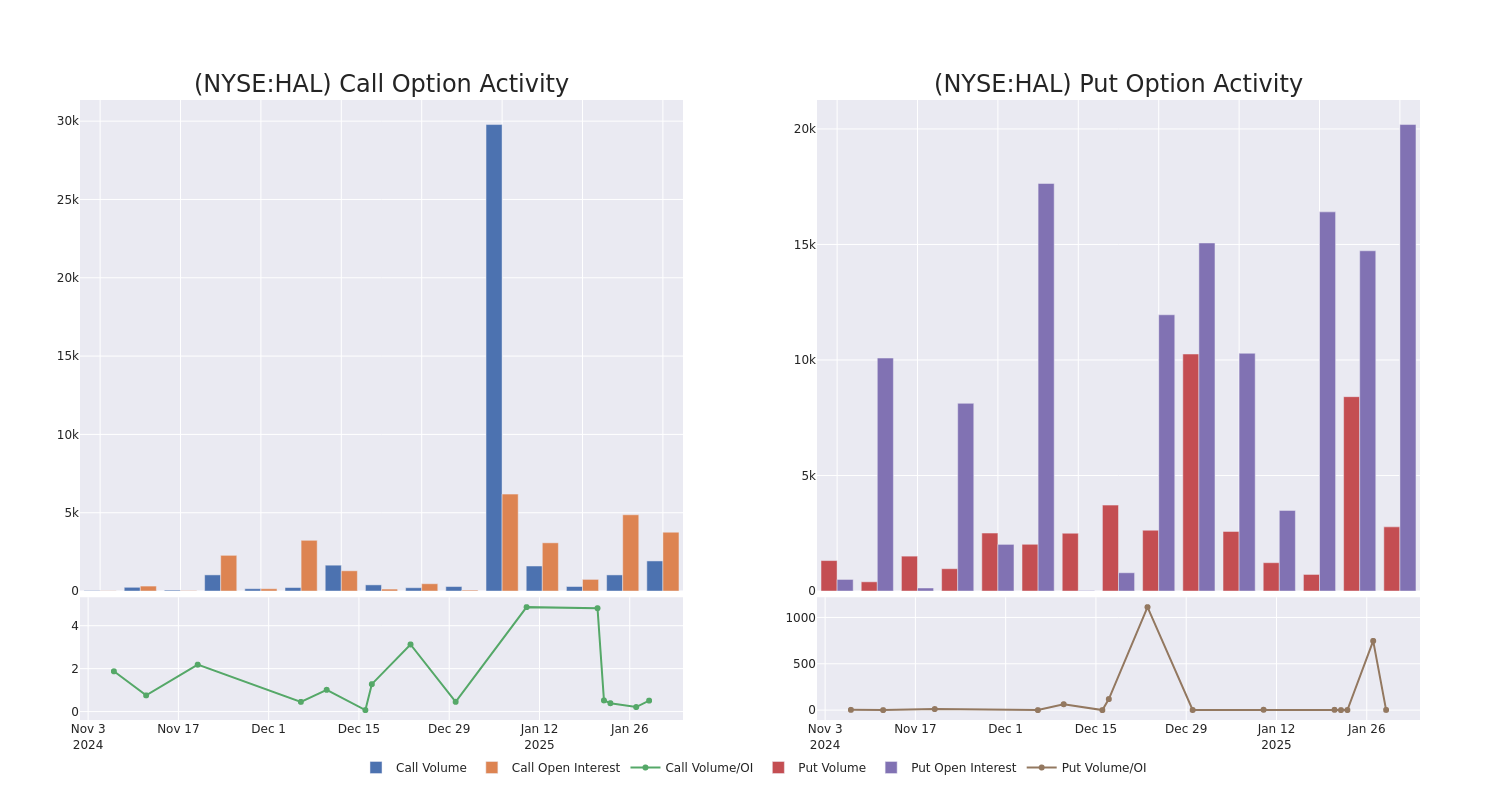

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Halliburton’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Halliburton’s significant trades, within a strike price range of $15.0 to $30.0, over the past month.

Halliburton 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HAL | PUT | TRADE | BULLISH | 07/18/25 | $1.44 | $1.37 | $1.37 | $24.00 | $164.4K | 19 | 1.4K |

| HAL | PUT | TRADE | BEARISH | 03/20/26 | $5.7 | $5.65 | $5.7 | $30.00 | $85.5K | 0 | 600 |

| HAL | PUT | TRADE | BULLISH | 03/20/26 | $5.8 | $5.65 | $5.7 | $30.00 | $85.5K | 0 | 450 |

| HAL | PUT | TRADE | BEARISH | 03/20/26 | $5.7 | $5.65 | $5.7 | $30.00 | $85.5K | 0 | 300 |

| HAL | PUT | TRADE | BEARISH | 03/20/26 | $5.7 | $5.65 | $5.7 | $30.00 | $85.5K | 0 | 150 |

About Halliburton

Halliburton is North America’s largest oilfield service company as measured by market share. Despite industry fragmentation, it holds a leading position in the hydraulic fracturing and completions market, which makes up nearly half of its revenue. It also holds strong positions in other service offerings like drilling and completions fluids, which leverages its expertise in material science, as well as the directional drilling market. While we consider SLB the global leader in reservoir evaluation, we think Halliburton leads in any activity from the reservoir to the wellbore. The firm’s innovations have helped multiple producers lower their development costs per barrel of oil equivalent, with techniques that have been homed in over a century of operations.

In light of the recent options history for Halliburton, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Halliburton Standing Right Now?

- Trading volume stands at 4,802,932, with HAL’s price down by -1.52%, positioned at $25.62.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 78 days.

Professional Analyst Ratings for Halliburton

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $34.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Barclays has decided to maintain their Equal-Weight rating on Halliburton, which currently sits at a price target of $30.

* An analyst from Evercore ISI Group persists with their Outperform rating on Halliburton, maintaining a target price of $35.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Halliburton, targeting a price of $35.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $34.

* Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Halliburton with a target price of $37.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Halliburton with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.