Whales with a lot of money to spend have taken a noticeably bearish stance on Sea.

Looking at options history for Sea SE we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $283,542 and 13, calls, for a total amount of $591,415.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $40.0 and $130.0 for Sea, spanning the last three months.

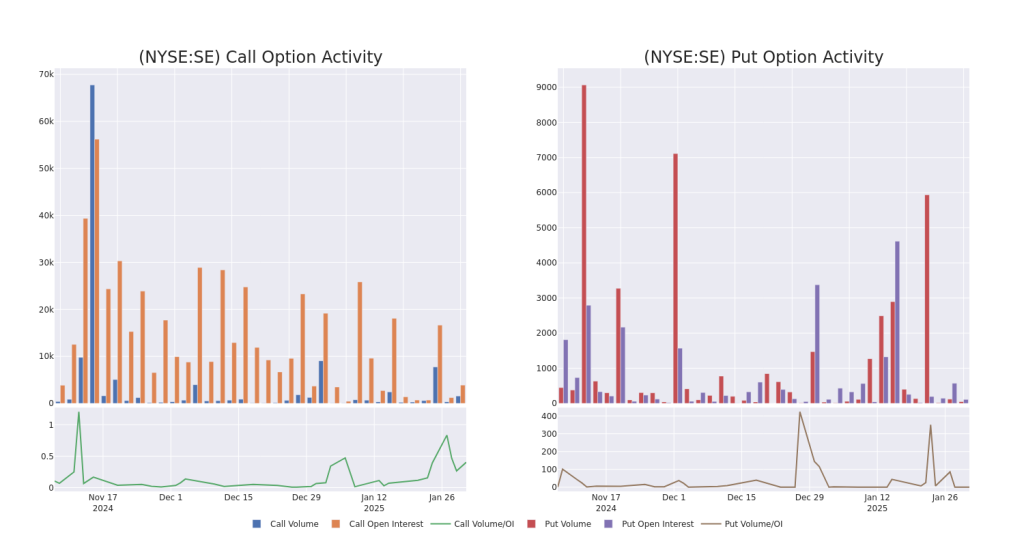

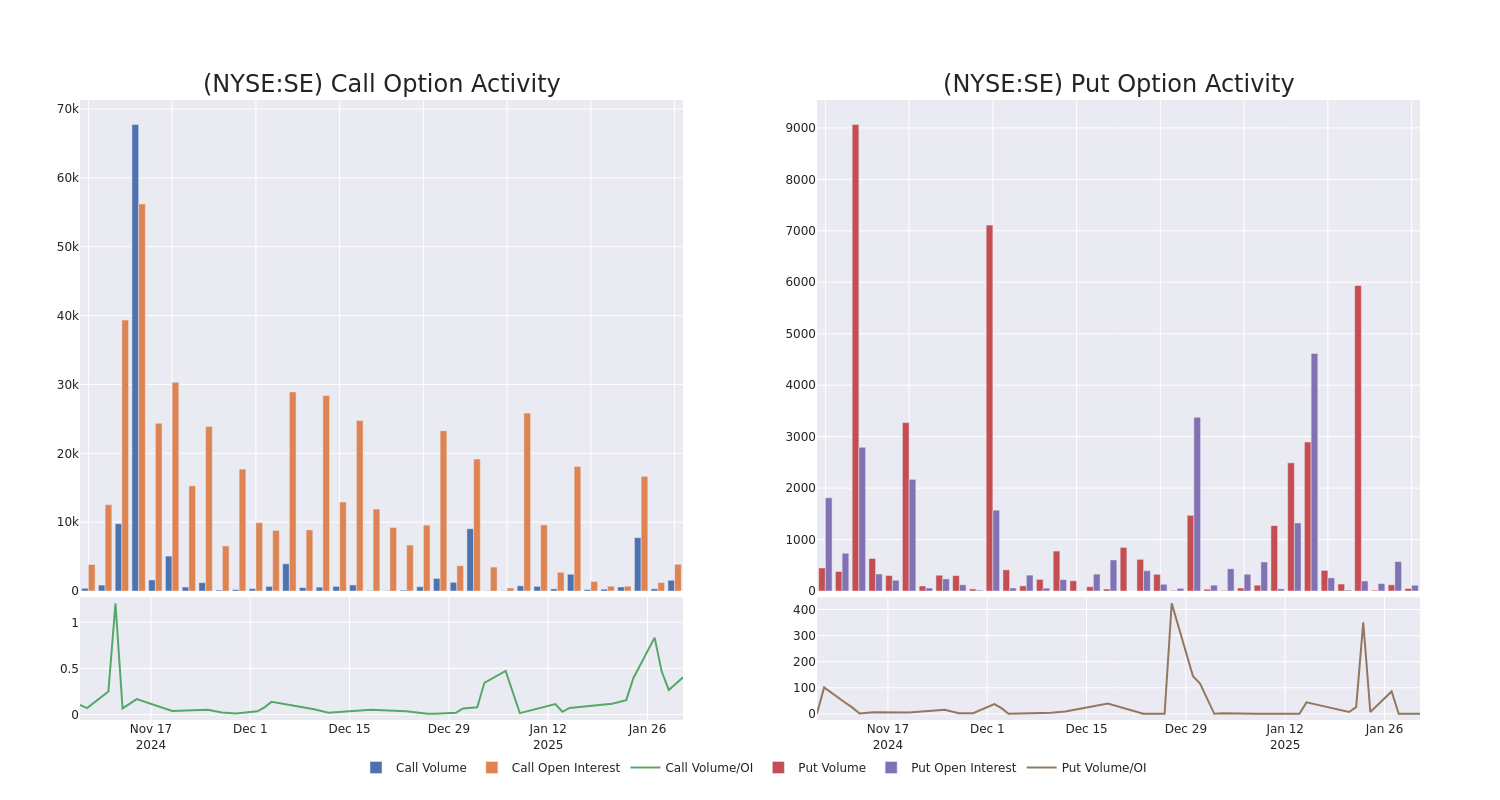

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Sea’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Sea’s substantial trades, within a strike price spectrum from $40.0 to $130.0 over the preceding 30 days.

Sea Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SE | PUT | TRADE | BULLISH | 07/18/25 | $6.15 | $5.55 | $5.65 | $100.00 | $237.3K | 0 | 420 |

| SE | CALL | TRADE | BULLISH | 06/20/25 | $41.55 | $41.25 | $41.55 | $85.00 | $70.6K | 332 | 68 |

| SE | CALL | TRADE | BEARISH | 06/20/25 | $37.85 | $37.45 | $37.45 | $90.00 | $63.6K | 2.4K | 85 |

| SE | CALL | TRADE | NEUTRAL | 06/20/25 | $37.75 | $37.0 | $37.35 | $90.00 | $63.4K | 2.4K | 85 |

| SE | CALL | SWEEP | BULLISH | 02/07/25 | $22.75 | $20.5 | $22.75 | $99.00 | $56.8K | 1 | 25 |

About Sea

Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce. Sea operates Southeast Asia’s largest e-commerce company, Shopee, in terms of gross merchandise value. Shopee is a hybrid C2C and B2C marketplace platform operating in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, the Philippines, and Brazil. For Garena, Free Fire is the key revenue generating game. Sea’s third business, SeaMoney, provides lending, payment, digital banking, and insurance services.As of March 31, 2024, Forrest Xiaodong Li, the founder, chairman and CEO, owned 59.8% of voting power and 18.5% of issued shares. Tencent owned 18.2% of issued shares with no voting power.

Having examined the options trading patterns of Sea, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Sea

- With a volume of 1,961,319, the price of SE is up 0.41% at $122.29.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 28 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Sea options trades with real-time alerts from Benzinga Pro.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.