Whales with a lot of money to spend have taken a noticeably bullish stance on KE Holdings.

Looking at options history for KE Holdings BEKE we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $2,925,000 and 7, calls, for a total amount of $280,886.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $14.0 to $22.0 for KE Holdings over the recent three months.

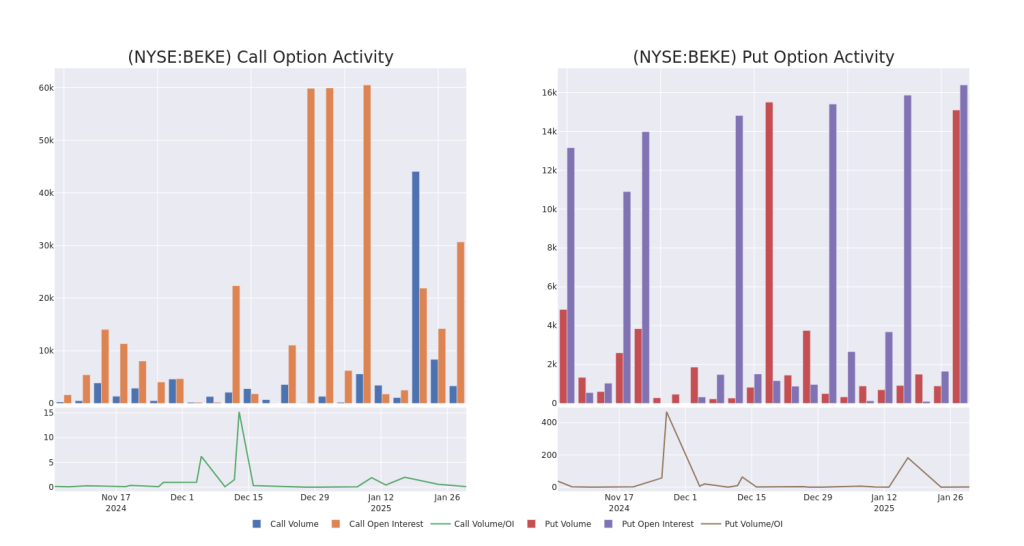

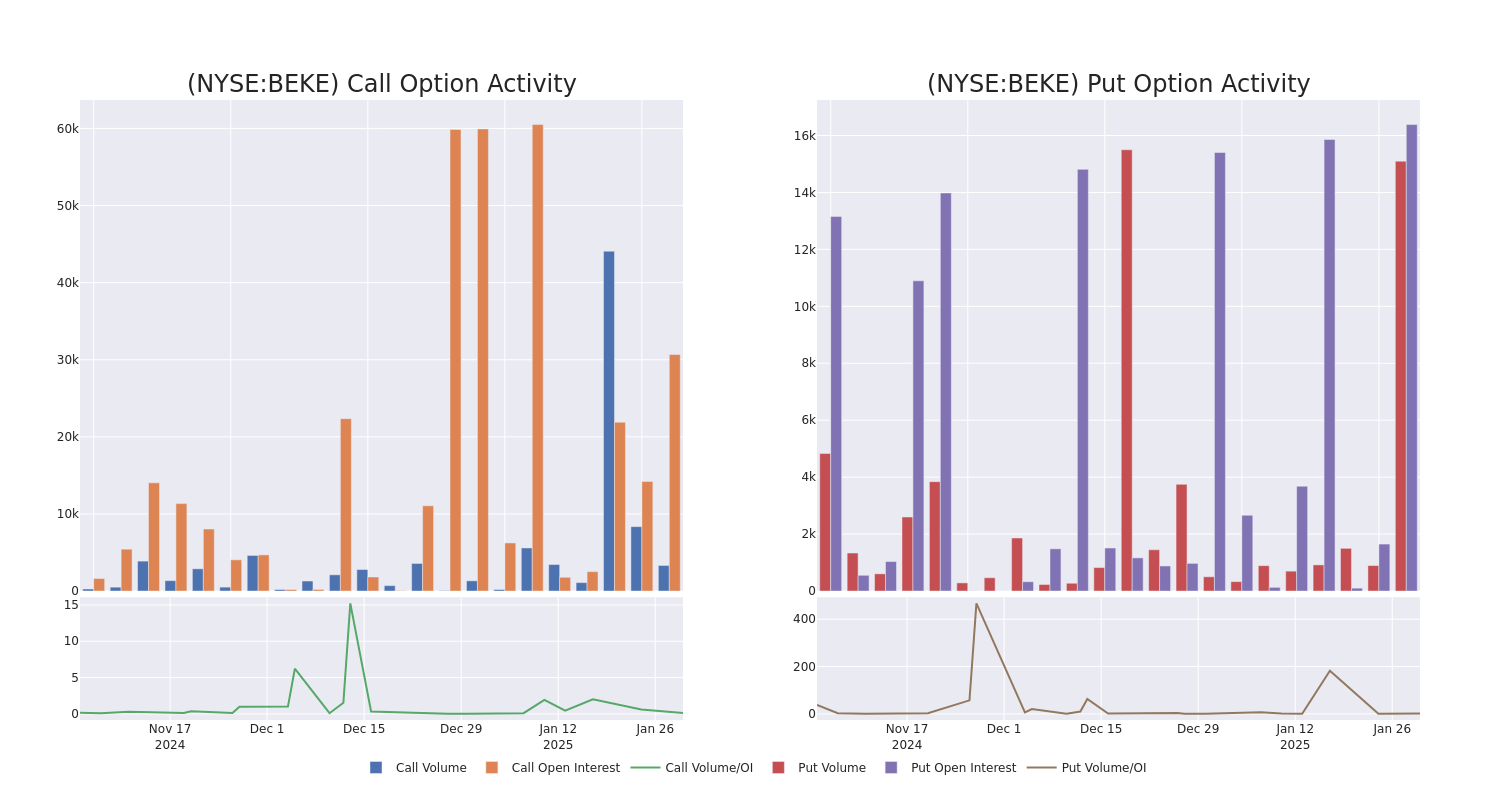

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in KE Holdings’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to KE Holdings’s substantial trades, within a strike price spectrum from $14.0 to $22.0 over the preceding 30 days.

KE Holdings 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BEKE | PUT | TRADE | BEARISH | 04/17/25 | $1.95 | $1.84 | $1.93 | $18.00 | $2.8M | 16.2K | 15.0K |

| BEKE | CALL | SWEEP | BEARISH | 04/17/25 | $5.65 | $4.5 | $4.62 | $14.00 | $78.8K | 305 | 170 |

| BEKE | CALL | TRADE | BULLISH | 03/21/25 | $2.09 | $1.84 | $2.05 | $18.00 | $40.9K | 497 | 258 |

| BEKE | CALL | SWEEP | BULLISH | 06/20/25 | $1.81 | $1.79 | $1.81 | $20.00 | $36.2K | 9.9K | 301 |

| BEKE | CALL | TRADE | BEARISH | 04/17/25 | $1.84 | $1.79 | $1.8 | $19.00 | $36.0K | 7.3K | 312 |

About KE Holdings

KE Holdings, or Beike, is a large residential real estate sales and rental brokerage company in China. Founded in 2001, the company operates through self-owned Lianjia stores in Beijing and Shanghai and connected third-party agencies including franchise brand Deyou in other cities, with commissions charged on existing-home and new-home transactions. Leveraging an online-offline hybrid model, Beike also attract clients through its namesake online marketplace. The company tapped into home renovation services by acquiring Shengdu Home Decoration in 2022. As of the end of 2023, Beike’s cofounders collectively control the company, while Tencent and its affiliates share 8% of voting power.

After a thorough review of the options trading surrounding KE Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of KE Holdings

- Currently trading with a volume of 5,156,202, the BEKE’s price is up by 6.83%, now at $18.55.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for KE Holdings, Benzinga Pro gives you real-time options trades alerts.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.