Deep-pocketed investors have adopted a bearish approach towards IonQ IONQ, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in IONQ usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 34 extraordinary options activities for IonQ. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 47% bearish. Among these notable options, 10 are puts, totaling $330,883, and 24 are calls, amounting to $1,740,824.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $5.0 to $55.0 for IonQ over the last 3 months.

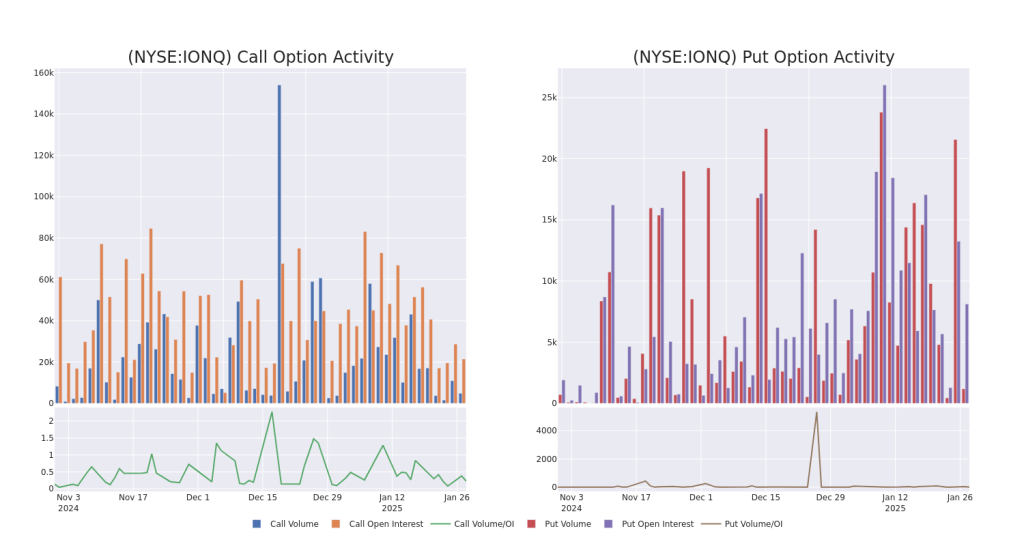

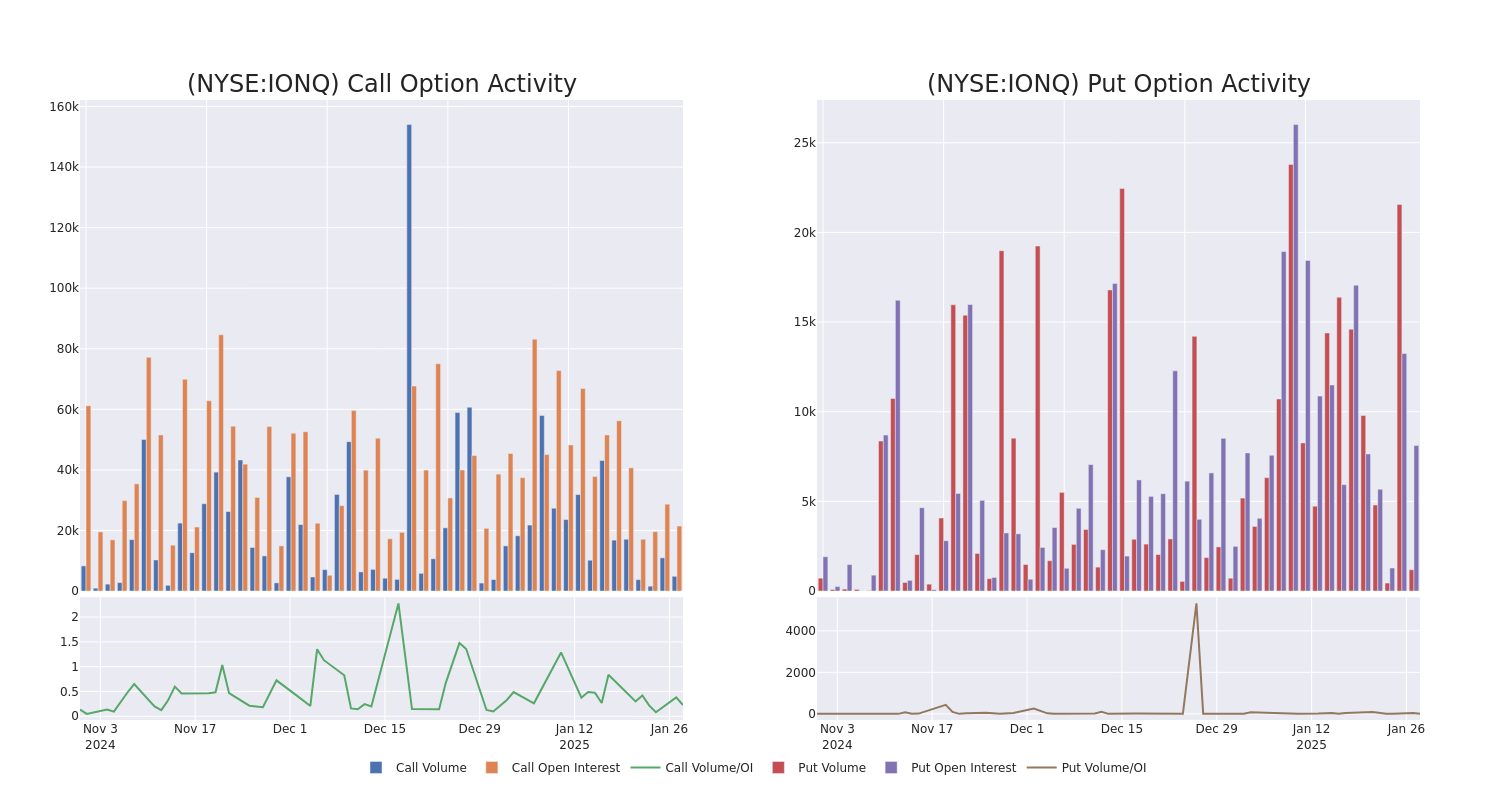

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in IonQ’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to IonQ’s substantial trades, within a strike price spectrum from $5.0 to $55.0 over the preceding 30 days.

IonQ Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | CALL | SWEEP | BULLISH | 04/17/25 | $7.9 | $7.8 | $7.9 | $40.00 | $395.0K | 4.2K | 541 |

| IONQ | CALL | TRADE | BEARISH | 01/15/27 | $18.65 | $17.15 | $17.15 | $55.00 | $171.4K | 498 | 100 |

| IONQ | CALL | TRADE | BULLISH | 03/21/25 | $3.25 | $3.2 | $3.25 | $55.00 | $146.2K | 402 | 551 |

| IONQ | CALL | SWEEP | BULLISH | 03/21/25 | $6.05 | $5.8 | $6.05 | $40.00 | $121.0K | 993 | 311 |

| IONQ | CALL | TRADE | BULLISH | 07/18/25 | $11.5 | $11.45 | $11.5 | $40.00 | $115.0K | 2.4K | 102 |

About IonQ

IonQ Inc sells access to several quantum computers of various qubit capacities and is in the process of researching and developing technologies for quantum computers with increasing computational capabilities. The company currently makes access to its quantum computers available via cloud platforms and also to select customers via its own cloud service. This cloud-based approach enables the broad availability of quantum-computing-as-a-service (QCaaS). The company derives its revenue from its quantum-computing-as-a-service arrangements, consulting services related to co-developing algorithms on company’s quantum computing systems, and contracts associated with the design, development, and construction of specialized quantum computing systems together with related services.

In light of the recent options history for IonQ, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

IonQ’s Current Market Status

- Currently trading with a volume of 12,042,251, the IONQ’s price is down by -3.48%, now at $37.2.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 29 days.

What The Experts Say On IonQ

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $30.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on IonQ with a target price of $30.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IonQ options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.