Boeing Co BA reported a loss for the fourth quarter on Tuesday.

The company reported a 31% year-over-year revenue decline to $15.242 billion in the fourth quarter of 2024, missing the consensus of $16.174 billion.

Adjusted loss per share grew to $5.90 from $0.47 in the same quarter of 2023, missing the consensus of a $2.44 loss.

Commercial Airplanes revenue fell 55% YoY to $4.862 billion, reflecting the IAM work stoppage, reduced deliveries, and $1.1 billion in pre-tax charges on the 777X and 767 programs.

Deliveries declined by 64%. 57 airplanes were delivered, and the backlog included over 5,500 airplanes valued at $435 billion. Defense, Space & Security revenue slid 20% year over year to $5.411 billion. The backlog was $64 billion, of which 29% represents orders from customers outside the U.S.

Global Services revenue grew by 6% YoY to $5.119 billion. The operating margin expanded 210 bps to 19.5%, reflecting higher commercial volume and mix.

Boeing shares closed at $177.78 on Tuesday.

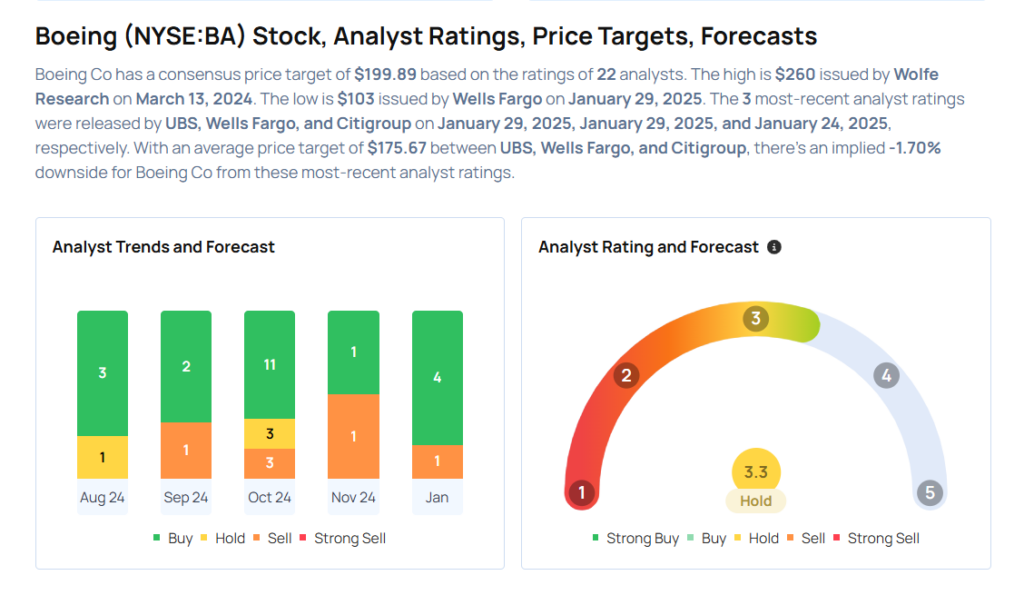

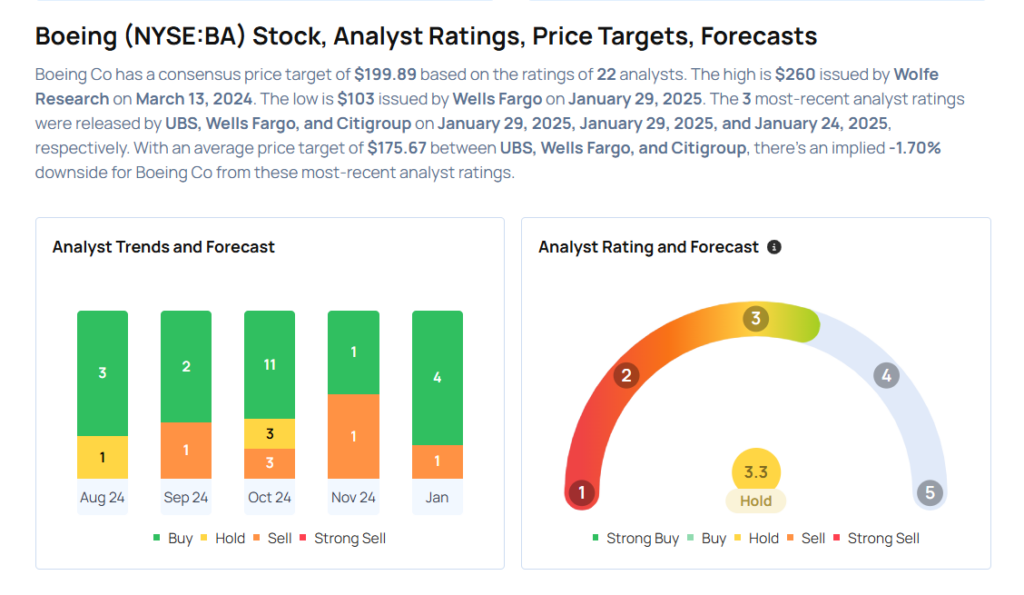

These analysts made changes to their price targets on Boeing following earnings announcement.

- Wells Fargo analyst Matthew Akers maintained Boeing with an Underweight and raised the price target from $85 to $103.

- UBS analyst Gavin Parsons maintained Boeing with a Buy and boosted the price target from $208 to $217.

Considering buying BA stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.