President Donald Trump‘s first week in office pushed equities to new highs, with the S&P 500 marking its first record of 2025. Trump’s focus on four key areas, driven by macroeconomic considerations, included technology, tariffs, the energy sector, and immigration reform.

What Happened: Some highlights from Trump’s first week included pouring tariff threats and the $500 billion artificial intelligence project – Stargate. This drove a rally in tech stocks and among the project beneficiaries.

However, experts at Edward Jones said that investors should remember to “not play politics with their portfolios.” The note stated that market forces are more powerful than political forces over the long term. “What sounds promising during election campaigns often may not work in reality.”

While new policy proposals were generally more measured than expected, which pleased markets, Edward Jones anticipates volatility as further updates are released. Here is their view on the list of reforms and which sector and stocks may be impacted by it.

Will The Energy Companies Support New Reforms?

The new administration prioritized energy reform, with Trump fulfilling his “drill, baby, drill” promise through executive actions supporting U.S. oil and gas production. These included declaring a national energy emergency to ease fossil-fuel production restrictions, expediting energy infrastructure projects, rolling back climate-change initiatives, and withdrawing from the Paris Climate Agreement.

However, Edward Jones’ analyst Mona Singh observed that increasing oil and gas supply would lower energy prices, potentially putting downward pressure on revenue growth and earnings for major energy producers. “Lower energy and gas prices would, however, be a positive for containing inflation.”

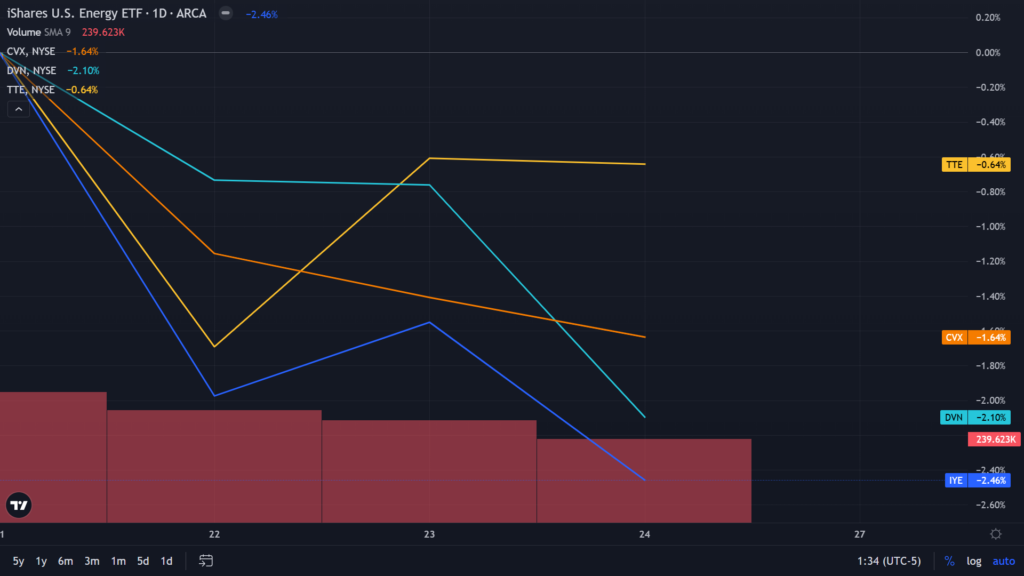

The exchange-traded fund tracking the sector, iShares US Energy ETF IYE, dropped 2.46% in the four sessions of the last week. Whereas, Chevron CVX slipped 1.64%, Devon Energy DVN fell 2.10%, and TotalEnergies TTE declined 0.64%, in the same period, as per Benzinga Pro.

Will Immigration Reform Increase Inflation?

The executive orders also prioritized immigration reform as key actions included declaring a national emergency, labeling drug cartels as terrorist organizations, and restricting benefits for undocumented immigrants. While mass deportations have not materialized, troop deployments have been enhanced at the border.

Investors will closely monitor any expansion of deportation activity, as this could significantly disrupt labor markets, said the note. “A smaller labor force could mean not only softer growth in the U.S., but it may also cause employers to pay higher wages to attract workers, which could lead to price increases and renewed inflationary pressure,” the note added.

No Concrete Action On Tariffs Yet

Despite the threats to impose 25% tariffs on Canada and Mexico, along with 10% on China, starting Feb. 1, no action has been taken. The Trump administration has directed federal agencies to evaluate U.S. trade policy and submit recommendations by April 1.

Tariffs are increasingly likely to target specific sectors and companies and serve as a negotiating leverage rather than a tool for global trade conflicts, the note said. “The administration is likely more sensitive to enacting tariffs that could increase consumer prices and be inflationary,” it added.

Bets On AI To Drive Technology

Microsoft Corporation MSFT, Nvidia Corporation NVDA, and Oracle Corporation ORCL are the U.S.-listed beneficiaries of the private-sector-backed project Stargate, announced by Trump last week. He also signed an executive order to make the U.S. the global leader in artificial intelligence, directing agencies to develop policies to ensure dominance in the field.

“The investments in data centers and electricity are critical for the U.S. to maintain leadership and be a driver for AI technology and applications. The government investment in technology infrastructure, we believe, will pay dividends in the form of enhanced innovation and productivity in the future,” the note added.

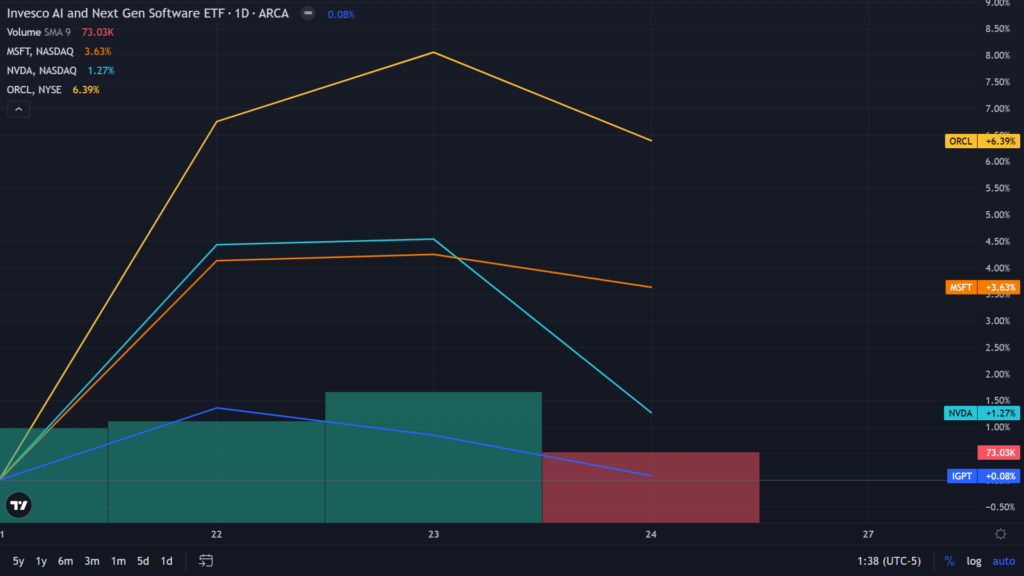

The ETF tracking AI-linked companies, Invesco AI and Next Gen Software ETF IGPT, rose 0.08% in the four sessions of the previous week. While MSFT was up 3.63%, NVDA gained 1.27% and ORCL advanced 6.39%, in the same period, as per Benzinga Pro.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.