Investors with a lot of money to spend have taken a bearish stance on Amgen AMGN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AMGN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 28 uncommon options trades for Amgen.

This isn’t normal.

The overall sentiment of these big-money traders is split between 39% bullish and 46%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $346,174, and 23 are calls, for a total amount of $1,767,629.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $200.0 and $320.0 for Amgen, spanning the last three months.

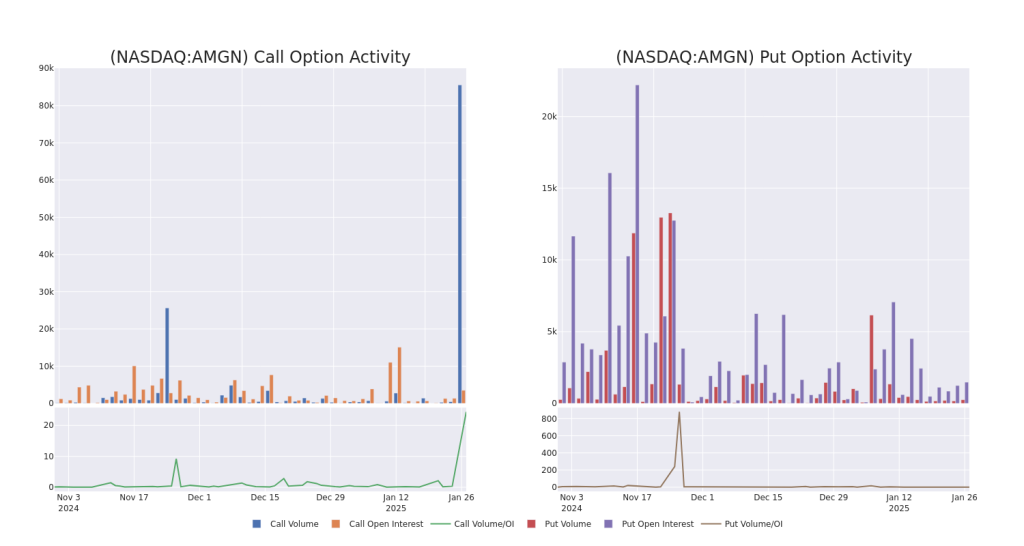

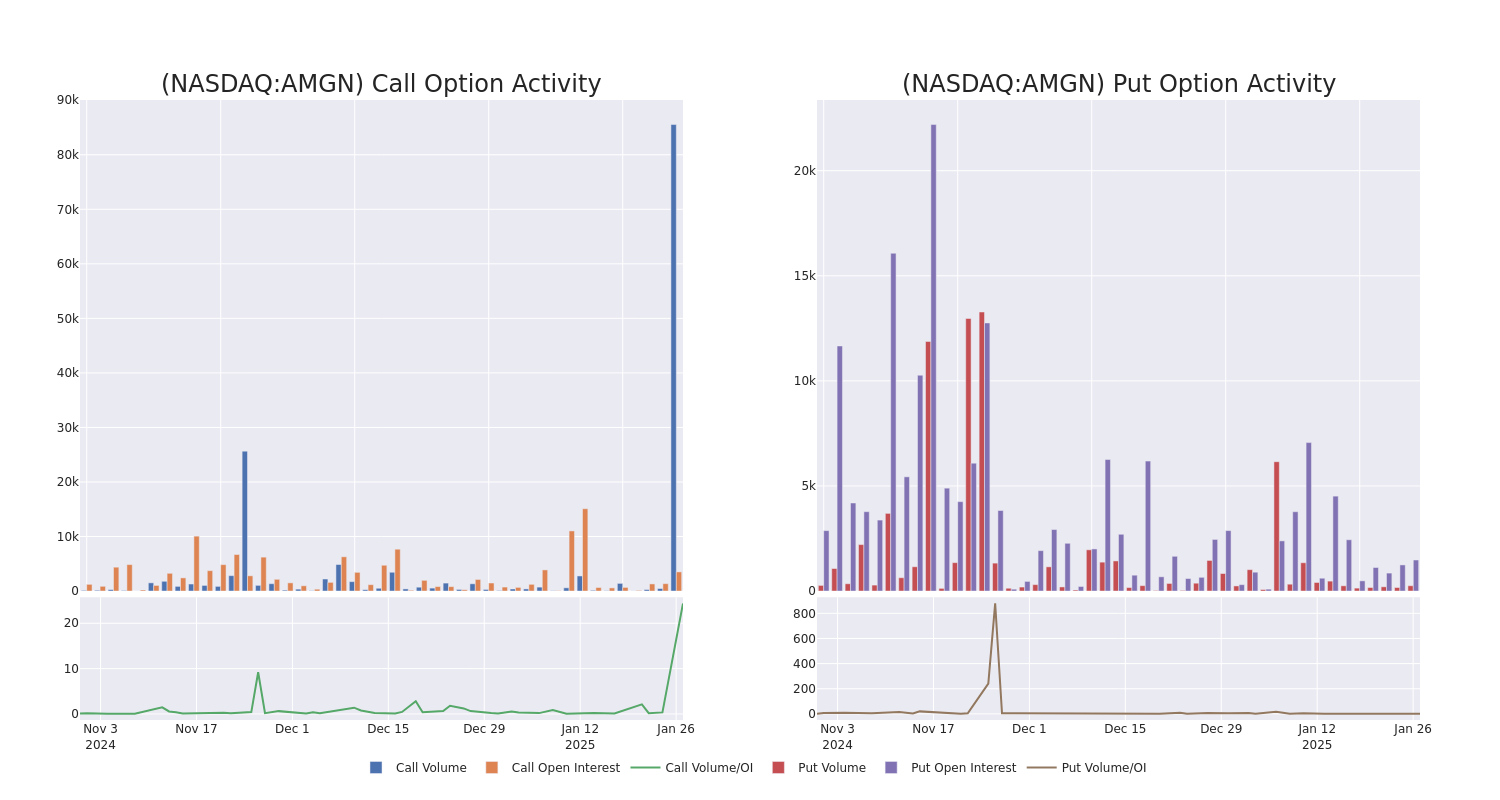

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Amgen stands at 415.42, with a total volume reaching 85,793.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $200.0 to $320.0, throughout the last 30 days.

Amgen Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | CALL | SWEEP | NEUTRAL | 02/21/25 | $2.05 | $1.95 | $2.0 | $295.00 | $351.2K | 358 | 8.5K |

| AMGN | CALL | SWEEP | BEARISH | 02/21/25 | $2.36 | $2.11 | $2.15 | $295.00 | $217.4K | 358 | 10.6K |

| AMGN | CALL | SWEEP | BEARISH | 02/21/25 | $2.5 | $2.26 | $2.3 | $295.00 | $182.5K | 358 | 11.7K |

| AMGN | CALL | SWEEP | BEARISH | 12/19/25 | $34.45 | $32.3 | $32.9 | $270.00 | $164.6K | 65 | 50 |

| AMGN | CALL | SWEEP | BULLISH | 02/21/25 | $2.0 | $1.98 | $2.0 | $295.00 | $140.0K | 358 | 3.0K |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm’s therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company’s own performance.

Present Market Standing of Amgen

- With a trading volume of 1,963,688, the price of AMGN is up by 2.63%, reaching $282.66.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 8 days from now.

What The Experts Say On Amgen

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $303.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Amgen, which currently sits at a price target of $280.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Amgen with a target price of $310.

* An analyst from Truist Securities has decided to maintain their Hold rating on Amgen, which currently sits at a price target of $298.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $324.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Amgen with Benzinga Pro for real-time alerts.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.