American Express Co AXP reported better-than-expected sales for its fourth quarter on Friday.

The company posted fourth-quarter revenue (net of interest expense) growth of 9% year-on-year to $17.18 billion, topping the analyst consensus estimate of $17.16 billion. The increase was primarily driven by strong Card Member spending, higher net interest income supported by growth in revolving loan balances, and accelerated card fee growth.

GAAP EPS of $3.04 was in line with the analyst consensus estimate.

Chair and CEO Stephen J. Squeri flagged record levels of annual Card Member spending, record net card fee revenues, and a record 13 million new card acquisitions in 2024 and continued to add millions of merchant locations to its network globally.

Amex said it expects FY25 revenue of $71.22 billion-$72.54 billion (up by 8%-10% Y/Y) versus a consensus of $71.28 billion. It expects EPS of $15.00–$15.50 versus the consensus of $15.23.

Amex shares fell 1.4% to close at $321.34 on Friday.

These analysts made changes to their price targets on Amex following earnings announcement.

- Morgan Stanley analyst Betsy Graseck maintained American Express with an Equal-Weight and raised the price target from $305 to $310.

- Keefe, Bruyette & Woods analyst Sanjay Sakhrani maintained American Express with an Outperform and raised the price target from $350 to $360.

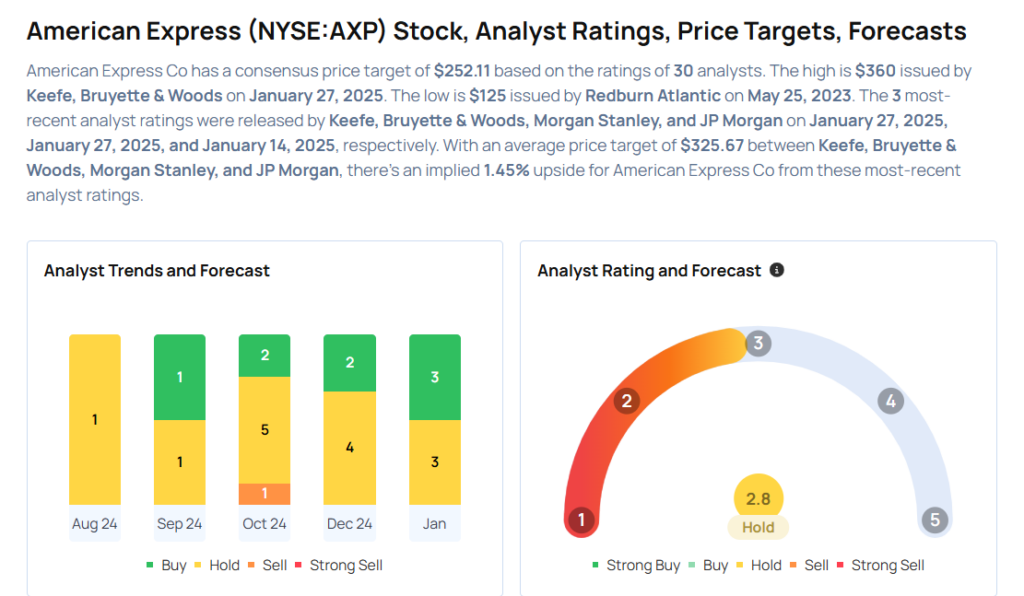

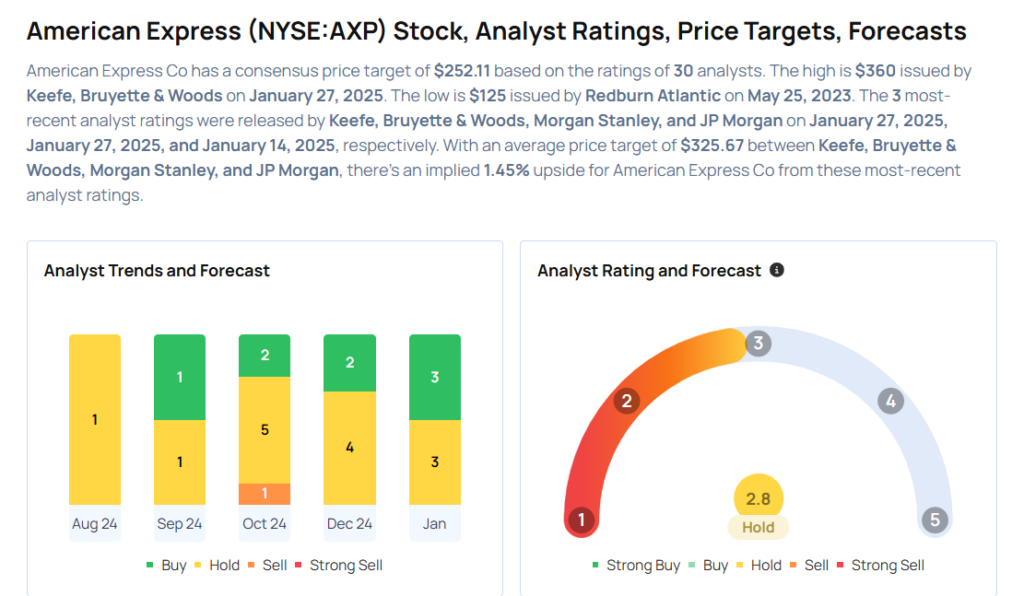

Considering buying AXP stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.