Deep-pocketed investors have adopted a bearish approach towards Carvana CVNA, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CVNA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 48 extraordinary options activities for Carvana. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 31% leaning bullish and 45% bearish. Among these notable options, 31 are puts, totaling $1,461,161, and 17 are calls, amounting to $3,204,359.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $30.0 and $390.0 for Carvana, spanning the last three months.

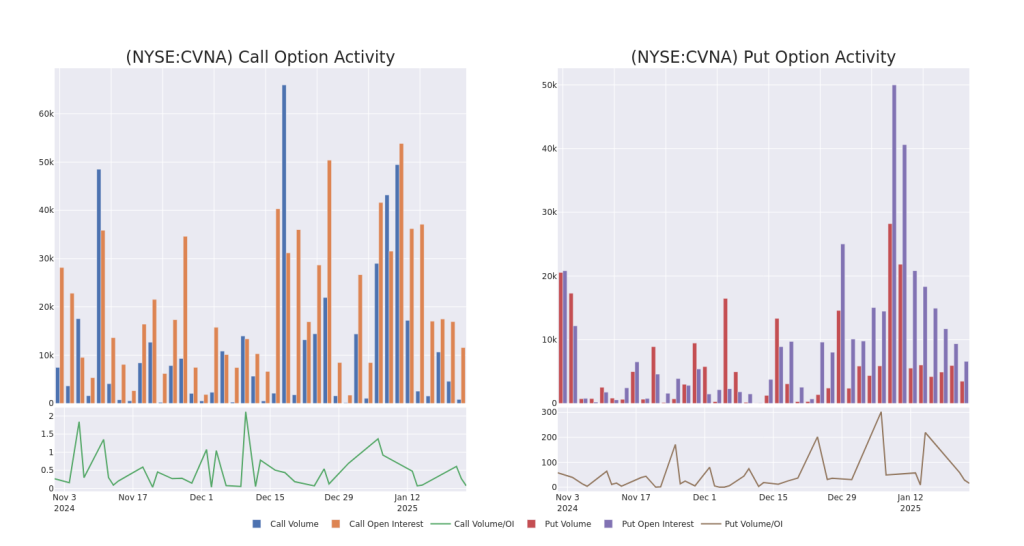

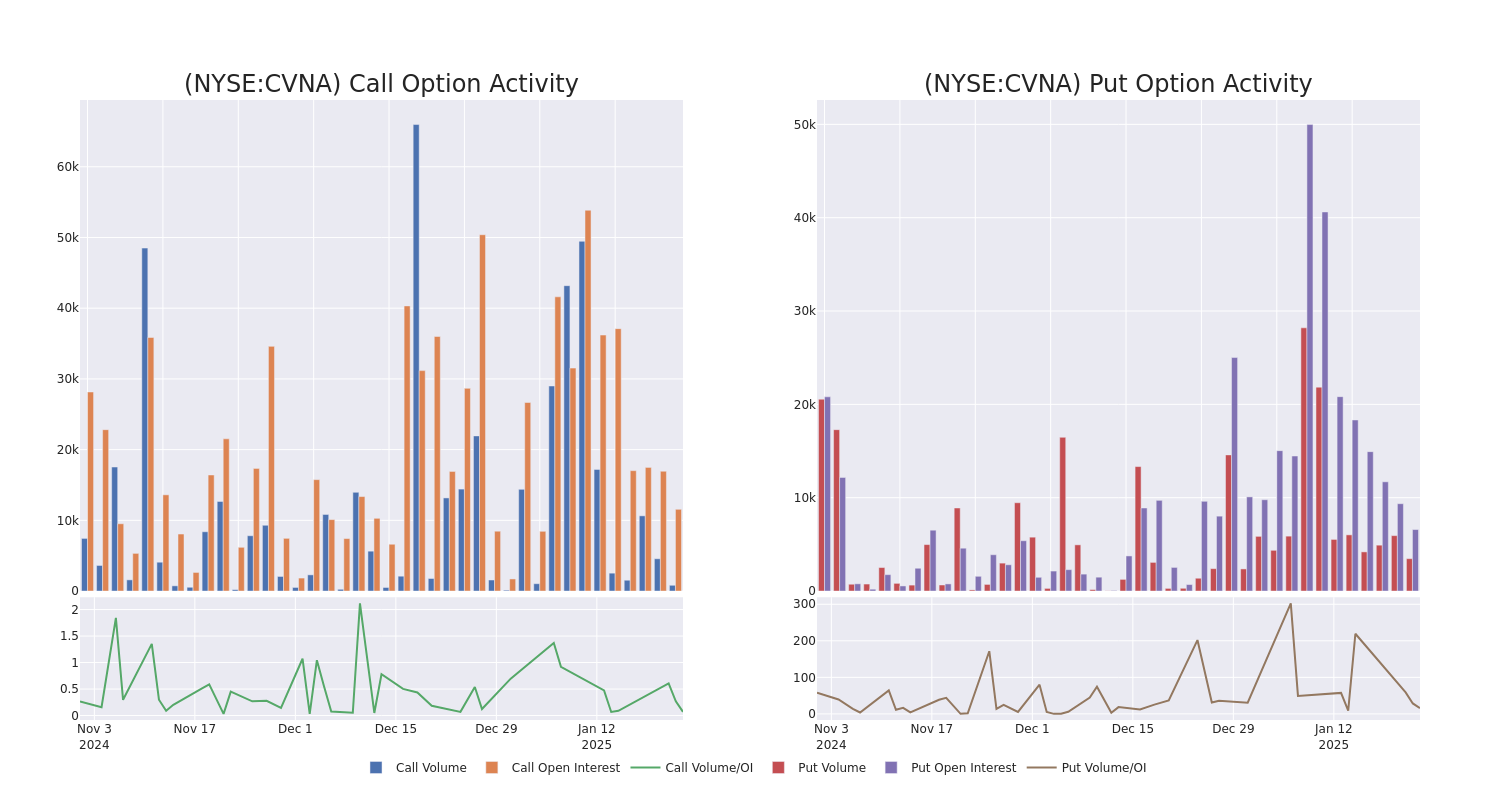

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Carvana options trades today is 879.46 with a total volume of 14,343.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carvana’s big money trades within a strike price range of $30.0 to $390.0 over the last 30 days.

Carvana 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | SWEEP | NEUTRAL | 02/21/25 | $21.0 | $20.3 | $20.65 | $240.00 | $1.0M | 2.6K | 629 |

| CVNA | CALL | SWEEP | BULLISH | 02/07/25 | $5.1 | $4.6 | $4.85 | $250.00 | $498.5K | 3.0K | 2.2K |

| CVNA | CALL | SWEEP | BEARISH | 02/07/25 | $5.5 | $4.8 | $4.85 | $250.00 | $436.8K | 3.0K | 1.0K |

| CVNA | CALL | TRADE | NEUTRAL | 01/31/25 | $29.15 | $26.2 | $27.6 | $215.00 | $276.0K | 5.0K | 101 |

| CVNA | PUT | SWEEP | BULLISH | 03/21/25 | $23.95 | $23.6 | $23.6 | $240.00 | $236.0K | 378 | 171 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Following our analysis of the options activities associated with Carvana, we pivot to a closer look at the company’s own performance.

Current Position of Carvana

- Currently trading with a volume of 1,280,876, the CVNA’s price is down by -0.1%, now at $240.23.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 23 days.

Professional Analyst Ratings for Carvana

In the last month, 5 experts released ratings on this stock with an average target price of $292.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Carvana with a target price of $275.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $330.

* An analyst from RBC Capital upgraded its action to Outperform with a price target of $280.

* Showing optimism, an analyst from Citigroup upgrades its rating to Buy with a revised price target of $277.

* Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carvana with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.