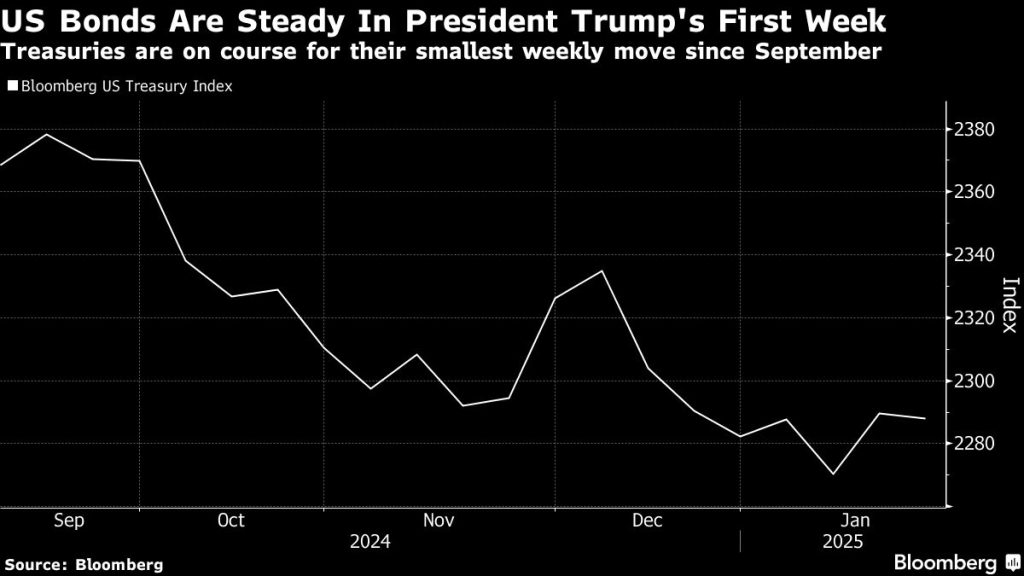

(Bloomberg) — Treasuries rose Friday and were on pace to eke out a small weekly gain after survey data showed signs of US economic cooling.

Most Read from Bloomberg

Yields were lower by at least two basis points, with short maturities down nearly four basis points. Session lows were reached after an unexpected drop in S&P Global’s gauge of services activity and a downward revision to the University of Michigan’s sentiment gauge, both for January. The rally left Treasury yields slightly lower on the week, which began with the inauguration of Donald Trump to a second non-consecutive presidential term.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

The data bolster the view that the Federal Reserve — which meets Jan. 28-29 — will cut interest rates at least once this year as early as June, after reductions at each of its last three meetings. Bonds also benefited from the lack of immediate action by Trump to impose tariffs on imports, though he said he intends to.

“With a data-dependent Fed, the market is hyper-focused on every economic release,” said Christian Hoffmann, portfolio manager at Thornburg Investment Management. At the same time, “politics will continue to be a major driver of volatility and uncertainty.”

Money markets and economists surveyed by Bloomberg are unanimous in expecting Fed Chair Jerome Powell and his colleagues to maintain their 4.25%-4.5% target range for the US overnight interest rate next week. Looking further ahead, rate swaps now favor two quarter-point reductions by year-end. A week ago, just one was anticipated.

Bonds began selling off in September, pushing 10-year yields to a 14-month high of 4.8% earlier this month, reflecting concerns that trade protectionism could lead to inflation. Benign inflation data for December released Jan. 15 and Fed Governor Christopher Waller’s comment the next day that a rate cut by mid-year remains possible stopped the bleeding.

Short-term Treasury yields, more sensitive than longer-term ones to rate changes by the Fed, have moved the most this week. The 10-year yield is 36 basis points higher than the two-year, vs 34 basis points a week ago. Open-interest data for Treasury futures suggests that investors anticipate further steepening of the curve.