Whales with a lot of money to spend have taken a noticeably bearish stance on VF.

Looking at options history for VF VFC we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $218,252 and 4, calls, for a total amount of $182,320.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.5 to $30.0 for VF over the recent three months.

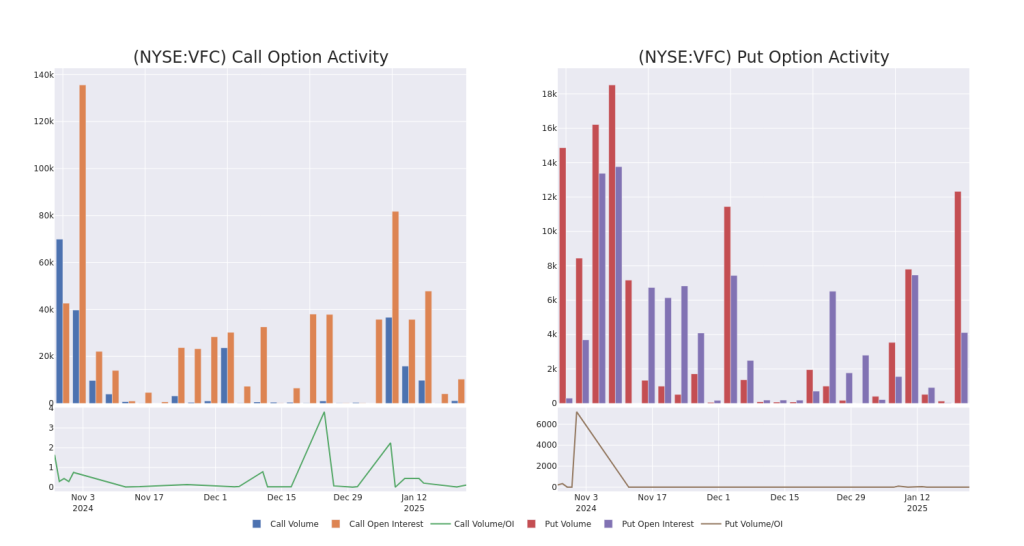

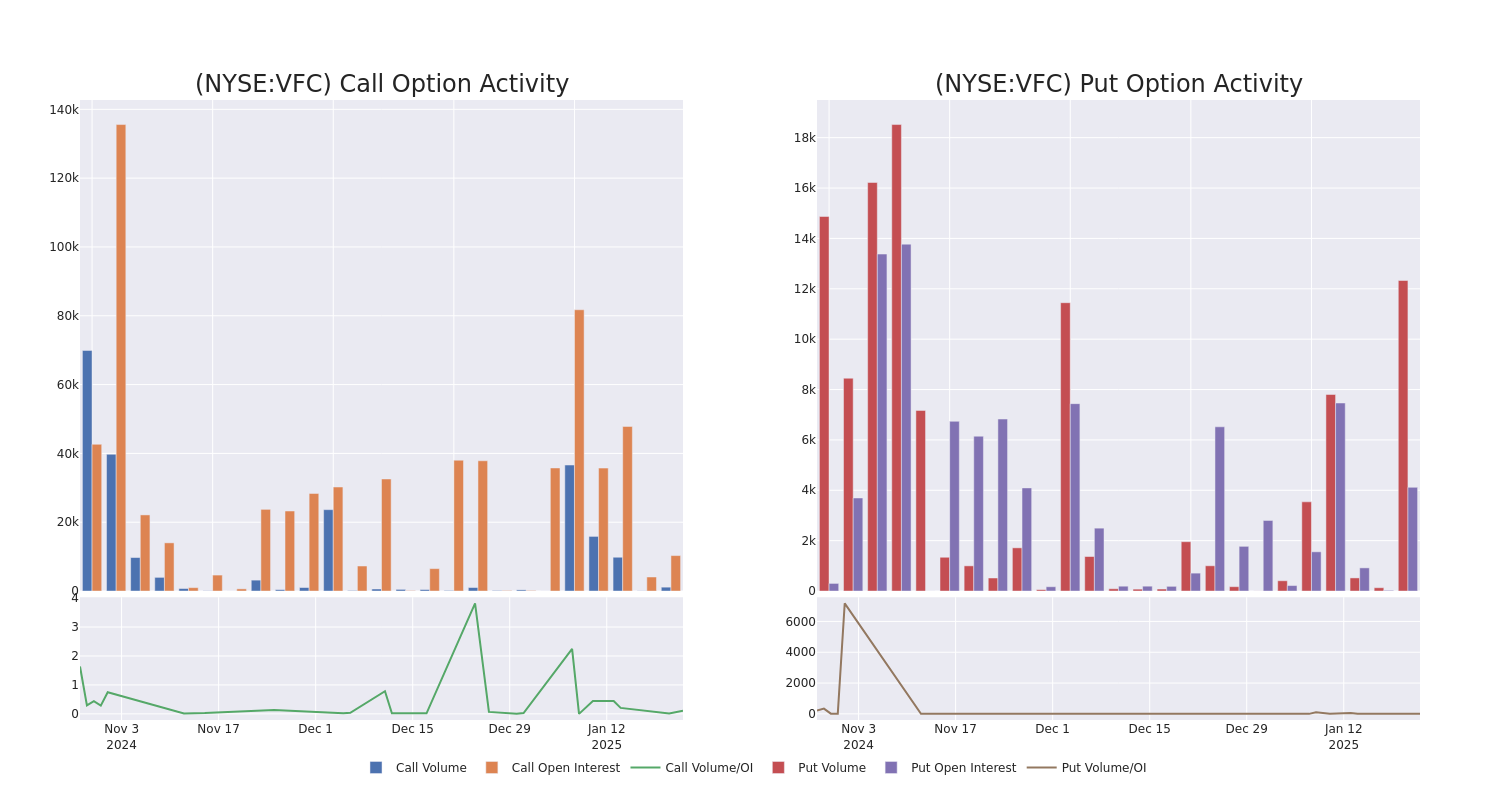

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of VF stands at 3853.0, with a total volume reaching 17,473.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in VF, situated within the strike price corridor from $17.5 to $30.0, throughout the last 30 days.

VF 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VFC | PUT | SWEEP | BEARISH | 01/31/25 | $2.1 | $2.09 | $2.1 | $27.50 | $68.7K | 0 | 327 |

| VFC | PUT | TRADE | BEARISH | 02/21/25 | $0.12 | $0.0 | $0.11 | $19.50 | $66.0K | 19 | 11.0K |

| VFC | CALL | TRADE | BULLISH | 01/16/26 | $4.1 | $2.54 | $3.7 | $30.00 | $61.4K | 9.5K | 193 |

| VFC | PUT | TRADE | BEARISH | 02/21/25 | $0.12 | $0.0 | $0.11 | $19.50 | $55.0K | 19 | 5.0K |

| VFC | CALL | SWEEP | BEARISH | 03/21/25 | $6.85 | $6.75 | $6.75 | $20.00 | $54.0K | 5.3K | 156 |

About VF

VF designs, produces, and distributes branded apparel, footwear, and accessories. Its apparel categories are active, outdoor, and work. Its portfolio of about a dozen brands includes Vans, The North Face, Timberland, Altra, and Dickies. VF markets its products in the Americas, Europe, and Asia-Pacific through wholesale sales to retailers, e-commerce, and branded stores owned by the company and partners. Tracing its roots to 1899, the company has evolved through many brand acquisitions and dispositions.

After a thorough review of the options trading surrounding VF, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

VF’s Current Market Status

- With a trading volume of 2,021,520, the price of VFC is up by 2.79%, reaching $26.34.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 5 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for VF with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.