Investors with a lot of money to spend have taken a bearish stance on Abbott Laboratories ABT.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ABT, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 20 options trades for Abbott Laboratories.

This isn’t normal.

The overall sentiment of these big-money traders is split between 40% bullish and 50%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $28,905, and 19, calls, for a total amount of $1,330,626.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $140.0 for Abbott Laboratories over the recent three months.

Insights into Volume & Open Interest

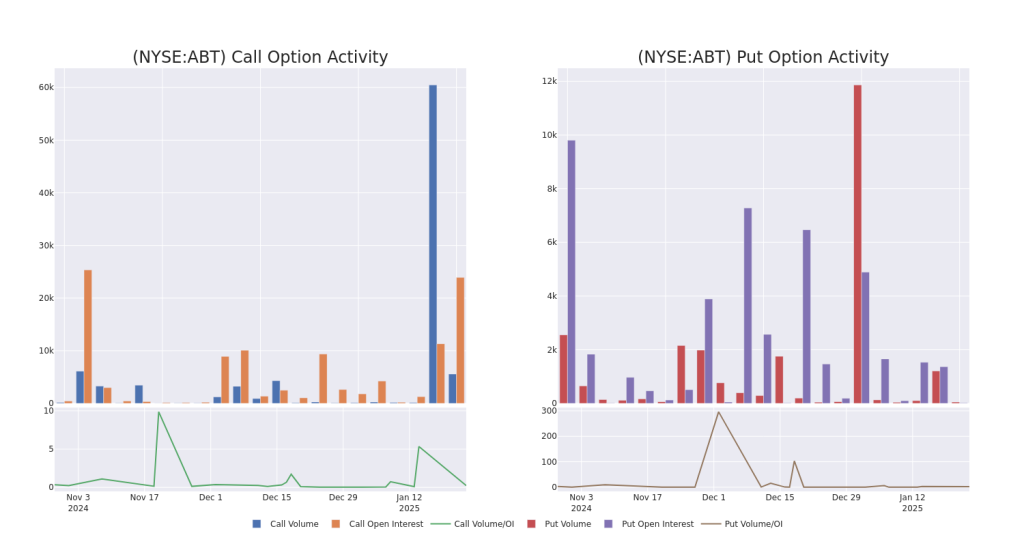

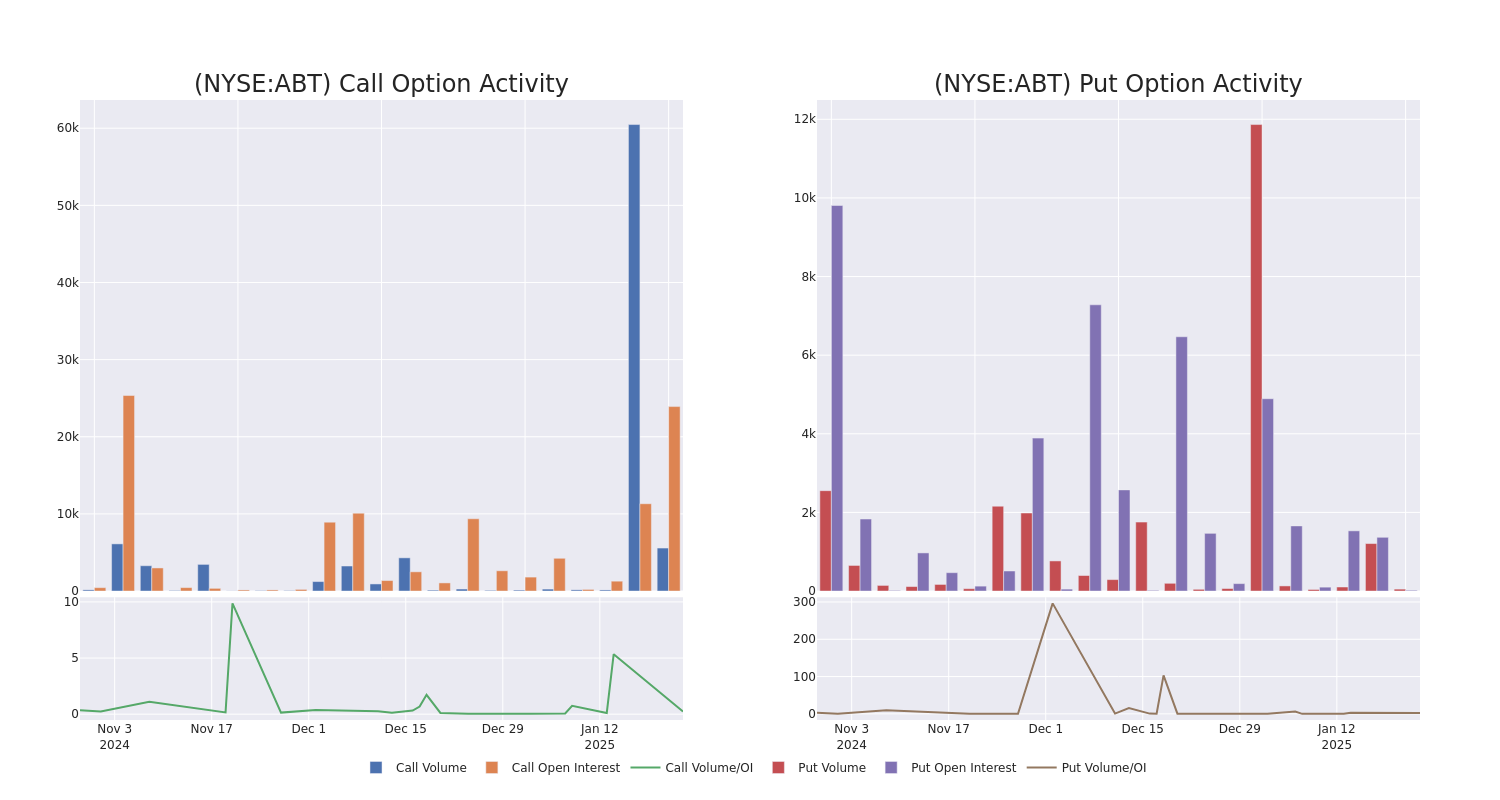

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Abbott Laboratories’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Abbott Laboratories’s whale trades within a strike price range from $60.0 to $140.0 in the last 30 days.

Abbott Laboratories Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | CALL | SWEEP | BULLISH | 01/15/27 | $29.5 | $29.5 | $29.5 | $105.00 | $218.3K | 365 | 74 |

| ABT | CALL | SWEEP | BEARISH | 01/16/26 | $17.9 | $17.7 | $17.9 | $115.00 | $178.9K | 823 | 106 |

| ABT | CALL | SWEEP | BULLISH | 01/15/27 | $29.75 | $29.7 | $29.75 | $105.00 | $145.7K | 365 | 130 |

| ABT | CALL | SWEEP | BEARISH | 03/21/25 | $66.25 | $65.45 | $65.77 | $60.00 | $131.5K | 0 | 20 |

| ABT | CALL | SWEEP | BEARISH | 01/15/27 | $10.3 | $9.1 | $9.1 | $140.00 | $78.2K | 1.1K | 88 |

About Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

After a thorough review of the options trading surrounding Abbott Laboratories, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Abbott Laboratories Standing Right Now?

- With a trading volume of 5,249,687, the price of ABT is down by -0.19%, reaching $122.98.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 82 days from now.

What The Experts Say On Abbott Laboratories

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $137.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Abbott Laboratories with a target price of $148.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Abbott Laboratories, which currently sits at a price target of $136.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $135.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $135.

* Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Abbott Laboratories, targeting a price of $135.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Abbott Laboratories with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.