SoFi Technologies Inc SOFI will be reporting its fourth-quarter earnings on Monday. Wall Street expects four cents in EPS and $674.13 million in revenues as the company reports before market hours.

The stock is up 140.94% over the past year, 28.91% YTD.

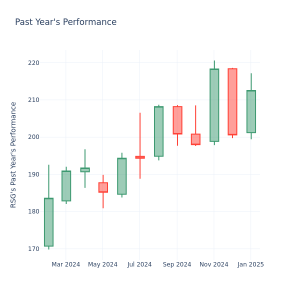

Let’s look at what the charts indicate for SoFi stock and how the stock maps against Wall Street estimates.

Read Also: Biden Announces More Student Loan Forgiveness, Bringing Debt Relief To Nearly 5 Million Borrowers

SoFi Stock Strong Bullish Ahead Of Q4 Earnings

SoFi stock is exhibiting a strongly bullish trend, with its share price trading above the five-day, 20-day and 50-day exponential moving averages, indicating sustained buying pressure.

Chart created using Benzinga Pro

SoFi stock, at $18.17, surpassing its eight-day simple moving average of $16.81, 20-day simple moving average of $15.80 and 50-day simple moving average of $15.51, reinforcing a bullish outlook.

Additionally, SoFi’s 200-day simple moving average at $9.66 confirms strong long-term upward momentum. The moving average convergence divergence (MACD) indicator at 0.68 signals continued bullish strength, while the relative strength index (RSI) at 67.63 is approaching overbought territory.

For investors, the technical setup suggests strong upside potential, especially for those with a long-term outlook. However, with RSI nearing overbought levels, short-term traders may want to watch for a potential pullback before entering new positions. Those already holding the stock could consider monitoring resistance levels for signs of continued momentum or consolidation.

SoFi Analysts See 29% Downside

Ratings & Consensus Estimates: The consensus analyst rating on SoFi stock stands at a Buy currently with a price target of $10.33. The latest analyst ratings from Citigroup, Keefe, Bruyette & Woods and Morgan Stanley suggest a $13 price target for SoFi stock, implying a 28.59% downside.

SOFI Price Action: SoFi stock was trading at $dd at the time of publication.

Read Next:

Photo: Shutterstock

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.