Aptiv PLC APTV disclosed that its Board of Directors has approved a plan to separate its Electrical Distribution Systems (EDS) business from Aptiv, creating two independent entities.

Aptiv also reaffirmed its 2024 outlook, with a fourth-quarter earnings report scheduled for February 6, 2025. While reporting third-quarter results in October, Aptiv said it expects FY24 adjusted earnings per share in the range of $6.00-$6.30 ($6.12 estimate) and net sales of $19.60 billion-$19.90 billion ($19.68 billion estimate).

Kevin Clark, Aptiv’s Chairman and CEO, emphasized that the separation is part of the company’s broader transformation strategy.

“Following completion of the transaction, Aptiv will have a portfolio of advanced software and hardware technologies and highly engineered, mission-critical products that are aligned with global mega trends fueling growth in diverse end markets,” Clark said.

Aptiv’s shares gained 1.5% to close at $62.73 on Wednesday.

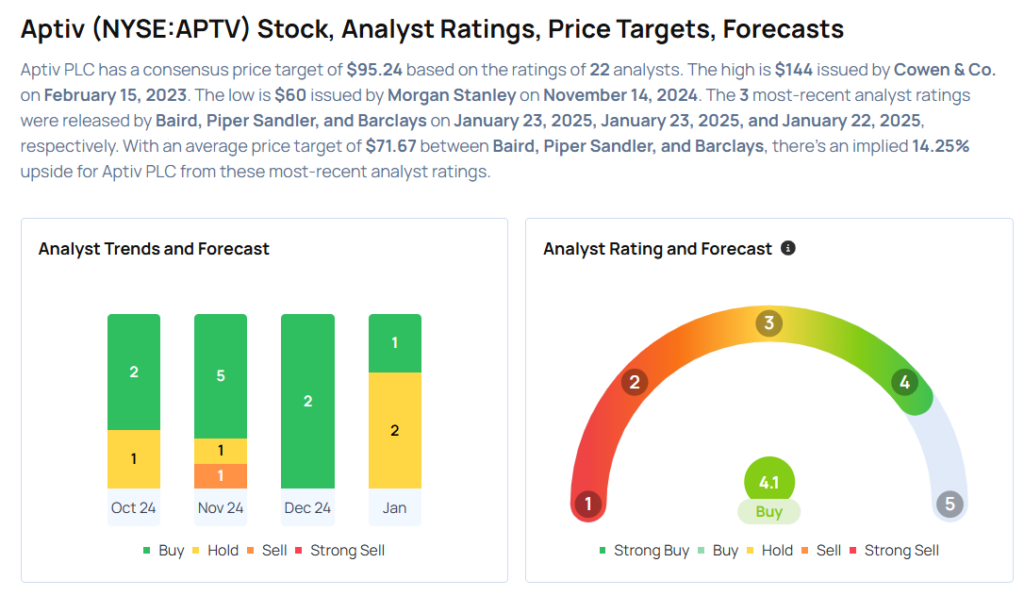

These analysts made changes to their price targets on Aptiv following the announcement.

- Piper Sandler analyst Alexander Potter upgraded Aptiv from Underweight to Neutral and raised the price target from $53 to $65.

- Baird analyst David Leiker maintained the stock with a Neutral and raised the price target from $70 to $75.

Considering buying APTV stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.