Wedbush Securities analyst Dan Ives has raised Tesla Inc.‘s TSLA price target to $550, signaling growing confidence in the electric vehicle manufacturer’s demand and autonomous potential under President Donald Trump‘s administration.

What Happened: Ives characterized the emerging landscape as a “golden era” for CEO Elon Musk and Tesla heading into 2025.

The price target increase comes amid complex market dynamics, including challenges in vehicle deliveries and potential policy changes. Tesla’s U.S. deliveries declined 5.6% in 2024 to 633,762 units, yet the company remains the dominant electric vehicle brand nationwide.

Simultaneously, debates around Tesla’s future have intensified. Investor Gary Black cautioned against inflated expectations for the Optimus robot program, estimating it could add only $0.70 to earnings per share by 2027.

Bank of America analyst John Murphy valued the Optimus segment between $14 billion and $95 billion, representing just 2% of Tesla’s total estimated value.

See Also: Nvidia Supplier SK Hynix Soars 102% In Revenue, But Stock Drops Despite AI Memory Boom

Why It Matters: The potential elimination of the $7,500 federal electric vehicle tax credit under the Trump administration introduces additional uncertainty. While Musk previously suggested minimal impact on Tesla, Black warned of significant pricing challenges.

Notably, Tesla’s stock performance has lagged behind market expectations, with fiscal 2025 and 2026 earnings estimates declining 39% and 45% respectively over the past year.

Despite these challenges, Ives remains optimistic, setting a bull case target of $650, representing a 56% increase from the current trading price, without factoring in Optimus’ potential.

Price Action: Tesla stock closed at $415.11 on Wednesday, down 2.11% for the day. In after-hours trading, the stock dipped further 0.32%. Over the past year, Tesla’s stock has gained 98.81%, according to data from Benzinga Pro.

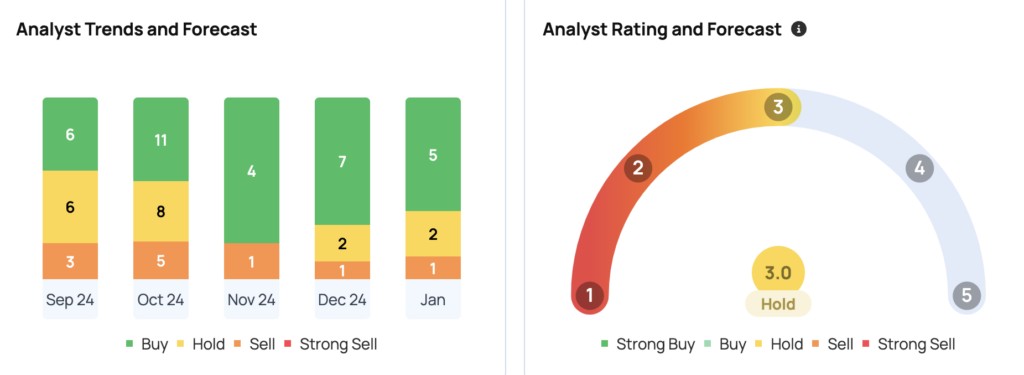

Tesla has a consensus price target of $308.4, with a high of $550 and a low of $24.86. The average target from Wedbush, Piper Sandler, and Barclays is $458.33, implying a 10.77% upside.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.