Financial giants have made a conspicuous bullish move on D.R. Horton. Our analysis of options history for D.R. Horton DHI revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $92,787, and 6 were calls, valued at $555,789.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $180.0 for D.R. Horton over the recent three months.

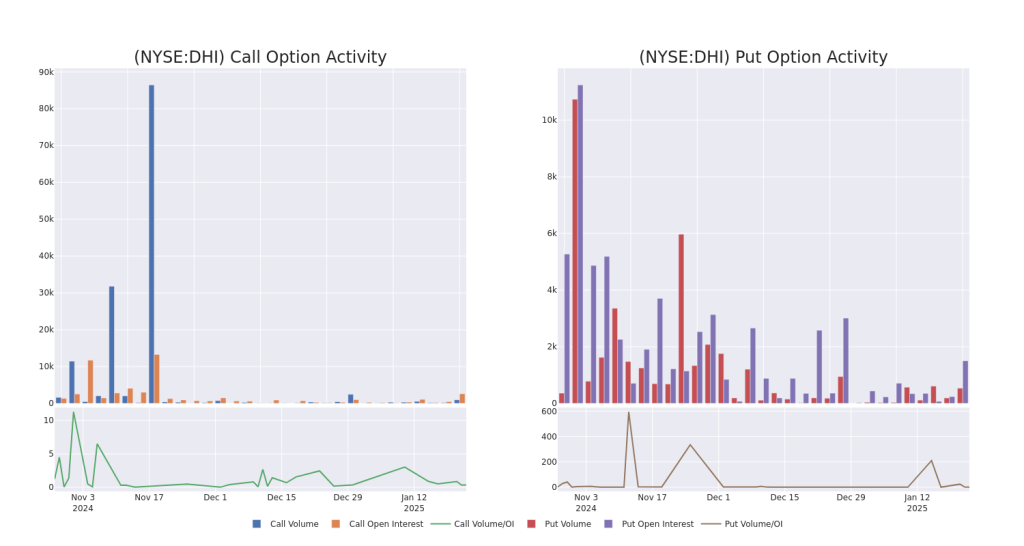

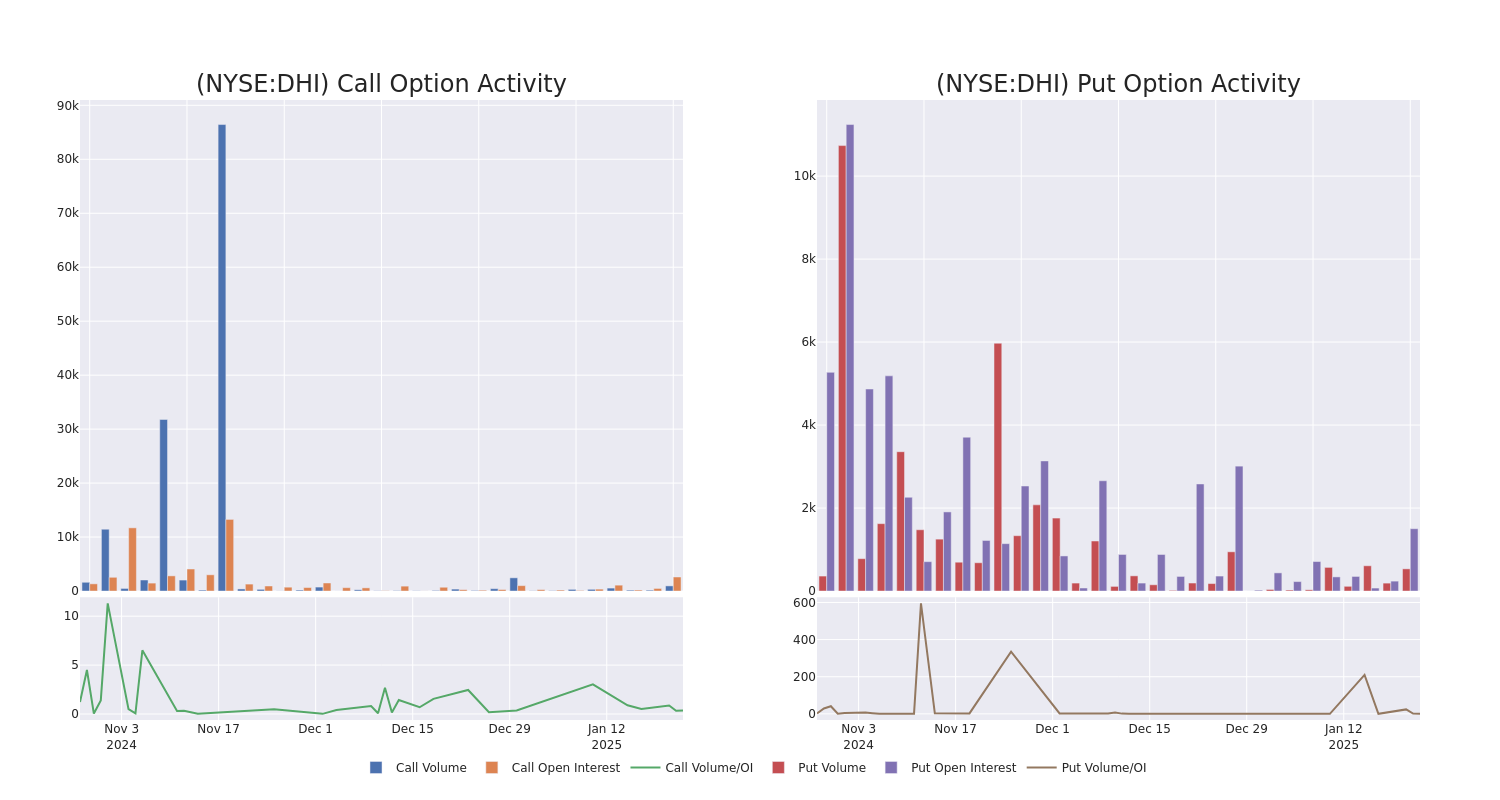

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of D.R. Horton stands at 586.57, with a total volume reaching 1,490.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in D.R. Horton, situated within the strike price corridor from $145.0 to $180.0, throughout the last 30 days.

D.R. Horton Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHI | CALL | TRADE | BULLISH | 06/20/25 | $10.3 | $10.0 | $10.2 | $150.00 | $235.6K | 467 | 234 |

| DHI | CALL | SWEEP | BULLISH | 03/21/25 | $4.9 | $2.8 | $4.7 | $150.00 | $115.6K | 78 | 248 |

| DHI | CALL | SWEEP | BULLISH | 02/21/25 | $4.8 | $4.6 | $4.8 | $145.00 | $96.0K | 541 | 326 |

| DHI | PUT | SWEEP | BEARISH | 02/21/25 | $8.0 | $7.5 | $7.5 | $150.00 | $60.0K | 457 | 83 |

| DHI | CALL | SWEEP | BULLISH | 02/21/25 | $4.7 | $4.5 | $4.64 | $145.00 | $46.3K | 541 | 126 |

About D.R. Horton

D.R. Horton is a leading homebuilder in the United States with operations in 125 markets across 36 states. D.R. Horton mainly builds single-family detached homes (over 90% of home sales revenue) and offers products to entry-level, move-up, luxury buyers, and active adults. The company offers homebuyers mortgage financing and title agency services through its financial services segment. D.R. Horton’s headquarters are in Arlington, Texas, and it manages six regional segments across the United States.

Following our analysis of the options activities associated with D.R. Horton, we pivot to a closer look at the company’s own performance.

Present Market Standing of D.R. Horton

- With a volume of 658,735, the price of DHI is down -0.84% at $145.69.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 84 days.

Professional Analyst Ratings for D.R. Horton

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $155.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from RBC Capital downgraded its action to Underperform with a price target of $125.

* An analyst from UBS has decided to maintain their Buy rating on D.R. Horton, which currently sits at a price target of $203.

* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on D.R. Horton with a target price of $152.

* An analyst from Barclays persists with their Equal-Weight rating on D.R. Horton, maintaining a target price of $150.

* An analyst from Barclays persists with their Equal-Weight rating on D.R. Horton, maintaining a target price of $145.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for D.R. Horton with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.