Netflix Inc. NFLX reported stronger-than-expected fourth-quarter financial results on Tuesday.

Netflix reported fourth-quarter revenue of $10.25 billion, up 16% year-over-year. The revenue total beat a Street consensus estimate of $10.11 billion according to data from Benzinga Pro.

The company reported earnings per share of $4.27 for the quarter, beating a Street consensus estimate of $4.19.

Netflix reported it added 18.91 million paid subscribers in the fiscal quarter, up 15.9% year-over-year.

Netflix is guiding for first-quarter revenue to be $10.42 billion, which would be up 11.2% year-over-year. The company is guiding for operating income of $2.94 billion in the first quarter and earnings per share of $5.58.

Full-year guidance for revenue in 2025 is now listed as a range of $43.5 billion to $44.5 billion, up $0.5 billion from the company’s previous range. This guidance represents year-over-year revenue growth of 12% to 14%.

Netflix shares gained 1.4% to close at $869.68 on Tuesday.

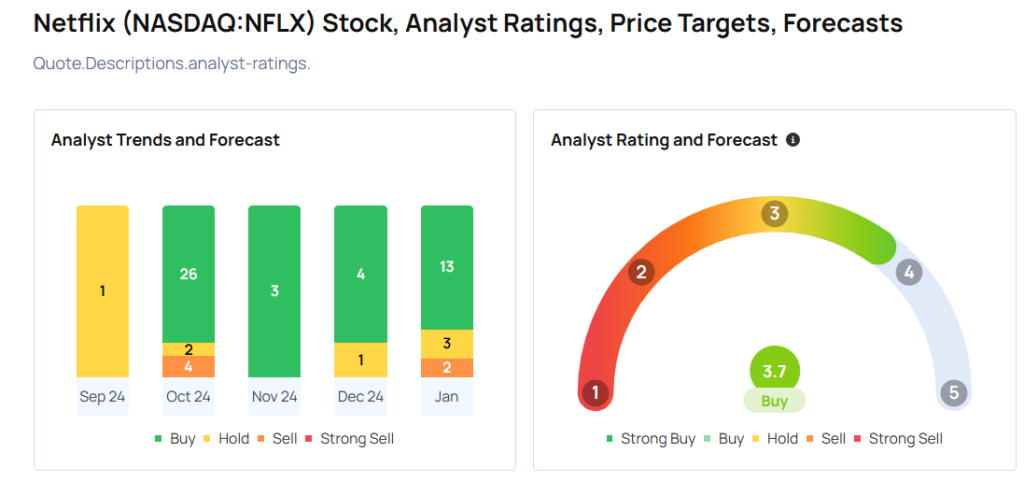

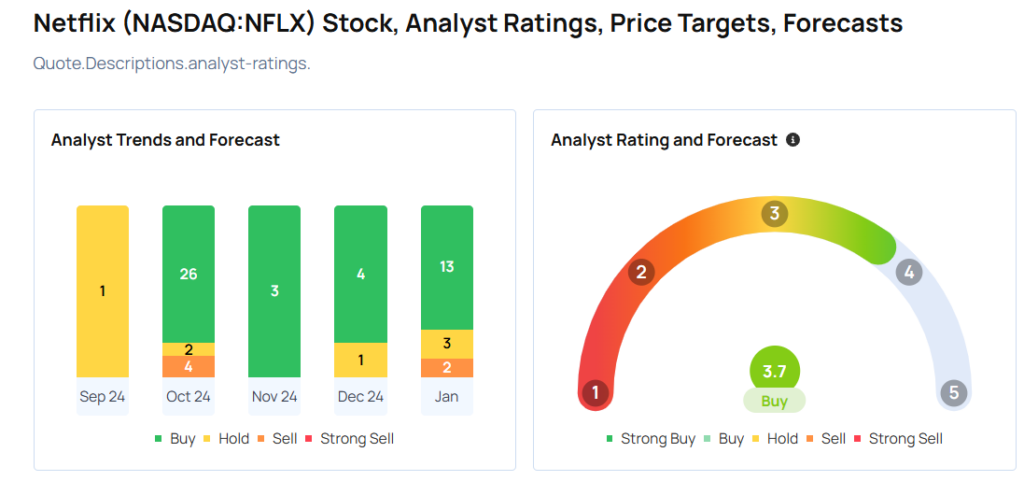

These analysts made changes to their price targets on Netflix following earnings announcement.

- Canaccord Genuity analyst Maria Ripps upgraded Netflix from Hold to Buy and raised the price target from $940 to $1,150.

- Barclays analyst Kannan Venkateshwar upgraded the stock from Underweight to Equal-Weight and raised the price target from $715 to $900.

- Needham analyst Laura Martin maintained the stock with a Buy and raised the price target from $800 to $1,150.

- Deutsche Bank analyst Bryan Kraft maintained the stock with a Hold and raised the price target from $650 to $875.

- Pivotal Research analyst Jeffrey Wlodarczak maintained Netflix with a Buy and boosted the price target from $1,100 to $1,250.

- B of A Securities analyst Jessica Reif Ehrlich maintained the stock with a Buy and raised the price target from $1,000 to $1,175.

- Morgan Stanley analyst Benjamin Swinburne maintained Netflix with an Overweight and raised the price target from $1,050 to $1,150.

- JP Morgan analyst Doug Anmuth maintained Netflix with an Overweight and raised the price target from $1,000 to $1,150.

Considering buying NFLX stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.