Financial giants have made a conspicuous bullish move on Thermo Fisher Scientific. Our analysis of options history for Thermo Fisher Scientific TMO revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 27% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $129,030, and 8 were calls, valued at $437,834.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $300.0 to $600.0 for Thermo Fisher Scientific over the recent three months.

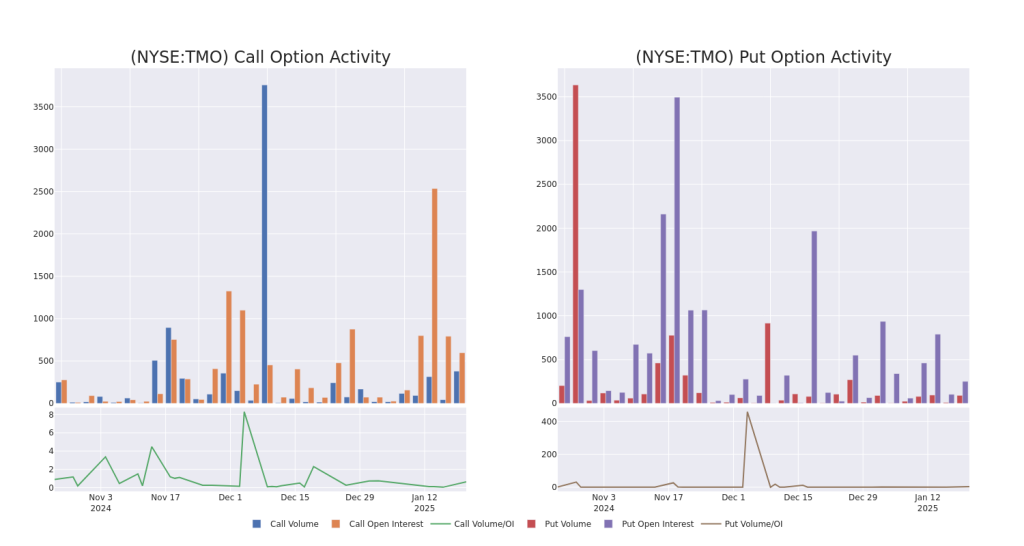

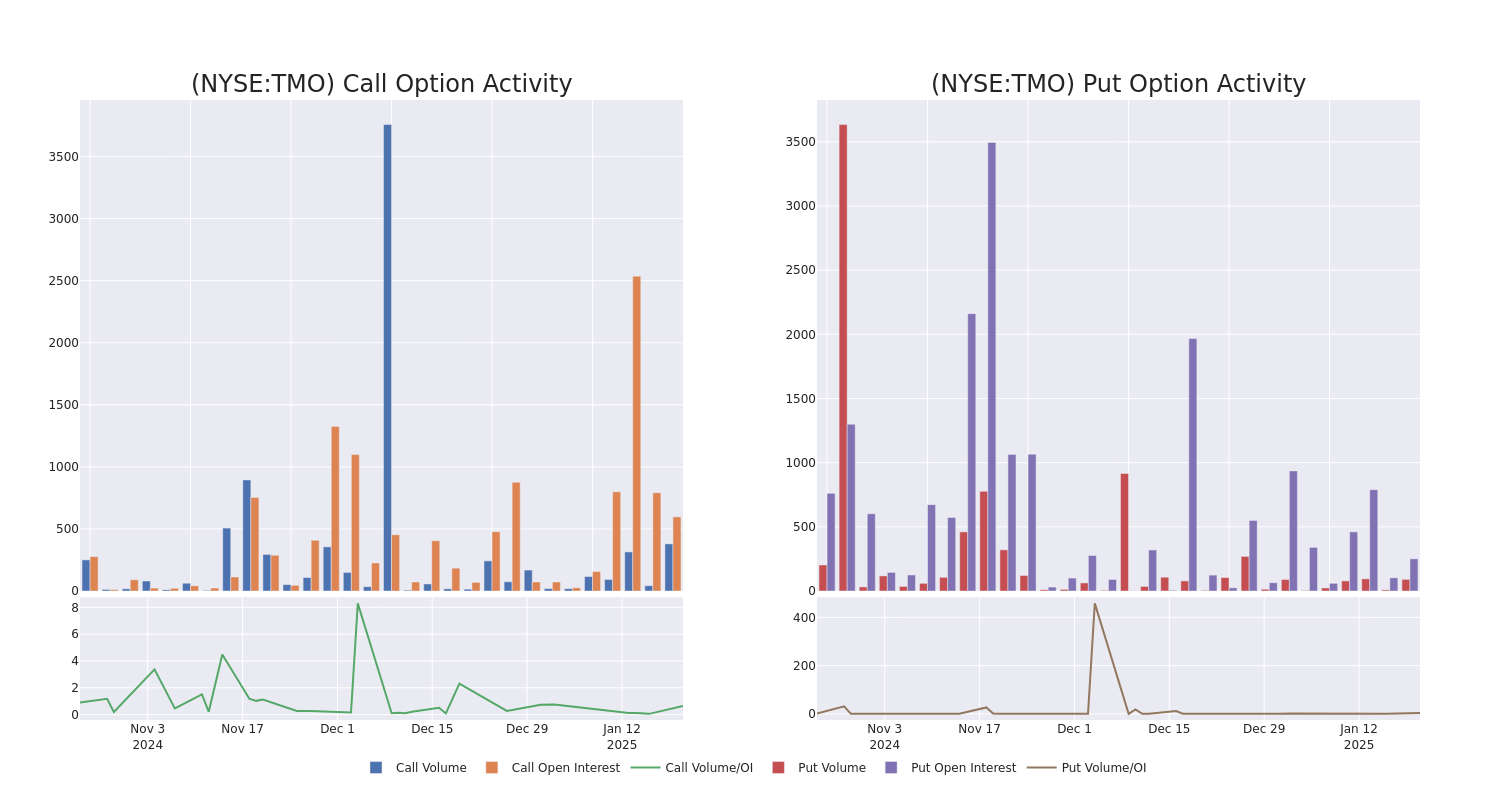

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Thermo Fisher Scientific’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Thermo Fisher Scientific’s whale activity within a strike price range from $300.0 to $600.0 in the last 30 days.

Thermo Fisher Scientific Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | CALL | SWEEP | NEUTRAL | 02/21/25 | $18.2 | $15.7 | $16.1 | $575.00 | $83.7K | 0 | 162 |

| TMO | CALL | TRADE | BULLISH | 02/14/25 | $40.6 | $35.6 | $39.3 | $540.00 | $70.7K | 19 | 18 |

| TMO | CALL | TRADE | BULLISH | 09/19/25 | $133.5 | $130.1 | $133.5 | $450.00 | $66.7K | 20 | 5 |

| TMO | PUT | SWEEP | BEARISH | 01/16/26 | $50.0 | $45.1 | $50.0 | $590.00 | $65.0K | 112 | 17 |

| TMO | CALL | SWEEP | BEARISH | 02/21/25 | $16.7 | $16.0 | $16.09 | $575.00 | $59.3K | 0 | 83 |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of mid-2024 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (11%); life science solutions (22%); and lab products and services, which includes CRO services (54%).

Present Market Standing of Thermo Fisher Scientific

- Currently trading with a volume of 1,355,083, the TMO’s price is up by 2.16%, now at $571.72.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 9 days.

Professional Analyst Ratings for Thermo Fisher Scientific

In the last month, 2 experts released ratings on this stock with an average target price of $626.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Scotiabank downgraded its action to Sector Perform with a price target of $605.

* An analyst from Morgan Stanley persists with their Overweight rating on Thermo Fisher Scientific, maintaining a target price of $647.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Thermo Fisher Scientific options trades with real-time alerts from Benzinga Pro.

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.