Investors with a lot of money to spend have taken a bearish stance on Accenture ACN.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ACN, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 9 options trades for Accenture.

This isn’t normal.

The overall sentiment of these big-money traders is split between 11% bullish and 66%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $106,400, and 8, calls, for a total amount of $1,091,761.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $357.5 to $420.0 for Accenture over the last 3 months.

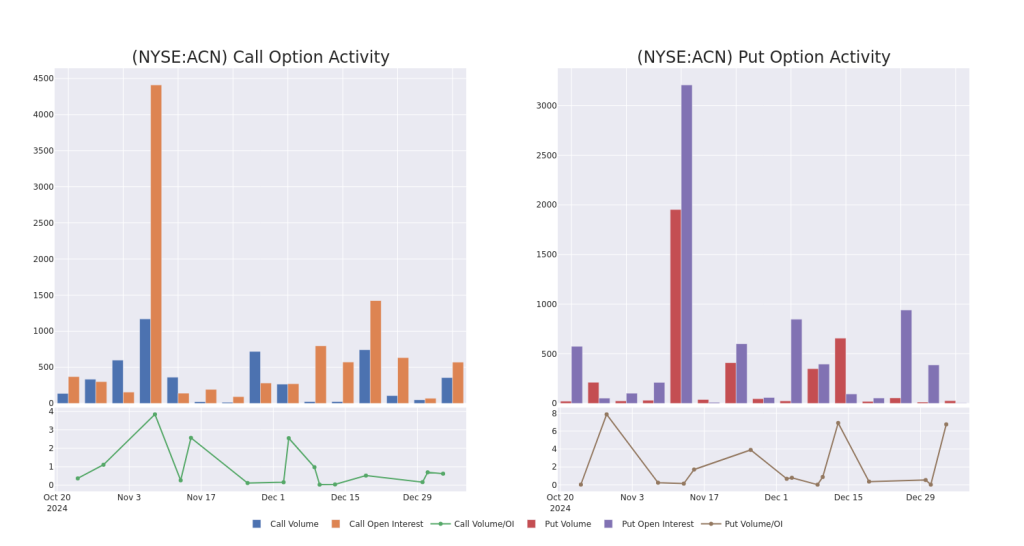

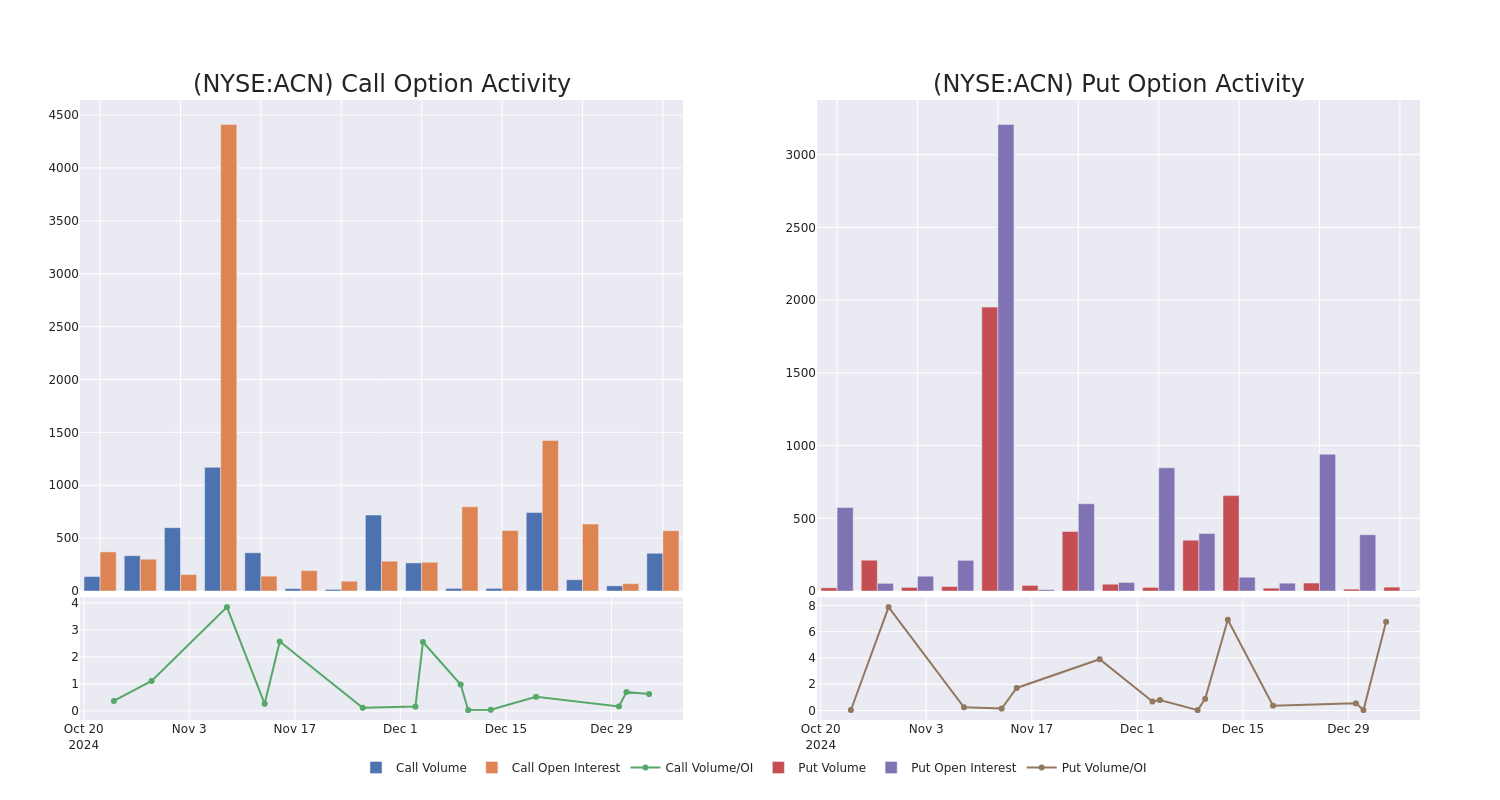

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Accenture’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Accenture’s whale trades within a strike price range from $357.5 to $420.0 in the last 30 days.

Accenture 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | CALL | TRADE | BEARISH | 06/20/25 | $20.3 | $19.5 | $19.5 | $360.00 | $360.7K | 663 | 135 |

| ACN | CALL | TRADE | BEARISH | 02/21/25 | $7.7 | $7.3 | $7.35 | $357.50 | $267.5K | 0 | 378 |

| ACN | CALL | TRADE | BEARISH | 06/20/25 | $20.3 | $19.5 | $19.5 | $360.00 | $263.2K | 663 | 135 |

| ACN | PUT | TRADE | NEUTRAL | 03/21/25 | $54.4 | $51.7 | $53.2 | $405.00 | $106.4K | 0 | 20 |

| ACN | CALL | SWEEP | BEARISH | 01/16/26 | $35.7 | $34.6 | $34.83 | $360.00 | $59.1K | 185 | 17 |

About Accenture

Accenture is a leading global IT services firm that provides consulting, strategy, and technology and operational services. These services run the gamut from aiding enterprises with digital transformation to procurement services to software system integration. The company provides its IT offerings to a variety of sectors, including communications, media and technology, financial services, health and public services, consumer products, and resources. Accenture employs just under 500,000 people throughout 200 cities in 51 countries.

Following our analysis of the options activities associated with Accenture, we pivot to a closer look at the company’s own performance.

Present Market Standing of Accenture

- Trading volume stands at 1,502,143, with ACN’s price up by 0.96%, positioned at $355.98.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 58 days.

What The Experts Say On Accenture

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $355.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Jefferies has decided to maintain their Hold rating on Accenture, which currently sits at a price target of $355.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Accenture, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.