Financial giants have made a conspicuous bearish move on Biogen. Our analysis of options history for Biogen BIIB revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $104,640, and 6 were calls, valued at $720,362.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $115.0 to $260.0 for Biogen during the past quarter.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Biogen options trades today is 238.14 with a total volume of 370.00.

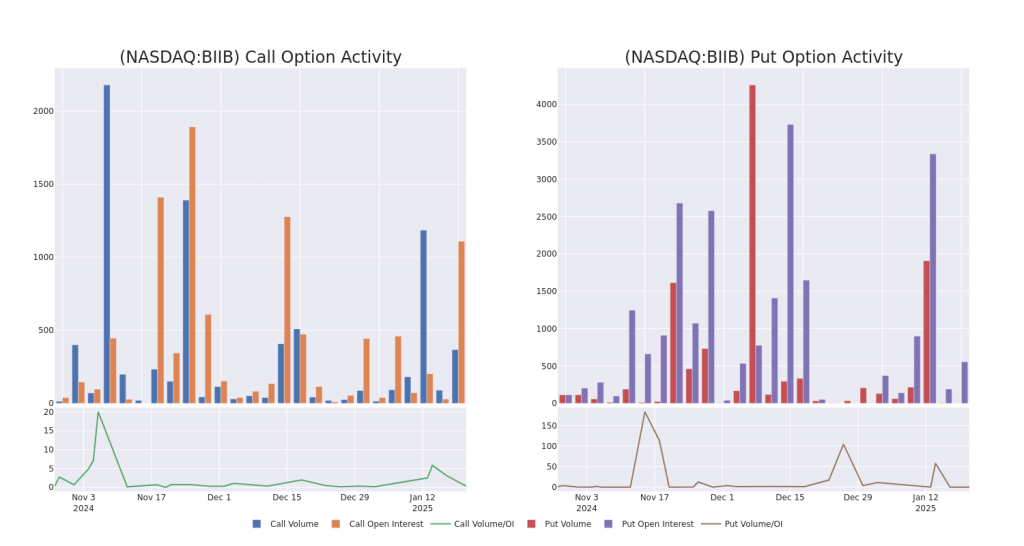

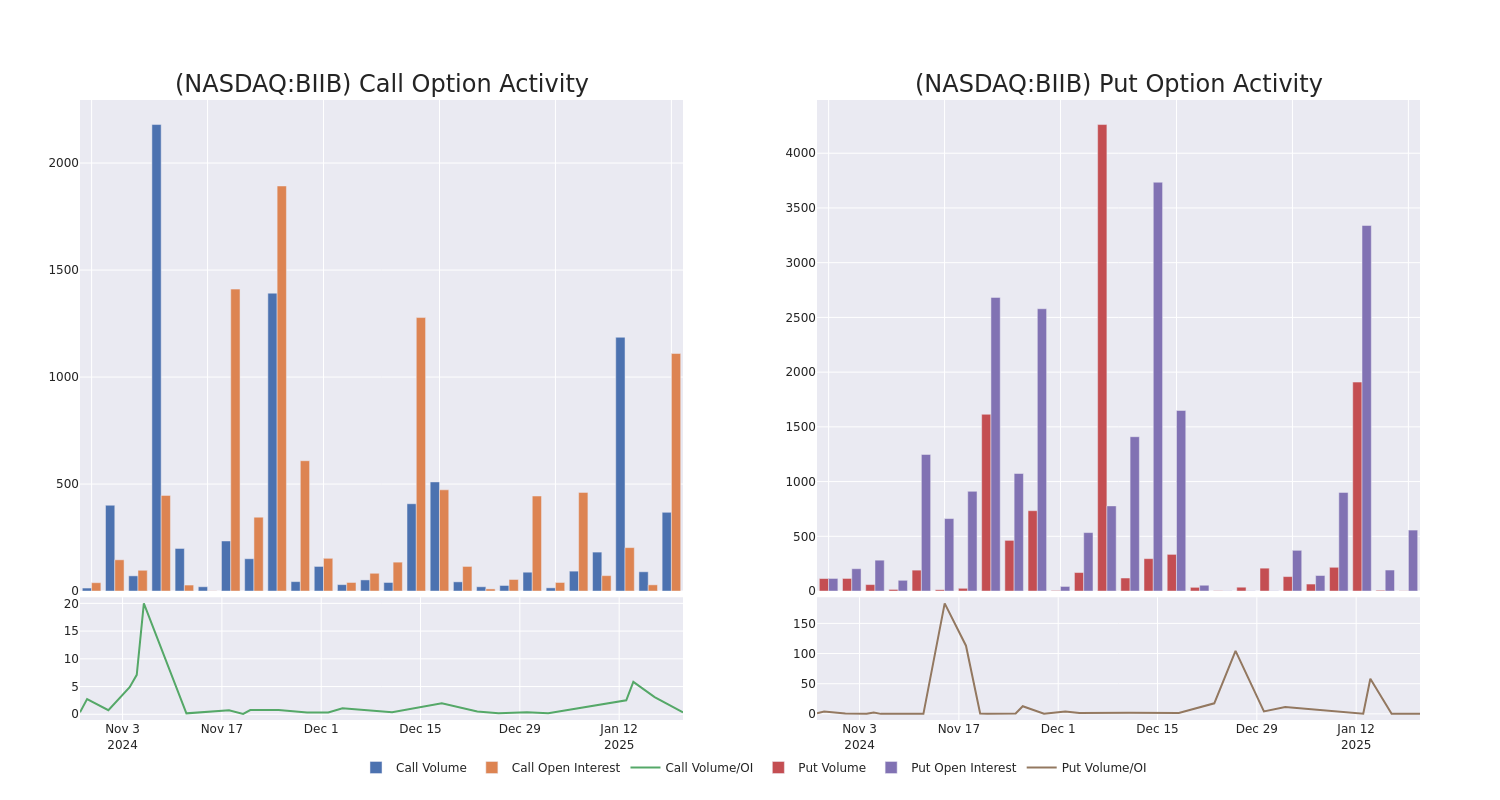

In the following chart, we are able to follow the development of volume and open interest of call and put options for Biogen’s big money trades within a strike price range of $115.0 to $260.0 over the last 30 days.

Biogen Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIIB | CALL | SWEEP | BEARISH | 01/15/27 | $43.4 | $41.0 | $41.0 | $130.00 | $328.0K | 604 | 0 |

| BIIB | CALL | SWEEP | BEARISH | 01/15/27 | $43.9 | $40.8 | $40.8 | $130.00 | $244.8K | 604 | 155 |

| BIIB | PUT | TRADE | BULLISH | 01/16/26 | $7.6 | $7.2 | $7.2 | $115.00 | $54.7K | 354 | 0 |

| BIIB | PUT | SWEEP | BEARISH | 09/19/25 | $9.6 | $9.4 | $9.6 | $130.00 | $49.9K | 203 | 2 |

| BIIB | CALL | SWEEP | BULLISH | 06/20/25 | $5.7 | $5.4 | $5.7 | $165.00 | $47.8K | 290 | 87 |

About Biogen

Biogen and Idec merged in 2003, combining forces to market Biogen’s multiple sclerosis drug Avonex and Idec’s cancer drug Rituxan. Today, Rituxan and next-generation antibody Gazyva (oncology) and Ocrevus (multiple sclerosis) are marketed via a collaboration with Roche. Biogen markets several multiple sclerosis drugs including Plegridy, Tysabri, Tecfidera, and Vumerity. Biogen’s newer products include Spinraza (SMA, with partner Ionis), Leqembi (Alzheimers, with partner Eisai), Skyclarys (Friedreich’s Ataxia, Reata), Zurzuvae (postpartum depression, Sage), and Qalsody (ALS, Ionis). Biogen has several drug candidates in phase 3 trials in neurology, immunology, and rare diseases.

After a thorough review of the options trading surrounding Biogen, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Biogen

- With a volume of 525,457, the price of BIIB is up 0.65% at $141.47.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 21 days.

What Analysts Are Saying About Biogen

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $174.33333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $138.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Biogen with a target price of $165.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Biogen, targeting a price of $220.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Biogen with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.