Financial giants have made a conspicuous bearish move on Sea. Our analysis of options history for Sea SE revealed 16 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 68% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $437,181, and 9 were calls, valued at $465,488.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $140.0 for Sea over the last 3 months.

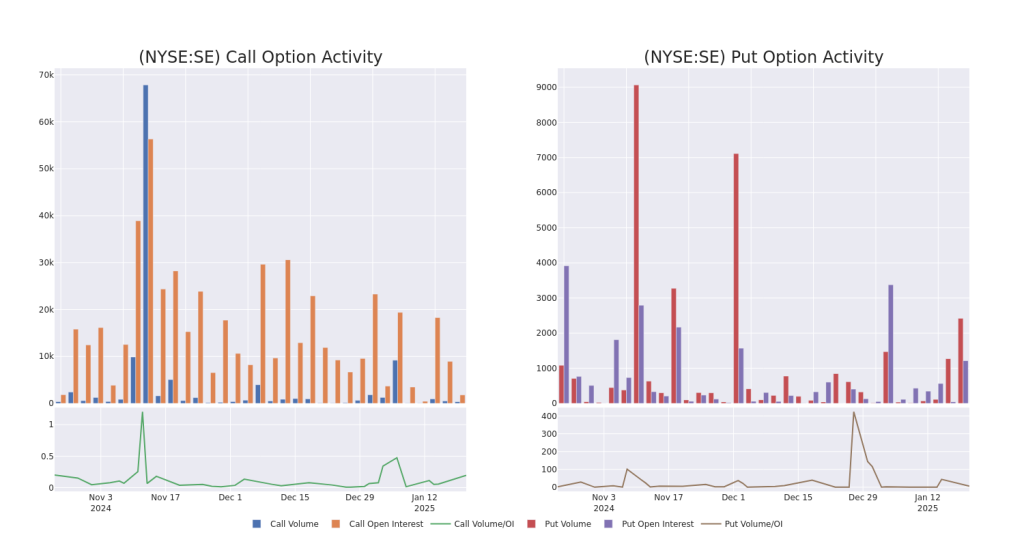

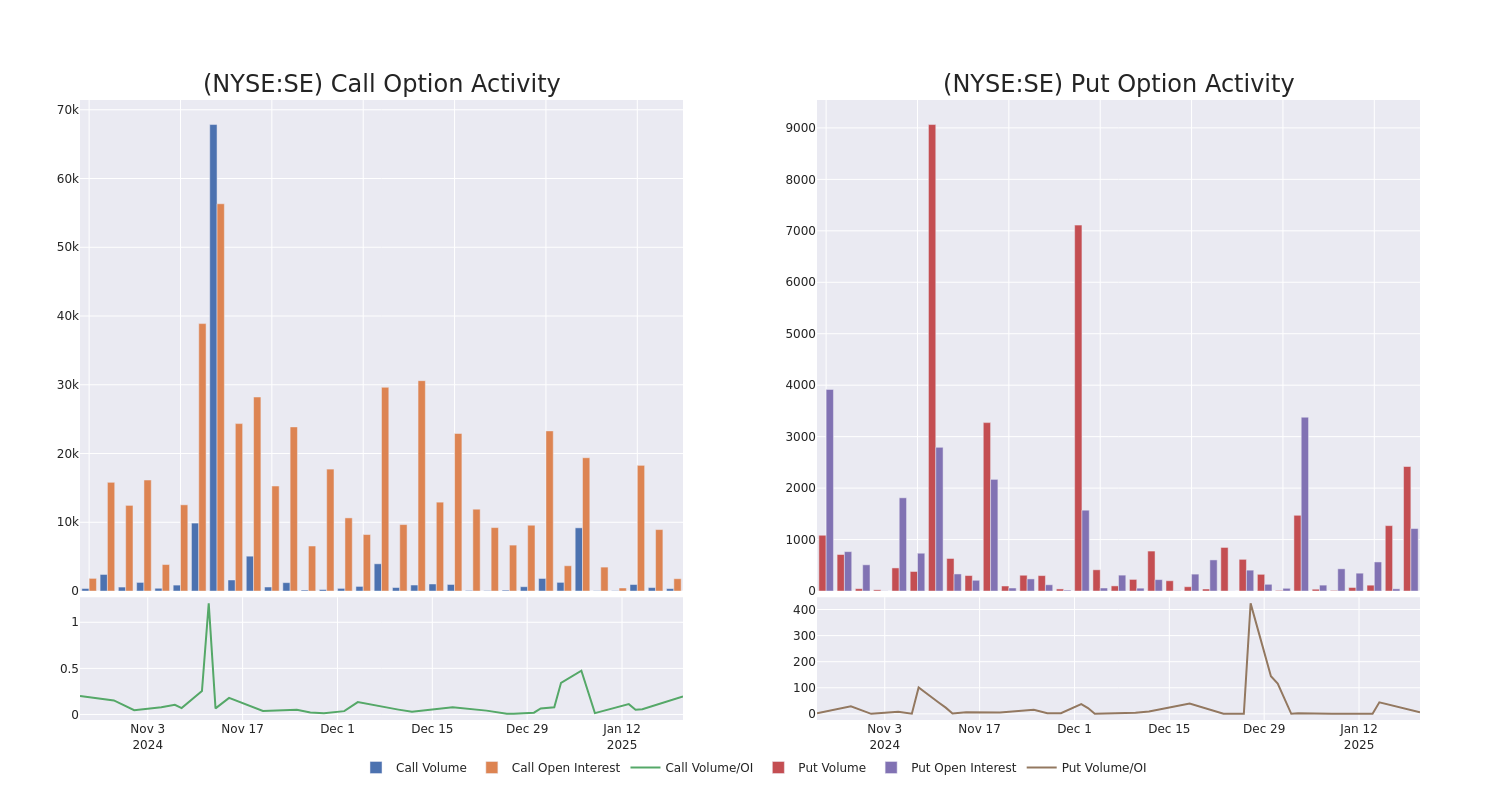

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Sea’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Sea’s whale activity within a strike price range from $70.0 to $140.0 in the last 30 days.

Sea Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SE | PUT | TRADE | BEARISH | 06/20/25 | $17.55 | $17.45 | $17.55 | $125.00 | $173.7K | 218 | 104 |

| SE | CALL | SWEEP | BEARISH | 01/16/26 | $39.95 | $39.45 | $39.62 | $90.00 | $79.1K | 920 | 80 |

| SE | CALL | SWEEP | BEARISH | 01/16/26 | $39.65 | $39.2 | $39.36 | $90.00 | $78.6K | 920 | 60 |

| SE | PUT | SWEEP | BULLISH | 04/17/25 | $7.1 | $6.85 | $6.9 | $110.00 | $69.1K | 393 | 159 |

| SE | CALL | TRADE | BEARISH | 06/20/25 | $16.75 | $16.4 | $16.4 | $115.00 | $57.4K | 691 | 36 |

About Sea

Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce. Sea operates Southeast Asia’s largest e-commerce company, Shopee, in terms of gross merchandise value. Shopee is a hybrid C2C and B2C marketplace platform operating in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, the Philippines, and Brazil. For Garena, Free Fire is the key revenue generating game. Sea’s third business, SeaMoney, provides lending, payment, digital banking, and insurance services.As of March 31, 2024, Forrest Xiaodong Li, the founder, chairman and CEO, owned 59.8% of voting power and 18.5% of issued shares. Tencent owned 18.2% of issued shares with no voting power.

Having examined the options trading patterns of Sea, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Sea

- Trading volume stands at 1,658,384, with SE’s price up by 2.43%, positioned at $117.88.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 41 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Sea options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.