Financial giants have made a conspicuous bullish move on Block. Our analysis of options history for Block SQ revealed 13 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $1,990,755, and 8 were calls, valued at $323,133.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $80.0 and $135.0 for Block, spanning the last three months.

Insights into Volume & Open Interest

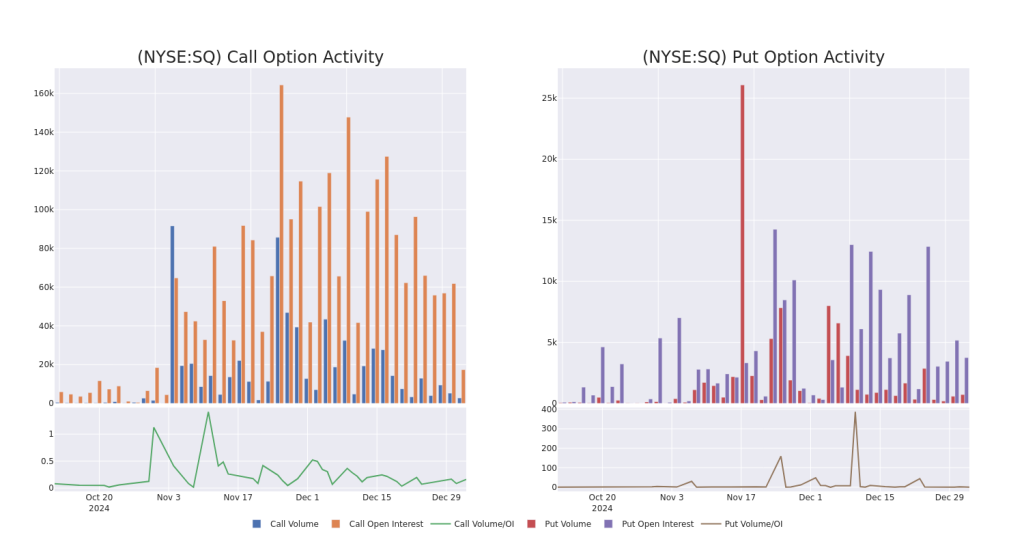

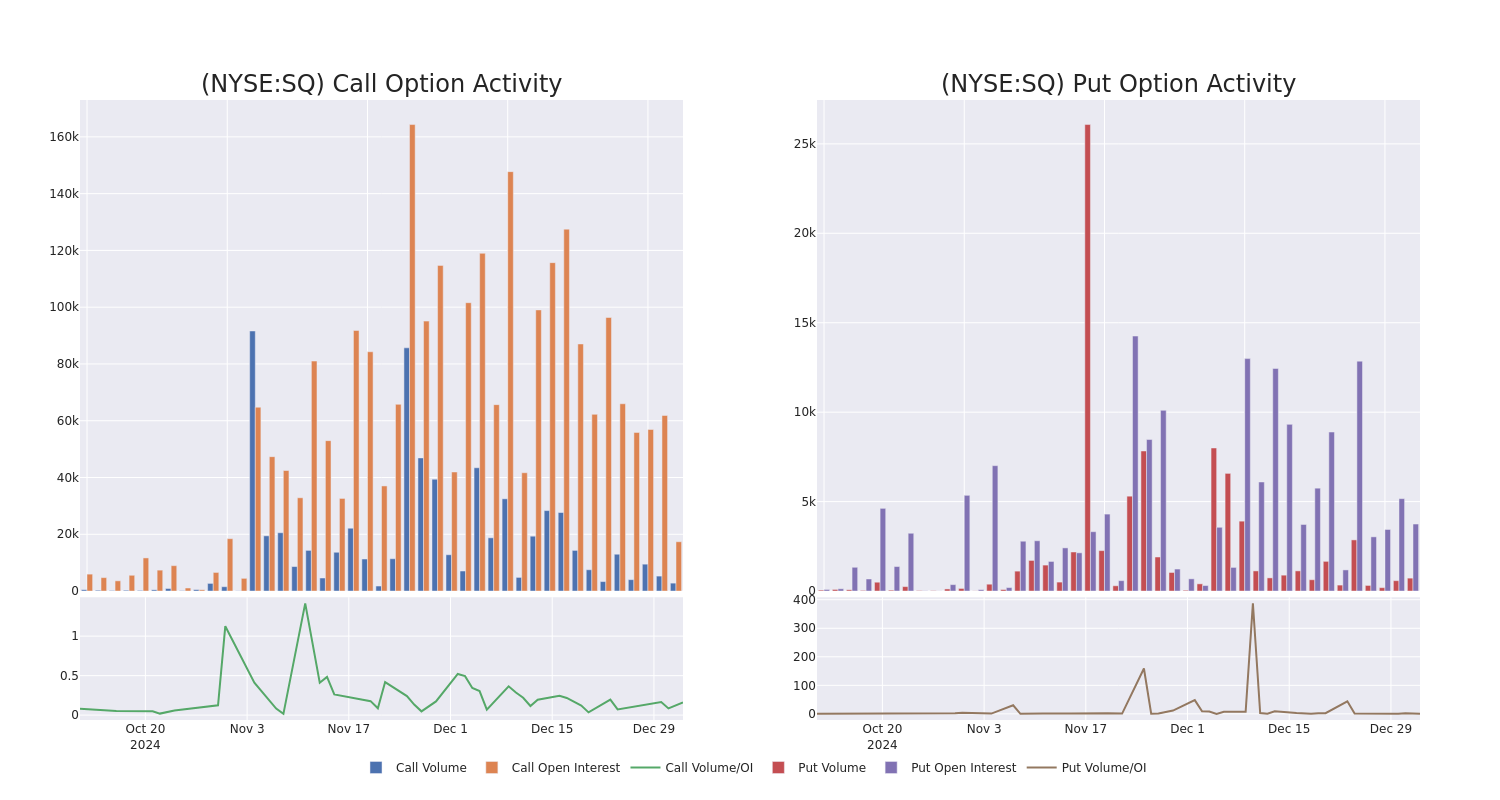

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Block’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block’s whale activity within a strike price range from $80.0 to $135.0 in the last 30 days.

Block Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | SWEEP | BEARISH | 01/16/26 | $49.75 | $49.55 | $49.75 | $135.00 | $840.7K | 1.2K | 169 |

| SQ | PUT | SWEEP | BEARISH | 01/16/26 | $49.75 | $49.55 | $49.75 | $135.00 | $781.0K | 1.2K | 169 |

| SQ | PUT | SWEEP | BEARISH | 01/16/26 | $50.5 | $49.55 | $49.75 | $135.00 | $293.5K | 1.2K | 400 |

| SQ | CALL | SWEEP | BULLISH | 03/21/25 | $2.67 | $2.6 | $2.66 | $105.00 | $56.6K | 2.1K | 215 |

| SQ | CALL | TRADE | BULLISH | 09/19/25 | $15.5 | $15.0 | $15.3 | $85.00 | $48.9K | 616 | 32 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square’s payment volume was a little over $200 million.

Where Is Block Standing Right Now?

- With a trading volume of 903,961, the price of SQ is up by 2.18%, reaching $86.84.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 49 days from now.

What The Experts Say On Block

5 market experts have recently issued ratings for this stock, with a consensus target price of $101.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Underweight rating on Block with a target price of $65.

* An analyst from Barclays has decided to maintain their Overweight rating on Block, which currently sits at a price target of $112.

* Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Block with a target price of $110.

* An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on Block, which currently sits at a price target of $105.

* An analyst from Oppenheimer upgraded its action to Outperform with a price target of $115.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.